Microbiology Instruments and Reagents

Market bounced back, after a dull 2020

The Indian market in 2021 bounced back, leading to a 60 percent increase for instruments over 2020, and a 45.2 percent increase for instruments-based reagents.

With testing volumes increasing exponentially, automation is getting ahead particularly for small- and mid-sized labs that are in underserved geographic areas. Overall testing volumes are expected to increase 10 to 15 percent per year for the next 20 years, due in part to an aging population that will require more healthcare. The global clinical microbiology market offers significant growth potential for prominent as well as emerging product manufacturers.

Historically, manual methods were used in culture-based microbiology laboratory testing, and automated methods (such as those that have revolutionized clinical chemistry and hematology in recent decades) were largely absent from the clinical microbiology laboratory.

The adoption of automated methods for culture-based laboratory testing in clinical microbiology has been driven by increased demand for microbiology testing and standardization of sample-collection devices for microbiology culture due to rising pandemic and epidemic outbreaks, as well as a dwindling supply of microbiology technologists. This, in turn, is expected to propel the clinical microbiology market even further.

Emerging markets are expected to offer significant growth opportunities to clinical microbiology product manufacturers and distributors during the forecast period. This can be attributed to the growing prevalence of infectious diseases, such as HIV, tuberculosis, influenza, and malaria as well as increasing R&D initiatives to develop innovative genomic techniques for efficient disease diagnosis in developing nations.

The growth in these markets is further supported by improvements in healthcare infrastructure, growing healthcare expenditure, and increasing availability and affordability of low-cost clinical microbiology products. In line with the ongoing trend, several government initiatives have been undertaken across emerging markets to strengthen and expand the healthcare infrastructure.

Diagnostic microbiology tests involve various types of patient samples, such as semen, saliva, tissue, blood, and urine. These diagnostic tests have a limited utilization of automated instruments to directly diagnose common pathogens. Clinical laboratories must have proper logistic support for timely sample collection, efficient transportation, and safe and standardized sample processing to provide correct and accurate diagnostic results to patients. However, meeting optimal criteria for sample handling and transportation is a key challenge faced by a majority of clinical laboratories.

The lack of qualified graduates and training programs, particularly in developing countries where demand for skilled professionals is rapidly increasing, may stymie market expansion. However, the introduction of automated systems into the market will eventually replace manually operated traditional platforms, reducing the impact of skills shortage.

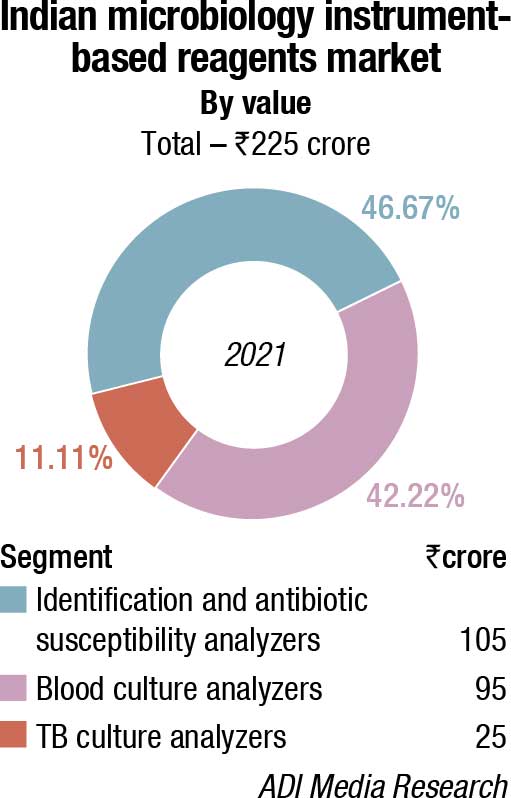

The Indian market for microbiology instruments and reagents in 2021 is estimated at ₹470 crore, a 34.3 percent increase over 2020. The instruments, along with the instrument-based reagents continued to constitute 56.4 percent of the market, with instruments at ₹40 crore, and reagents at ₹225 crore. The non-instruments-based reagents contributed the balance 43.6 percent to the market at ₹205 crore.

After a dull 2020, the market in 2021 bounced back very strongly leading to a 60 percent increase for instruments over 2020, and the instruments-based reagents a 45.2 percent increase. The non-instruments-based reagents grew by 14.7 percent in 2021, over 2020.

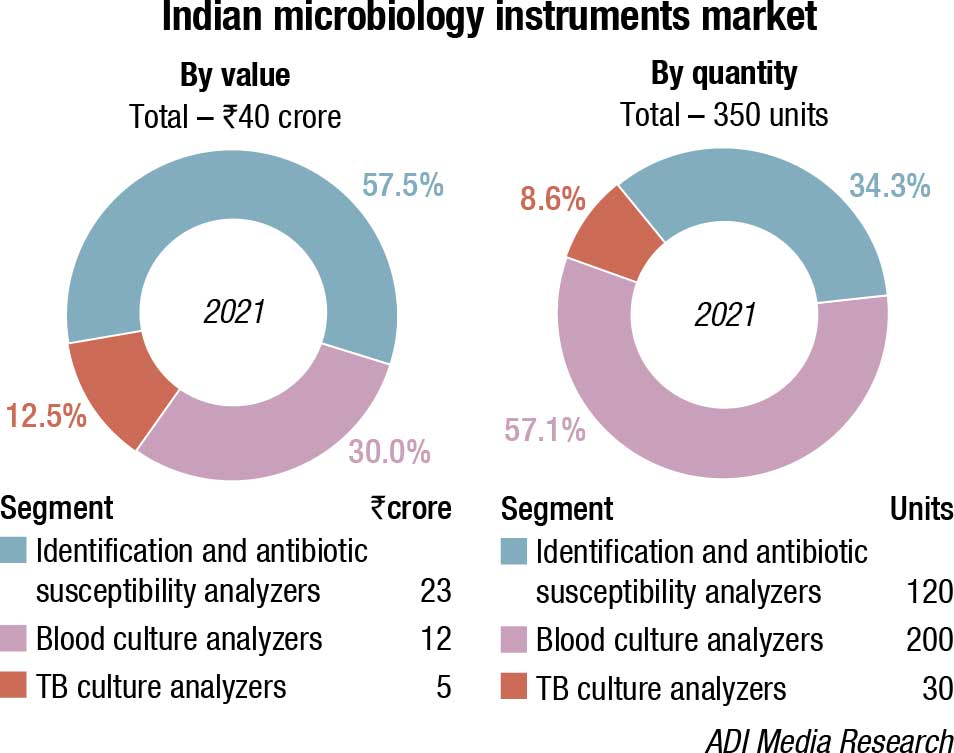

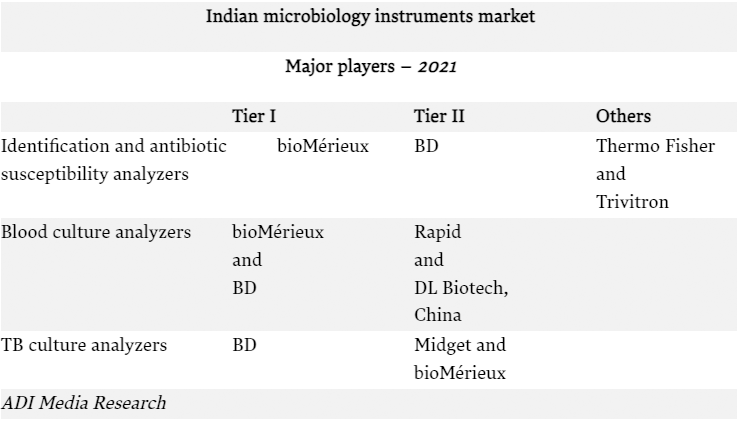

Within the analyzers segment, in 2021, the blood culture analyzers dominated with a 57 percent share by quantity and identification and antibiotic-susceptibility analyzers dominated at 57.5 percent share by value. bioMérieux and BD are the two brands that continue to dominate the instruments and instruments-based reagents segments. The instruments market saw a huge increase in 2021, the increase by value being 66.7 percent for TB cultures, 64 percent for identification and antibiotic-susceptibility analyzers and 50 percent for blood culture analyzers over 2020.

|

Indian microbiology instruments and reagents market |

|

|

Major players – 2021 |

|

| Segment | Vendors |

| Indian microbiology automated instruments market | bioMérieux, BD India, Beckman Coulter, Thermo Fisher, and Trivitron |

| Indian microbiology instruments-based reagents market | bioMérieux, BD India, Beckman Coulter, and Thermo Fisher |

| Indian microbiology non instruments-based reagents market | Hi-Media, BD India, Thermo Fisher, Bio-rad, bioMérieux, Beckman Coulter, Microxpress, Merck Millipore, and Titan Biotech (TM Media) |

In the non-instruments-based reagents segment, Hi-Media dominates. This includes ready-to-use plates, antibiotic disks, MICs, etc. Titan Biotech (TM Media) and Tulip are the other aggressive players.

In 2022, the market is headed for a 15–20 percent increase over 2021. The methods are changing, and microbiology is making way for molecular testing. A gradual shift is observed in favor of molecular, thereby affecting the practice of clinical medicine. For each of these technologies, the additions to healthcare costs are weighed against the potential advantages. The techniques and the technologies are here. The efficacy of these technologies is the deciding factor.

The global microbiology instruments and reagents market is expected to grow from USD 3.42 billion in 2021 to USD 3.98 billion in 2022 at a compound annual growth rate (CAGR) of 16.4 percent. The market is expected to grow to USD 6.85 billion in 2026 at a CAGR of 14.6 percent. Technological advancements, rising incidences of infectious diseases and growing outbreak of epidemics, and increased funding and public-private investments, are some of the key factors driving the growth of the clinical microbiology market.

In addition, the increasing investments in digital health technologies, artificial intelligence, and non-invasive monitoring capability, delivery of gene therapy and regenerative medicines technologies, and customized 3D printing of medical devices are expected to drive the microbiology diagnostic devices market.

Unfavorable regulatory scenarios are one of the major restraints in the microbiology diagnosis devices market. In the US, section 510(k) of the Food, Drug, and Cosmetic Act states that every device manufacturer must register with FDA, and notify their intent to market a medical device at least 90 days in advance. These pre-market notifications are considered to be lengthy, rigorous, and time-consuming processes for the approval of medical devices.

Next-generation sequencing (NGS) technologies are increasing their prevalence in the microbiology diagnostic devices market due to their cost effectiveness, sensitivity to detect low-frequency variants, and comprehensive genomic coverage. NGS or high-throughput sequencing or Massively Parallel Sequencing (MPS) is a method of sequencing genomes with the ability to sequence hundreds to thousands of genes or gene regions and the capability to detect novel resistance genes (ARG) in bacteria.

The majority of microbiologists would have agreed ten years ago that workflows in a microbiology laboratory could not be automated in the same way that clinical chemistry workflows could. Aside from the differences in sample types and operations, no two microbiology laboratories are similar! Today, however, various technologies exist that automate the cycle from incubation through reporting. Microbiologists should value and recognize the opportunity to rethink microbiology and shed some unneeded, longstanding, and established behaviors in a controlled, reflective, and evidence-based manner. It is past time for microbiology to move into the twenty-first century.

Most of the current conventional microbiological assays detect only a restricted panel of pathogens at a time or require a microbe to be successfully cultured from a sample. Metagenomic NGS (mNGS) is increasingly being applied in clinical laboratories for unbiased culture-independent diagnosis. Whether it can be a next routine pathogen identification tool has become a topic of concern.

Since 2008, numerous studies from over 20 countries have revealed the practicality of mNGS in the work-up of undiagnosed infectious diseases. mNGS performs well in identifying rare, novel, difficult-to-detect, and co-infected pathogens directly from clinical samples, and presents great potential in resistance prediction by sequencing the antibiotic resistance genes, providing new diagnostic evidence that can be used to guide treatment options and improve antibiotic stewardship. Many physicians have recognized mNGS as a last-resort method to address clinical infection problems.

Although several hurdles, such as workflow validation, quality control, method standardization, and data interpretation, remain before mNGS can be implemented routinely in clinical laboratories, they are temporary and can be overcome by rapidly evolving technologies. With more validated workflows, lower cost and turnaround time, and simplified interpretation criteria, mNGS will be widely accepted in clinical practice.

Overall, mNGS is transforming the landscape of clinical microbiology laboratories, and to ensure that it is properly utilized in clinical diagnosis, both physicians and microbiologists should have a thorough understanding of the power and limitations of this method.