Molecular Diagnostics

Mdx-Beyond COVID-19 testing

In the upcoming years, the market for molecular diagnostics is projected to gain momentum due to rising demand for accurate early-stage detection of chronic illnesses. Numerous technological developments and the subsequent creation of sophisticated molecular diagnosis methods are key factors in this expansion. R&D activities and research projects have increased dramatically in recent years all around the world, which has greatly aided industry growth. These investigations’ use of cutting-edge technological tools, including mass spectroscopy, in-situ hybridization, and PCR is crucial.

A few additional variables that will fuel demand for point-of-care (POC) diagnostic solutions and molecular diagnostics over the coming years include increased infectious disease prevalence globally, and rising research and development initiatives.

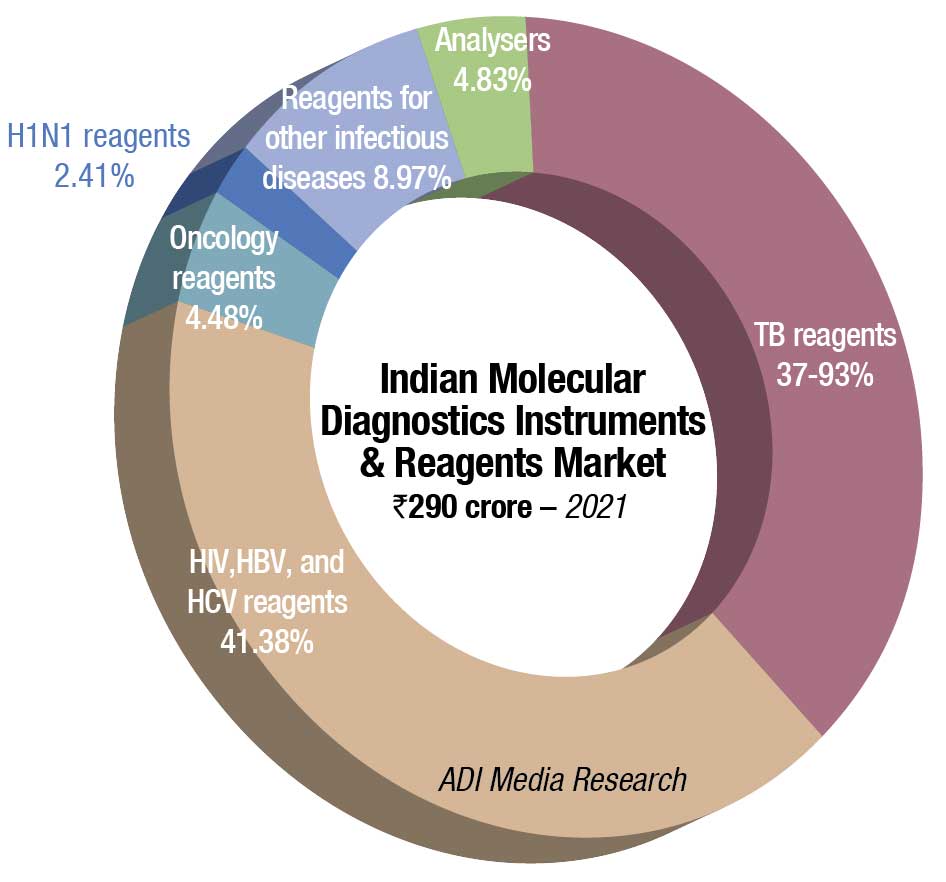

The Indian molecular diagnostics market in 2021, sans Covid testing, is estimated at ₹290 crore, a 9.8-percent increase over 2020. This growth trend is expected to continue over the next couple of years. Some traction was observed in demand for TB reagents, HIV, HBV, and HCV reagents, and a miniscule increase in reagents for oncology testing. The demand for analyzers remained steady.

While reliable estimates are not available for the value of analyzers procured in 2021 for Covid testing, one estimate suggests that the market in 2021 was in the vicinity of ₹8000 crore. This includes extraction machines, extraction kits, amplification test equipment, rapid molecular test kits, and RT-PCR kits.

| Indian molecular diagnostics market | |

| Leading players | |

| Segment | Vendors |

| Indian microbiology automated instruments market |

Roche, Abbott, Thermo Fisher, Qiagen, Danaher, and Randox |

| Indian microbiology instruments-based reagents market | Danaher, Molbio, Qiagen, and Bio-Rad |

| Indian microbiology non instruments-based reagents market | Abbott, Qiagen, Roche, and Altona |

| Oncology reagents | Qiagen, 3B BlackBio Biotech, Roche, and Siemens (Fast Track) |

| H1N1 reagents | Siemens (Fast Track), Qiagen, and Hi-Media |

| Reagents for other Infectious diseases (including HPV, CT/NG, STI markers, dengue etc ) |

Bio-Rad, PerkinElmer, Beckman Coulter, bioMérieux, Tulip Diagnostics, CPC, and Medsource Ozone |

| ADI Media Research | |

In the first two years of Covid, regular molecular tests were on the back burner, and momentum picked up only from July 2021. The PLHIV (viral load testing for all people living with HIV/AIDS) Program, announced in February 2018 providing free-of-cost testing for 1.2 million HIV patients, had suffered a setback in the pandemic.

The Covid-19 pandemic severely disrupted tuberculosis control efforts, and services too. Resources dedicated to identifying and treating tuberculosis were diverted to the Covid response, with direct effect on tuberculosis programs. Similarly, measures to prevent Covid-19 transmission, such as lockdowns, made it harder for people to access tuberculosis testing and care. As a result, there was a drastic decline in the number of people who were newly diagnosed and treated for tuberculosis, and an increase in deaths from tuberculosis for the first time in more than a decade. These tests saw a restoration to somewhat normalcy in the latter half of 2021.

While 2022 has seen a revival of the regular molecular tests, the 918 labs conducting TrueNat tests and 126 labs for CBNAAT tests, set up for Covid-19, are now lying almost idle. Late 2020 and 2021 had seen stabilization of supply chains for Covid-19 testing, establishing a strong market, particularly for NAATs. Later, the development of rapid antigen detection tests and POC NAATs saw the market shift away from the test base previously dominated by high-volume, core laboratory-based NAATs. The Covid-19 PCR tests conducted at 2302 labs are expected to contract beyond 2022. These had already in some cases made way for the faster rapid molecular test, LAMP, when the presence of an active infection is detected by targeting specific gene sequences of SARS-CoV-2. Barring the rise of a more severe virus variant, PCR testing is expected to experience a plateau in the short term due to successful efforts in public vaccination campaigns. Currently, 44 labs are doing other molecular nucleic-acid tests. There is a total of 1450 government labs and 1940 private labs, as of September 2022.

In 2022, the government buying continued to be a question mark. Since the Covid outbreak, funds were diverted to pandemic-related equipment. With the pandemic receding, the thrust on Make in India initiative has held back procurement of high-end, niche equipment.

The global molecular diagnostics market size was valued at USD 37.04 billion in 2021, and is expected to decline at a compound annual growth rate (CAGR) of −1.6 percent from 2022 to 2030. The shrinking of the market can be attributed to the decline in demand for molecular Covid-19 testing over the next 8 years.

The reagents segment accounted for the largest revenue share of the market in 2021. It is expected to maintain its dominance in upcoming years owing to its wide adoption in research and clinical settings. Standard reagents help achieve efficient and accurate results. Standardized results, improved efficiency, and cost-effectiveness are anticipated to support the market growth.

Global molecular diagnostics market outlook has witnessed several advancements over the years, owing to robust efforts from the industry players to develop innovative products and achieve commendable market share. Research studies pertaining to molecular diagnostics solutions have offered a deep insight of molecular attributes to the healthcare industry to facilitate a better understanding of human health and develop care standards for diagnoses of diseases.

The introduction of NAAT (nucleic acid amplification test) devices has given healthcare professionals access to more advanced diagnostic tools. Since these tools possess high specificity, sensitivity, and offer superior-quality results, the CDC or Centers for Disease Control and Prevention has certified NAAT as the gold standard for the diagnosis and detection of various ailments, such as influenza, malaria, and trichomonas. This, in turn, is likely to present lucrative growth prospects for the global market outlook in the forthcoming years.

Molecular testing on Covid-19 is paired with declines in more traditional molecular tests as patients avoided doctors, and continued to reduce in-person doctor visits during the lockdown. Down-but-not-out segments include cancer, histology, and inherited diseases, which are expected to continue to grow, perhaps surge, in coming years.

The molecular diagnostics field worldwide, up until recently, has been dominated by large firms, such as the market leader, Roche, followed by Cepheid/Danaher, bioMérieux, Qiagen, Hologic, BD, Siemens, and Luminex.

While many of these companies are focused on competitive strategies (e.g., sophisticated automation for molecular testing, test menu expansion) to maintain their position, emerging competitors are also entering the market by developing next-generation technologies.

The global Covid-19 pandemic has accelerated these and other new approaches for molecular diagnostics to enter the market, through substantially reduced regulatory hurdles, with many novel technologies coming out of research laboratories. As the need for Covid-19 testing collapses to a fraction of its current demand, molecular diagnostics companies will be holding and maintaining facilities that can create immense supply. This mismatch between demand and supply will either lead to a collapse in prices of molecular diagnostic tests, as suppliers struggle to break even on their facilities maintenance costs, or a mass selloff, or repurposing of these facilities.

Either way, the companies in the molecular diagnostics space will have to plan their next steps very carefully. They have made a lot of money in the boom of the Covid-19 pandemic, but they must be careful not to be saddled with large illiquid material assets for a market that is a fraction of its previous price.