Industry

Navigating 2024!

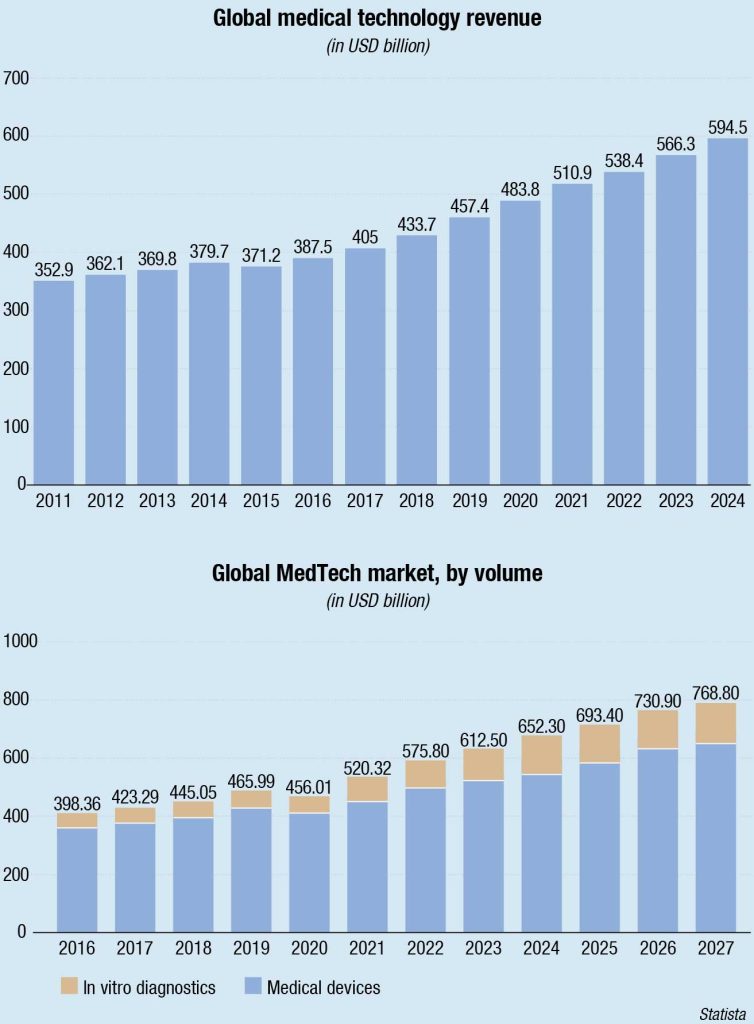

In anticipation of the upcoming year, the healthcare industry is poised for a transformative and accelerated growth trajectory in 2024, driven by key trends and investment insights, thereby indicating a pivotal shift in the industry landscape.

Having faced unprecedented disruption, confronted by a challenging macroeconomic climate marked by high inflation, constrained capital markets, uncertain supply, and rising geopolitical tensions now, the MedTech industry is having to re-invent itself across multiple dimensions.

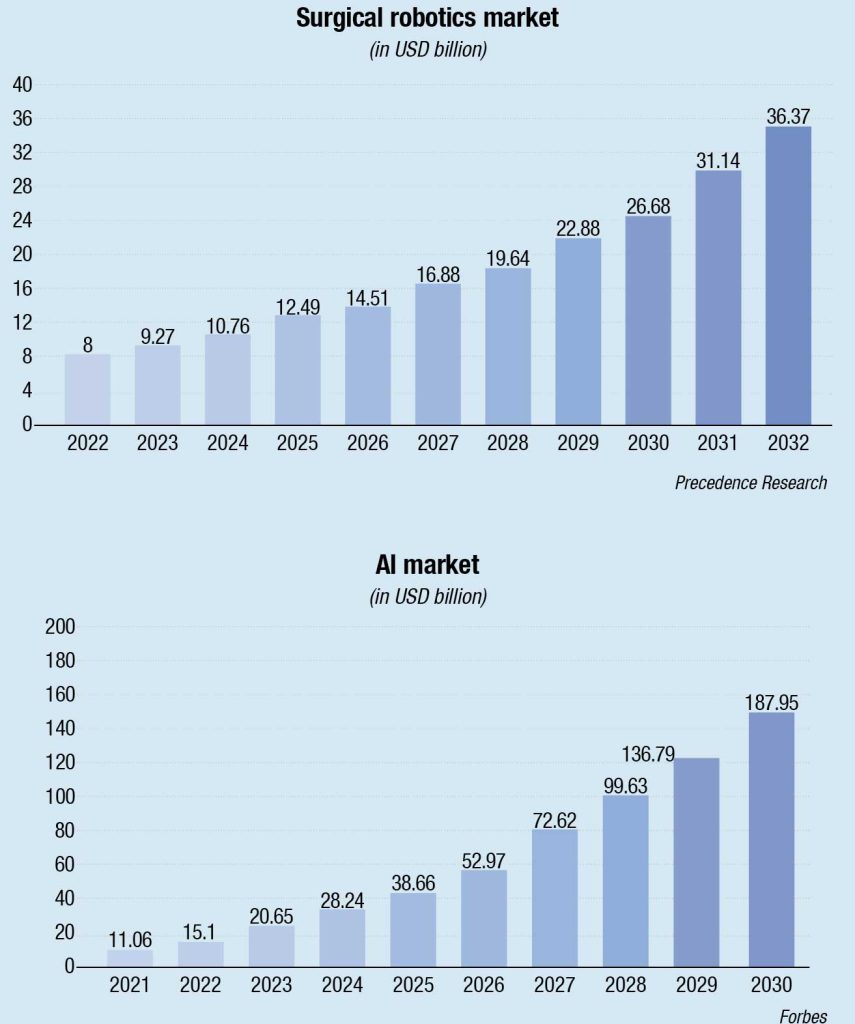

Every aspect of the healthcare industry has been impacted by technology, and further innovations will continue to advance the future of the industry. With the integration of artificial intelligence (AI) and machine learning (ML) into today’s medical devices, new insights gleaned from massive amounts of data have the potential to transform the use and delivery of healthcare. Blockchain technology is emerging as a potential solution, offering secure and transparent data management, streamlined processes, and enhanced interoperability.

Today, healthcare professionals use AI-enabled devices and platforms every day, from performing robot-assisted joint replacements to analyzing X-rays and flagging anomalies for further review by a human radiologist.

AI is expected to become a primary driver of medical devices innovation globally. More than 530 AI/ML-enabled medical devices have been authorized by the FDA, with more added every quarter. The FDA recently released a new plan allowing developers of AI/ML-enabled medical devices to update those devices automatically and safely in response to new data. A clear sign of the growing acceptance of AI and ML, it will eliminate the current requirement to gain approval for every product update, which may be a lengthy process, and increases patient access to safe and effective advanced medical devices. With AI and ML, medical devices researchers and manufacturers can use the latest available data to create new, and enhance existing, features designed to help doctors with their clinical decision-making process and improve patient care.

Indian private hospital chains are seeing strong growth in robotic surgeries. Faster recovery and minimal invasive intervention is tilting the option for robotic surgeries over conventional ones. The surgeons too prefer robotic surgeries to perform complex procedures as they offer more precision, flexibility, and control. Since surgeons operate the robots from a sitting posture, it benefits them ergonomically, especially during complex surgical procedures that may take 6–8 hours. Given the CapEx on robotic equipment, AMC, and the recurring cost of surgical instruments attached to the robotic arms, cost of robotic treatments is prohibitively high.

However, insurance firms are reimbursing just about one-fifth of the treatment cost in case of robotic surgeries and the full amount in case of open surgeries. This is not very different from the global practice. Japan approved reimbursement for robotic-assisted surgery in 2012 – nearly 12 years after the first robotic system was introduced in the country. So did Taiwan, reimbursements for robotic surgeries were signed off in 2023, even though the first procedure was done in 2004.

That said, the industry has just scratched the surface of how AI, ML, and robotics can assist the medical devices industry. In the face of economic challenges, the MedTech industry is poised for excellence, driven by scientific breakthroughs, AI integration, and innovations in surgical robotics, marking 2024 as a year of continued advancement.

Manufacturing has long been at the center of MedTech. The industry is known for designing and mass-producing high-precision equipment, devices, and other hardware to meet clinical needs. While this approach has generally served the industry well, cost pressures, evolving provider and consumer needs, and competition from new entrants are prompting MedTech companies to change how they operate and how they go to market with their products and services.

Some key differentiators

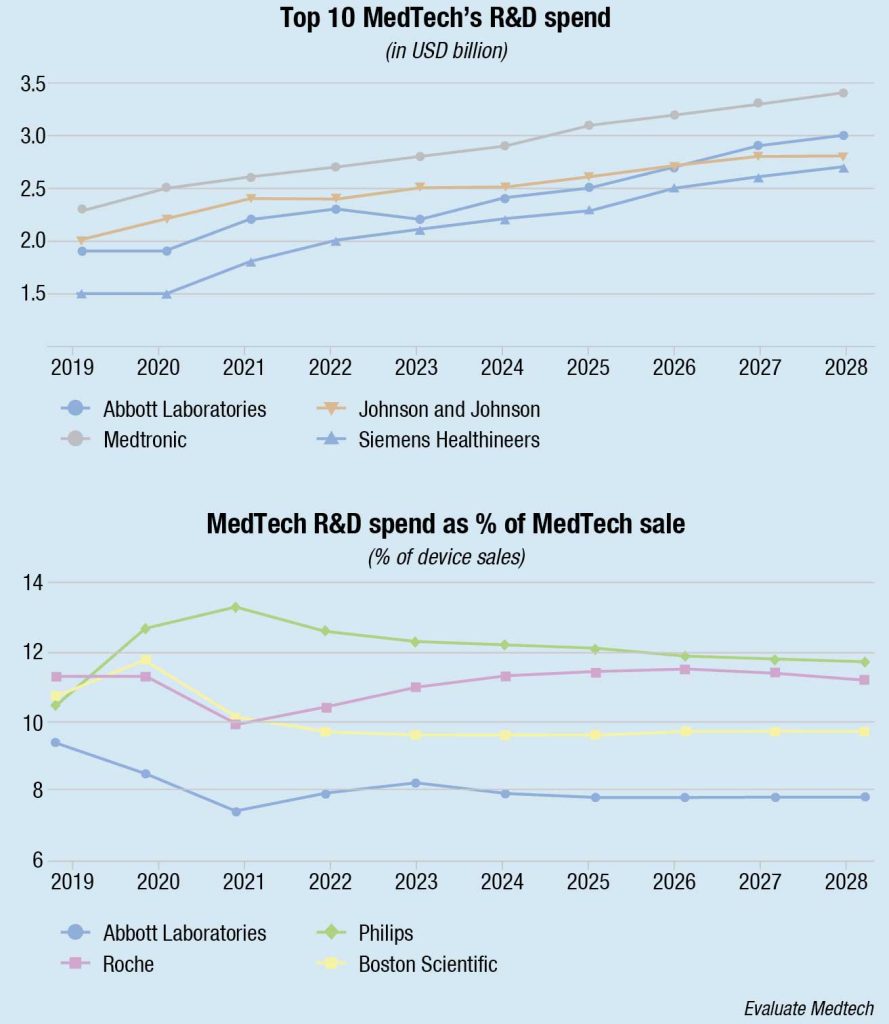

R&D. 2022 saw MedTech companies set a new record global high, and R&D spending accelerated despite economic headwinds. Annual R&D spending at large medical devices companies grew more than USD 1.1 billion – or 5.1 percent – to USD 23.4 billion, in the top 100 companies.

Three medical devices companies spent more than 20 percent of their revenue on R&D – MicroPort (49.9%), Novocure (38.3%), and Applied Medical Resources (20.0%).

A dozen medical devices companies grew their R&D spending by more than 25 percent – ICU Medical (95.8%, though the Smiths Medical acquisition could have played a role), Shockwave Medical (61.6%), Orthofix (48.7%), Inari Medical (45.5%), MicroPort (41%), Masimo (39.5%), Medacta (38%), Alphatec (37.5%), HU Group (31.5%), Intuitive Surgical (31%), B. Braun Melsungen (29.8%), and Carl Zeiss Meditec (25.5%).

Twelve medical devices companies reduced their R&D expenditures year-over-year – Getinge (−1%), Medtronic (−1.8%), Convatec (−2.6%), Smith+Nephew (−3.1%), Avanos Medical (−5.3%), Bio-Rad (−5.4%), Dexcom (−6.4%), Zimmer Biomet (−6.9%), LivaNova (−15.1%), Alcon (−16.6%), Globus Medical (−25%) and Invacare (−59.7%).

The unfortunate reality is that many MedTech companies have historically underinvested in digital R&D, leaving them trailing in the exploration of connectivity solutions, for both legacy and next-gen devices.

R&D excellence is foundational for business growth in MedTech. Its effectiveness, efficiency, and ROI is a top priority for MedTech leaders, but it is not achieved through spending alone. MedTech leaders excel at developing and managing an R&D portfolio, which serves as a compelling road map to growth and commercial performance. Their organizations have leading capabilities in product management, design thinking, and systems engineering. MedTech leaders have adopted agile development practices and next-generation digital and analytical tools, which increase their speed and effectiveness. And they engage with external sources of innovation.

Digital healthcare ecosystems. The healthcare landscape is undergoing a revolutionary transformation, thanks to the advent of the digital health ecosystem. This interconnected landscape of multiple stakeholders is reshaping the way healthcare service providers approach healthcare delivery and patient care. This intricate web of medical devices, policies and regulations, hospital ecosystems, digital tools and technologies, data-sharing platforms, and interconnected devices has the potential to revolutionize healthcare by offering personalized and data-driven solutions that improve patient experiences and outcomes while maintaining costs. MedTech companies are expanding their role in digital healthcare ecosystems by using their devices and data assets to improve care outcomes.

The MedTech industry needs to continue to move forward with its digital innovation plans despite industry leaders’ reservations and the challenges that stand in the way. Innovating via digital technologies and transforming traditional business models may be essential for long-term success, and the second cannot happen without the first. Despite the challenge, MedTech organizations can unlock new growth opportunities, deliver better patient experiences, and stay ahead in an ever-evolving healthcare environment by shifting to digital solutions.

By playing to their strengths, including deep clinical expertise, cutting-edge medical knowledge, and established customer relationships and trust, MedTech companies may be in a strong position to keep digital disruptors at bay. Incorporating data and evidence-based insights into decision support can help providers deliver high-quality, efficient care, and help patients with self-care and prevention − ultimately improving healthcare outcomes.

Determining which technologies to pursue and prioritize (and which to ignore) can be tricky as the sector transitions from fragmentation to convergence. New technologies and business models − while under sustained financial pressure − might be the biggest challenge healthcare executives will face in 2024. While the year ahead will likely be fraught with challenges, some remarkable innovations are likely as organizations adapt to the new environment, and ensure they are not left behind.

We can expect to see convergence as the disruption of traditional healthcare stakeholders, entrance of new players like retailers and tech companies, and the reassembly of a new ecosystem that creates opportunities.

Reimagining operations for the challenges of the next decade. As companies grow bigger and devices become more complex, operations will be a differentiating factor for MedTech leaders. MedTech companies can improve their operations to become more reliable, robust, and profitable, ultimately delivering better patient care. They can pursue targeted initiatives to rebuild supply chains with resilience as a priority and capture the full value of digitization and Industry 4.0. They can drive innovation with a design-to-value approach and redesign their manufacturing and distribution networks to balance costs, increase flexibility, and expand market access. Importantly, MedTech leaders can invest in quality capabilities that are deeply embedded in business processes.

Environmental, social, and governance. The integration of ESG considerations emerges not merely as a trend but as an imperative. The industry can expect innovations catering to medical needs while prioritizing environmental and social concerns. The ascent of digital health solutions, telemedicine, and AI-driven diagnostics will revolutionize patient care and reduce the carbon footprint by minimizing reliance on physical infrastructure and transportation.

Challenges are inevitable. Evolving regulatory landscapes, shifting consumer expectations, and the global economic milieu will present unforeseen obstacles. Yet within these challenges lie unparalleled opportunities. MedTech companies that wholeheartedly embrace ESG will position themselves as market leaders and vanguards of thought and innovation. These trailblazers will set industry benchmarks, influence policy frameworks, and command consumer trust.

Collaboration remains paramount. Governments, industry stakeholders, investors, and consumers must work together to create an ecosystem that champions innovation while upholding ESG tenets. Endeavors, such as cross-border research collaborations, sustainability-centric investment portfolios, and consumer education campaigns can expedite the industry’s trajectory toward a sustainable future.

By embedding ESG in the core of this metamorphosis, the industry can ensure growth that is exponential, responsible, resilient, and aligned with cherished values.

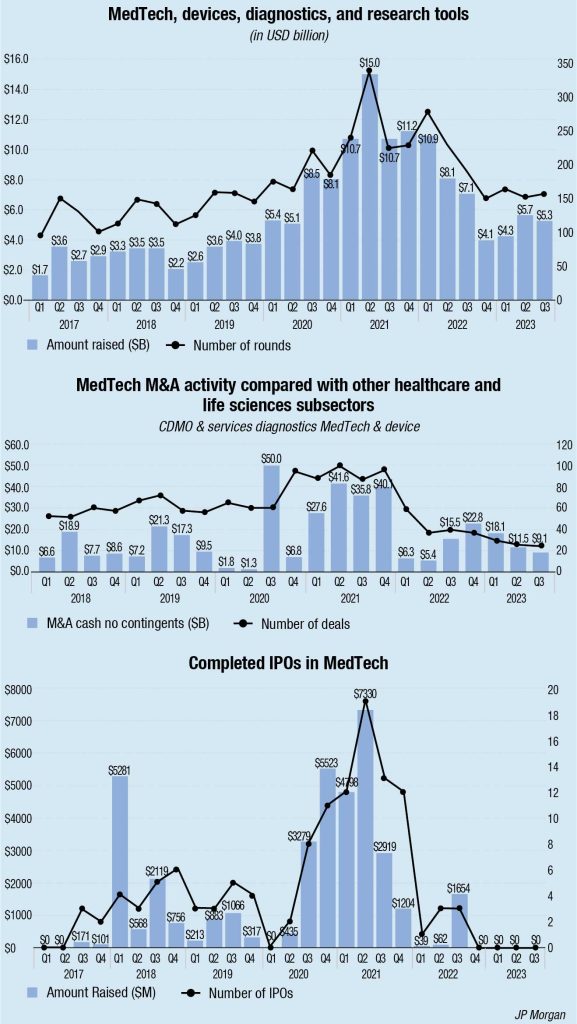

M&A. The MedTech mergers and acquisitions arena is not only alive but also poised for continued growth and evolution. The MedTech sector, known for its innovation and adaptability, seems to be leveraging M&A as a means to navigate complexities, foster synergies, and drive sustainable growth.

The dynamics of MedTech M&A in 2024 extend beyond traditional business strategies. Regulatory considerations and compliance play a crucial role in shaping M&A activities. The formal and highly regulated nature of the medical industry necessitates a keen focus on navigating regulatory landscapes, ensuring that M&A transactions align with industry standards and requirements.

Therefore, the MedTech M&A landscape in 2024 is vibrant, dynamic, and characterized by a strategic response to the evolving healthcare environment. The industry’s resilience is evident as companies anticipate and actively engage in M&A activities to foster innovation, collaboration, and sustainable growth. The trends of strategic partnerships, spinoffs, and global transactions underscore a forward-looking approach, positioning the MedTech sector for continued success in 2024. As the industry navigates challenges and embraces opportunities, M&A remains a cornerstone for driving transformative change and shaping the future of medical technology.

Multi-billion dollar acquisitions in the MedTech industry carry significant implications that reverberate across the sector. However, challenges accompany such mega-deals, including the need for effective integration strategies to harmonize diverse corporate cultures and optimize operational synergies. Additionally, regulatory scrutiny and compliance become paramount considerations to ensure a smooth transition and uphold industry standards. In essence, multi-billion dollar acquisitions in MedTech fuel innovation, foster market growth, but necessitate meticulous management to realize their full potential.

Shortage of medical professionals. Shortage of doctors, nurses, and growing need for administrative talent versed in global best practices is a serious issue that needs to be resolved.

India’s doctor-to-patient ratio hit a record high of 1.2 doctors per 1000 patients in 1991, but as its population surged, the ratio dropped to about 0.7 in 2020. The WHO recommended level is 1 and China, with a comparable population to India, is at 2.4. The uneven distribution of health workers among the states, the rural-urban and public-private sectors is even more alarming.

There is a shortage of specialist doctors, particularly in the fields of surgery (83.2%), obstetrics and gynaecology (74.2%), medicine (79.1%), and pediatrics (81.6%). Specialist doctors tend to go overseas or join the private sector in metropolitan and other large cities. The Rural Health Statistics report released by the Ministry of Health and Family Welfare on January 12, 2023, says that community health centers (CHCs) lack approximately 80 percent of the needed specialists. No wonder, patients in rural areas tend to go to the cities for treatment, seemingly trusting the hospitals there more.

India is facing a shortage of nurses and we are nowhere close to the WHO’s recommendation of three nurses for a population of 1000 people. In India, the current figure is 1.7 per 1000 people. Indian nurses are one of the most sought-after talent pools in the world. Many nurses migrate to countries outside in search of better prospects, such as financial independence, higher standard of living, more exposure, and freedom of choice.

India is yet to fully understand the changing nature of nursing, which is why it continues to be among the biggest exporters of nurses, even while facing acute shortages at home. In 2020, some 61,000 Indian nurses were working in just four countries – the US, Britain, Canada, and Australia.

An ecosystem like in the Western countries, where nurses serve as the first level of medical practitioners patients encounter will have to be created. Recognizing and enabling nurses to serve as practitioners can help improve outcomes.

Recently, the government announced a possible revision in the Indian Nursing Council Act 1947 to address the shortage of nurses. Currently, foreign nurses or those with a degree from outside India cannot work in the country. The draft National Nursing and Midwifery Commission Bill, 2020, is likely to change this scenario by allowing the registration of foreign nurses with state nursing councils.

The government has nearly doubled the number of undergraduate medical seats in private and public colleges to 101,043 as of March 2023 from 51,348 before 2014. More than 1.76 million students appeared in tests for those seats last year. There is also a plan to open 157 new nursing colleges.

Medical inflation. India has one of the highest medical inflation rates in Asia, reaching 14 percent. Government schemes play a pivotal role. However, the stability of charges under these schemes over the past decade raises questions about their sustainability. Hospitals, functioning as business entities, face financial strains amplified by regulatory mandates, such as the recent Pollution Control Board requirement.

The depreciation of the rupee reverberates through the healthcare system, impacting the costs of imported medical devices and contributing to inflationary pressures. Additionally, the rise in medical insurance premiums stems from a combination of low policy penetration, demographic patterns, and the inadequacy of coverage, prompting collaborative efforts for improvement.

The healthcare industry is on the cusp of a transformative journey in 2024. MedTech trends and substantial technology investments collectively indicate a trajectory toward a more interconnected, innovative, and patient-centric healthcare ecosystem. The integration of cutting-edge technologies, strategic collaborations, and a data-driven approach positions the industry for accelerated growth and evolution in the coming year.

As India navigates these intricacies, a concerted effort, involving government bodies, hospitals, and insurance agencies, is imperative. Balancing the scales to ensure accessible and sustainable healthcare for all requires a nuanced understanding of the interplay between policies, financial dynamics, and global economic factors.

In this journey toward a healthier, more equitable healthcare system, collaboration and a comprehensive approach will be the cornerstones of success. By addressing the root causes and working collectively, India can pave the way for a healthcare landscape that truly serves the diverse needs of its population.