Biochemistry Instruments and Reagents

Looking for a perfect one-stop solution

Buyers are looking for a model to provide one-stop solution for routine chemistries, electrolytes, and Covid parameters on a single-desk work.

Clinical chemistry, which runs tests on body fluids to assess human health and monitor chronic disorders, is at the heart of most lab activities. Clinical chemistry is becoming increasingly automated, as is the case in other areas of the laboratory, with sophisticated instrumentation, capable of executing hundreds to thousands of tests each hour. With the rising frequency of lifestyle-related disorders, such as obesity and cardiovascular disease, clinical chemistry is expected to play an increasingly important role in patient management.

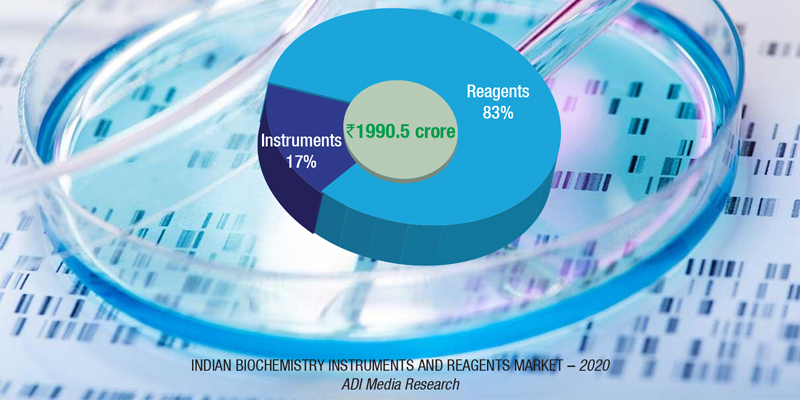

In 2020, the Indian biochemistry instruments and reagents market is estimated at ₹3156 crore, with reagents continuing to dominate at ₹1660 crore, at 83.4-percent market share.

The floor-standing analyzers are estimated at ₹103.5 crore and 740 units; benchtop analyzers at ₹97.5 crore and 1950 units; and semi-automated analyzers at ₹129.5 crore and 18500 units. Almost 80–90 percent floor instruments are on rentals; this figure is much smaller for bench-top. Semi-automated instruments are all procured, with almost none on rentals. The size of the market in 2019 has been calculated on assigning a monetary value to all the instruments installed, whether placed or sold.

2020 saw a preference for floor instruments, and this could be explained by the fact that the government procurement share was 71 percent in 2020 – out of a ₹201 fully automated instruments market, government procurement amounted to ₹150 crore. These are only for the period February to September 2020; there seem to be no tenders invited after September.

|

Indian biochemistry instruments and reagents market |

|||

|

Major vendors – 2020* |

|||

| FA | SA | Reagents | |

| Tier I | Transasia | Transasia | Transasia, Roche, Beckman Coulter, Siemens, OCD and Abbott |

| Tier II | POCT, Mindray, OCD and Roche | Mindray, and Robonik | Agappe, Randox, Accurex, Diasys |

| Tier III | Biosystems, Beckman, Abbott, Thermo Fisher, Siemens and CPC | Agappe, Eurit, CPC, Biosystems, Thermo Fisher, Accurex, Tulip, Microlab, Beacon, and regional brands | Biosystems, Fuji, Mindray, Rapid and local brands |

| Others | Trivitron, Sysmex, Tulip, Biosystems, Accurex (Dirui) | ||

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian biochemistry instruments and reagents market. | |||

| ADI Media Research | |||

Transasia continues to be a clear leader in this segment, its major contributions coming from the government and the Indian Army. Of the ₹150-crore orders placed by the government, there were some clear winners. POCT secured ₹66.71 crore, GCC ₹10.47 crore, PD Enterprises ₹4.92 crore, SPM Medicare ₹4.44 crore, Metadesign ₹4.36 crore, Chromous Biotech ₹2.93 crore, Spinco ₹2.5 crore, Transasia ₹2.35 crore, Titan Biotech ₹2.35 crore, Trivitron ₹2.33 crore, Biosense ₹2.23 crore, Avantor ₹2.1 crore, Tulip ₹1.84 crore, P Bhogilal ₹1.59 crore, Bioaid Lab Solutions ₹1.28 crore, PerkinElmer ₹1.28 crore, Rupshee Comm ₹1.17 crore, and HiMedia Rs 1.03 crore. Since Agappe represents Mindray, Canon (Toshiba), TokyoBoeki, Furono, and Dirui for fully automated instruments, the company has not been included in the tier table.

Amid the COVID-19 crisis, the global market for biochemistry analyzers estimated at USD 3.5 billion in the year 2020, is projected to reach a revised size of USD 4.7 billion by 2026, growing at a CAGR of 5.2 percent. Clinical diagnostics segment is projected to record a 5.1-percent CAGR and reach USD 4.1 billion by 2026. After a thorough analysis of the business implications of the pandemic, and its induced economic crisis, growth in the drug-development segment is readjusted to a revised 5.9-percent CAGR for the next 7-year period.

The rising burden of diseases and steps to reduce them will foster the market growth. Growing initiatives by several government and non-government organizations to control and reduce the burden of diseases will positively impact the industry expansion. For instance, the Population Services International (PSI) incentivizes staff members to identify and mark health conditions with high economic burden. In the last decade, PSI added a goal to target around 42 percent of such diseases, and list them under the Global Burden of Disease (GBD) study. This goal will aid organizations to take decisions regarding reduction of disease burden. Such initiatives by the government and non-government organizations will boost the market value over the coming years.

The biochemistry analyzers market in the US is estimated at USD 1.1 billion in the year 2021. China, the world’s second-largest economy, is forecast to reach a projected market size of USD 834.2 million by the year 2026, trailing a CAGR of 5 percent. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 4.9 percent and 4.4 percent respectively. Within Europe, Germany is forecast to grow at approximately 4.9 percent CAGR.

Major players in the market are also focused on launching diagnostic tests for COVID-19. Major players operating in the global biochemistry analyzers market include Roche Diagnostics GmbH, Siemens AG, Beckman Coulter Inc., Abbott Diagnostics Inc., Mindray, Bio-Medical Electronics Co. Ltd., Hologic Inc., Randox Laboratories Ltd., Awareness Technology Inc., Transasia Biomedicals Ltd., and Nova Biomedical Corp.

Biochemistry has never been more exciting, important, or central to solving problems in human health and the environment than it is today.

Over the past 80 years, chemistry has played a central role in the determination of the structures and chemical reactivity of the building blocks used by all organisms, providing the molecular framework to elucidate the pathways involved in central metabolism.

Everything depends on clinical chemistry test reports, from emergency care to planned surgeries; even for treating OPD patients or any other clinical condition, patient lab reports are essential.

Clinical labs not only assist physicians in their decision-making, but they also provide crucial information in determining a patient’s state and stage of sickness. In the Indian population, lifestyle diseases, cardiac illness, and high blood-pressure concerns are common, and a lab test can diagnose the condition and risk factors linked with it. In terms of assessing an individual’s inner health picture, lab medicine can point them in the right direction for better lifestyle disease prevention.

Clinical chemistry tests are also critical in managing and recovering from the COVID-19 pandemic; to mention a few, CRP, D-Dimer, and Ferritin are critical.

Automated testing systems have grown in popularity in recent years, allowing users to change their output while also providing other perceived benefits, such as less work, less preparation time, and fewer input errors. Labs are expanding their business by increasing menu, opening new branches, and joining hands with existing market leaders, creating good demand for automation.

Minimizing reaction volume to reduce patient sample requirements and reagent use is significant in today’s laboratories. This is especially beneficial for pediatric and geriatric patients. Sample probe clog detection, horizontal and vertical probe movement collision protection, and effective internal and external probe washing are all important safety elements for a high-quality result and smooth operation. For test result integrity, an optimal number of wavelengths, a long-lasting lamp, and a maintenance-free incubator design that ensures correct incubator temperature are critical.

To summarize, the current market needs with newer instrument model to provide perfect solution for the middle-to high-workload laboratories looking for one-stop solution for routine chemistries, electrolytes and also Covid parameters, special parameters, like D-Dimer, Ferritin, CRP, HS-CRP, direct enzymatic HbA1c, RA, ASO, IgA, IgG, IgM, IgE, Apo-lipo proteins, micro-albumin, and many more on a single work desk.

Whatever the next few years hold, one thing is certain. Innovation still has, and always will have, a key role in the lab.