Industry

MedTech licensing and venture in Q3 2023

MedTech venture investment maintains longer-term growth trend despite a dormant IPO market.

The MedTech sector saw continued venture investment in the third quarter of 2023 with a return to the steady growth trend from 2017–19. Despite the cautious optimism in private financing following the blockbuster totals of 2021, other dealmakers are still waiting to jump back in. Licensing and service contract activity was mixed, as the number of deals signed continued lower but with higher commitment totals.

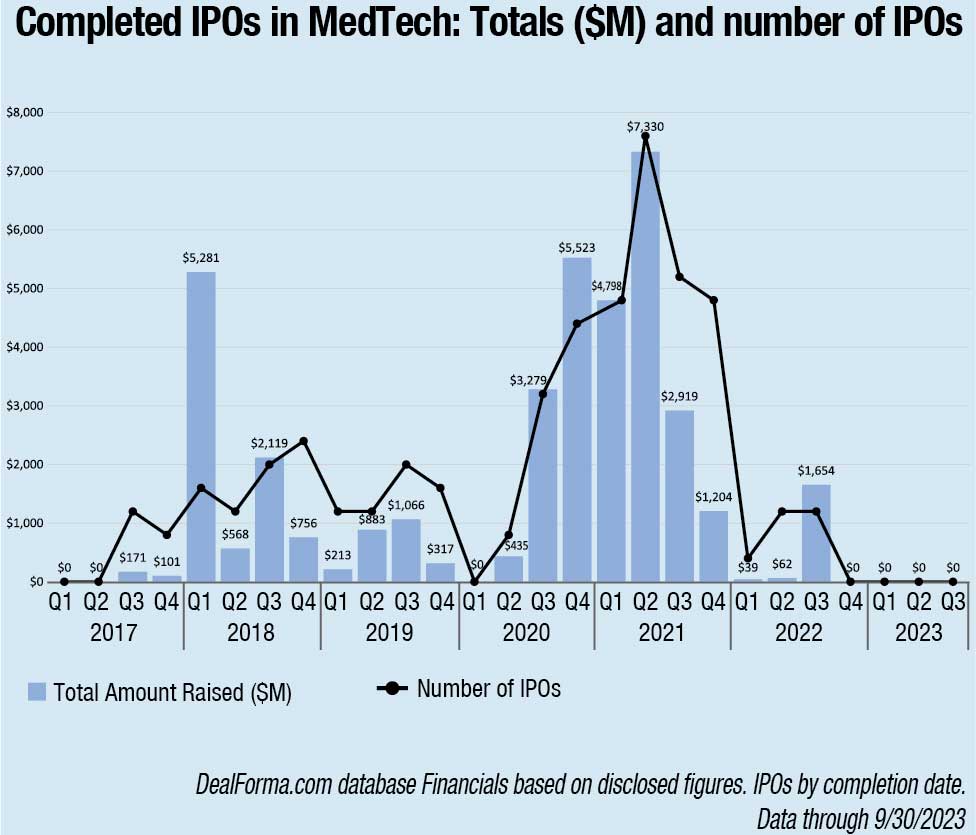

The number and total value of MedTech M&A deals declined, and IPOs were non-existent again—as they have been since the third quarter of 2022.

Here are a few highlights from the third-quarter report:

- VC investment: USD 5.3 billion was raised across 151 private funding rounds for MedTech companies in Q3 2023.

- IPO: There were no MedTech IPOs in Q3 2023.

- M&A: There were 24 M&A transactions for a total transaction value of USD 9.1 billion in the third quarter.

- Licensing deals and service contracts: USD 6.6 billion in total announced deal values for MedTech programs across 66 deals in the third quarter of 2023.

Parameters

MedTech companies are defined as firms developing medical devices, diagnostics, digital health therapeutics, and research tools.

Biopharma companies are defined as firms developing therapeutics and technology platforms engaged in drug discovery, clinical R&D and commercialization. Therapy areas, development stages and modalities are segmented per the DealForma database.

Financials are based on disclosed figures curated by DealForma. Multiple tranches of the same Series are counted as one together.

MedTech dealmaking in 2023

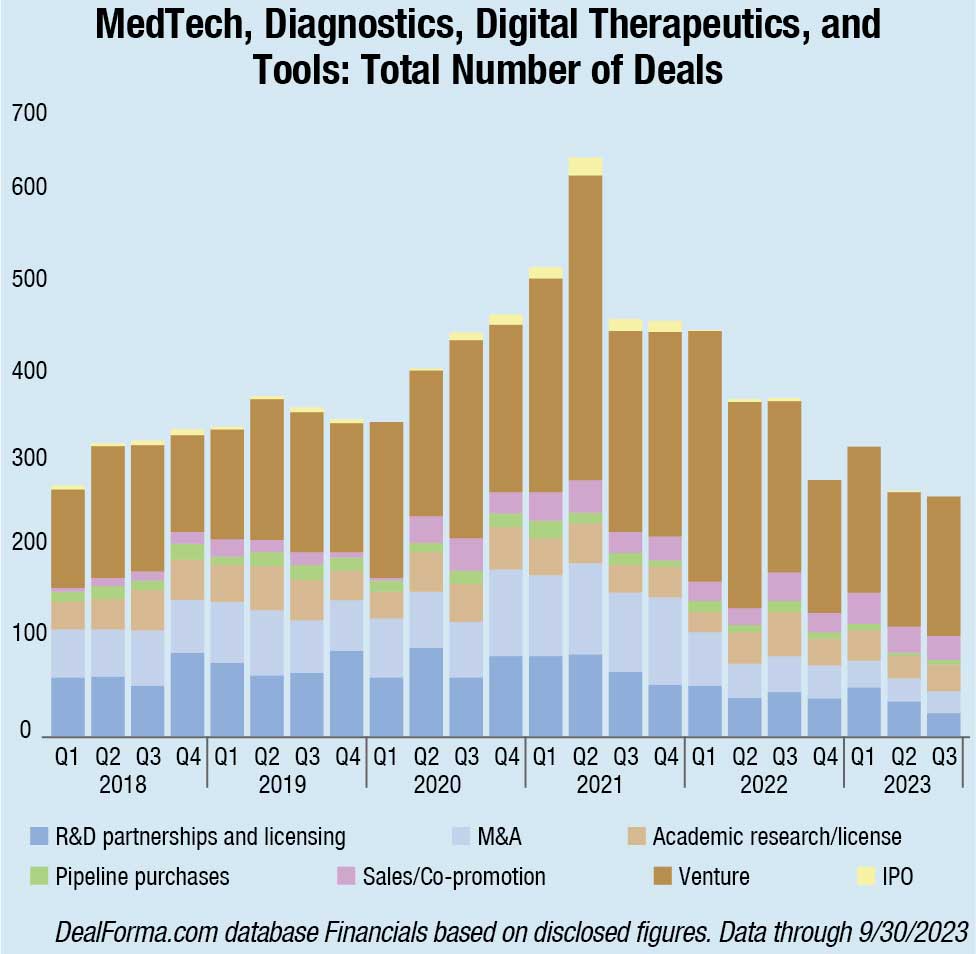

MedTech, device, diagnostics, and research tools saw steady venture activity through 2023, with a slight increase in the number of deals in Q3. Partnership and licensing activity declined, however, to the lowest since before 2018.

- 151 venture deals completed for MedTech companies in Q3 2023, up from 146 in Q2 2023.

- 25 MedTech R&D licensing partnerships signed in Q3 2023, down from 38 in Q2 2023.

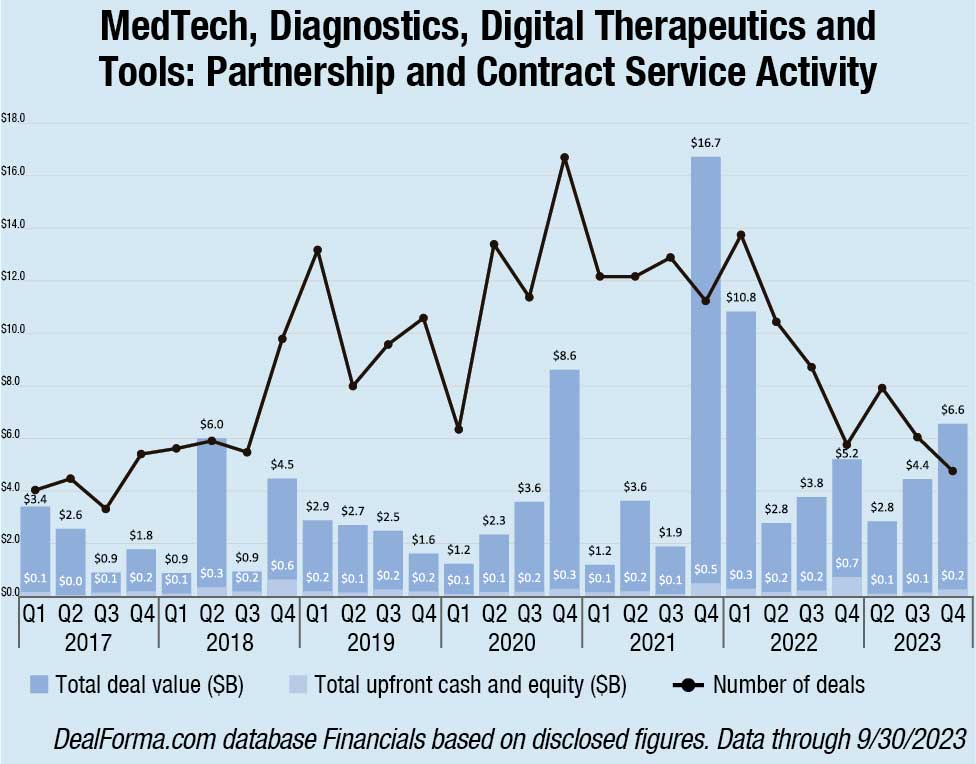

MedTech contracts and licensing activity remained low despite deals with large potential

Quarterly MedTech licensing and service contract activity for devices, diagnostics, and digital health therapeutics saw an increase in total announced deal values when factoring in potential milestone payments. This was concentrated on fewer deals, however, as the quarterly deal count fell to 66.

USD 6.6 billion for 66 deals in Q3 2023, compared to USD 4.4 billion in total announced deal values for MedTech programs across 84 deals in Q2 2023.

- USD 200 million in total upfront cash and equity in licensing and service contract deals for Q3 2023, double the Q2 2023 upfront figure.

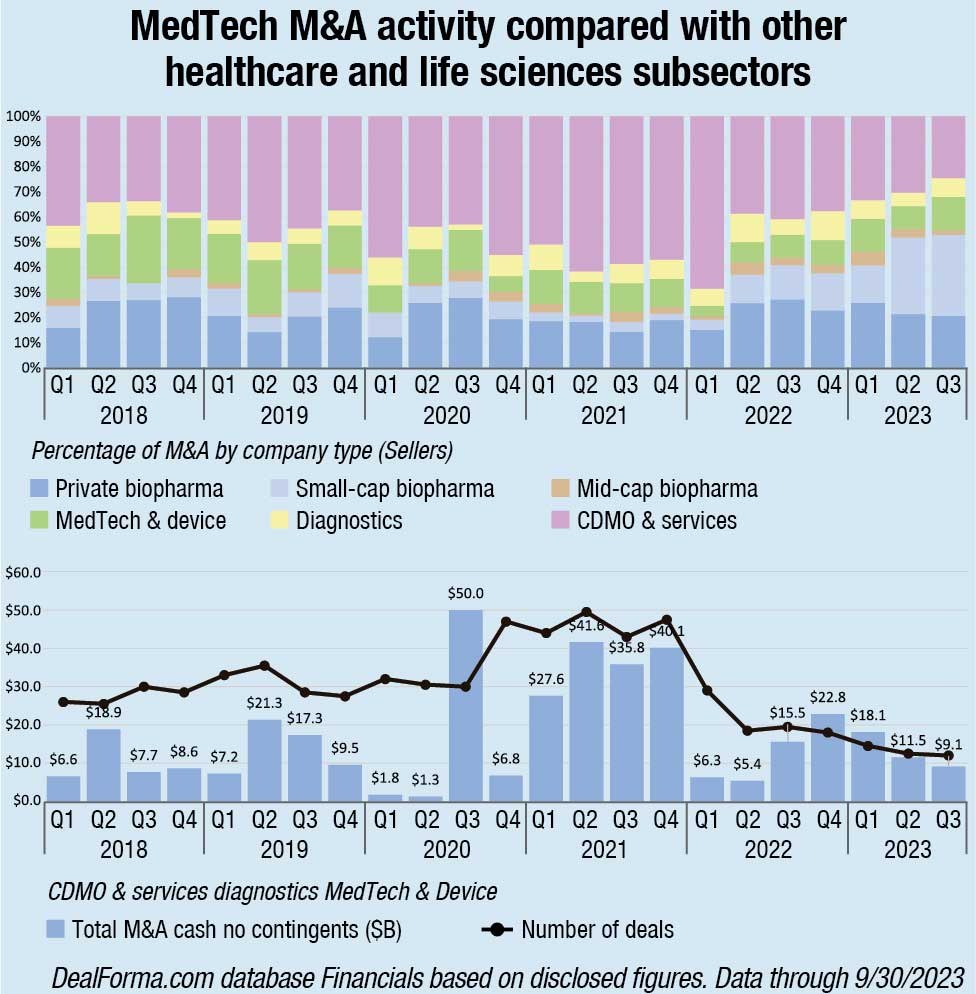

Medtech M&A continued to decline with fewer and smaller deals in Q3

MedTech M&A continued its decline since Q4 2022. There were fewer deals and smaller total deal values through the third quarter of 2023.

- 24 M&A transactions were announced in the third quarter of 2023.

- USD 9.1 billion in total M&A deal value for MedTech companies, reverting to mid-2022 dollar totals.

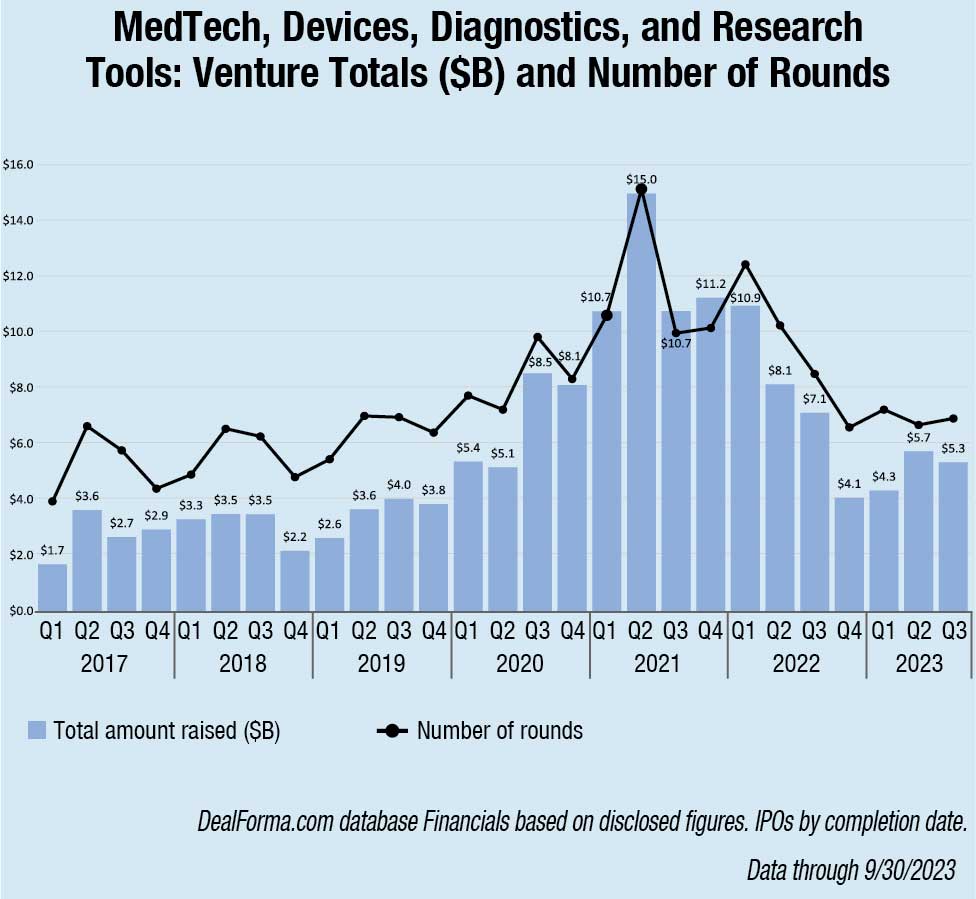

MedTech venture activity held steady in Q3, remaining above 2018/2019 levels

Quarterly MedTech venture dollar totals fell slightly to USD 5.3 billion while the number of rounds increased slightly to 151 in the third quarter of 2023.

- USD 5.3 billion was raised in private funding rounds for MedTech companies in the third quarter of 2023.

- More rounds were raised at 151 in the third quarter of 2023, up slightly from 146 rounds in Q2 2023.

MedTech IPO completions were flat at zero for four quarters in a row

MedTech IPOs remained non-existent in 2023 since the last cohort of three companies went public in Q3 2022.

Authored by Kathryn McDonough, Head of Life Sciences, Innovation Economy, Commercial Banking, J.P. Morgan and Skip Kelly, Head of Healthcare VC Coverage, Commercial Banking, J.P. Morgan.