Trends

MedTech research spending set to slow in 2022

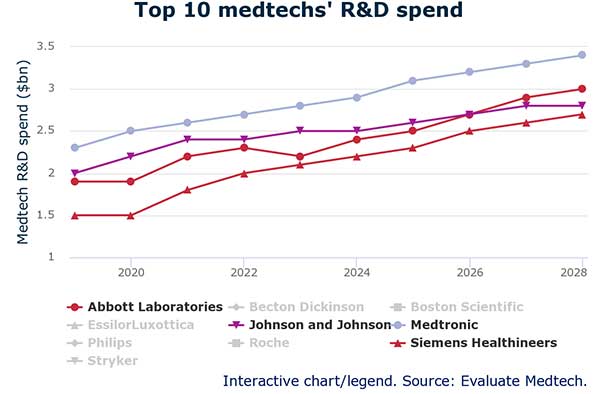

In 2020 the novel coronavirus prompted the largest MedTech companies to boost their spending on R&D significantly, with the top 10 groups investing more than $15bn between them in bringing new technologies to market. And in 2021 the increase was even sharper, with this figure reaching $17.4bn.

When these big MedTechs report their financial results for the current year, however, the sellside sees their R&D expenditure increasing much more slowly. After that, moderate growth will see the top 10 cohort spend just shy of $23bn on in-house development in 2028.

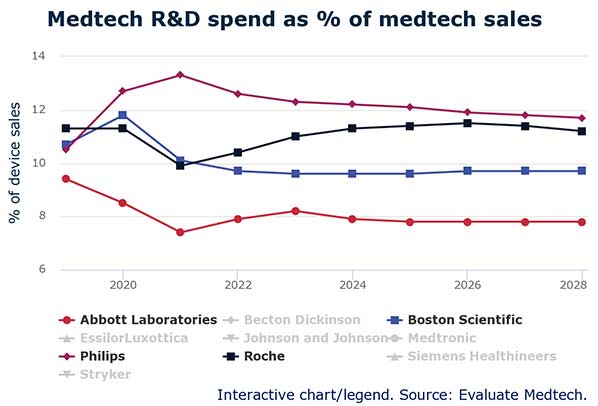

These forecasts, compiled by Evaluate MedTech from sellside reports and recently extended out to 2028, see Medtronic as the biggest spender on research in six years’ time, with an R&D bill of $3.4bn. In terms of spending as a proportion of sales, however, Philips is forecast to lead – but this is arguably more to do with falling sales than increased spending.

While the rate of growth in a MedTech’s R&D outlay can fluctuate, it is rare for companies – divestments aside – to make actual cuts to their research spending. But four of the top 10 companies are forecast to do just that in the coming few years.

From 2021 to 2022, the sellside believes that Becton Dickinson, Philips and Roche will downgrade their research spending, by 7%, 4% and 0.4% respectively. In all three cases this is a retrenchment from the splurges of 2020 and 2021 as they raced to develop technologies to aid the fight against the coronavirus – diagnostics from BD and Roche, and ventilators from Philips.

In 2023, Abbott is forecast to make the same move.

Following that, analysts expect a return to the steady, even growth that had been the usual pattern in pre-pandemic years – excluding large strategic moves such as mergers and divestments, that is.

Calm after the storm

A look at proportional spending – what fraction of a company’s medical device sales they re-invest in MedTech research – shows a similarly turbulent few years, with a calmer period beyond 2023. For many of the companies, the change in proportional spending is less to do with managerial decisions to allocate cash to R&D than it is with marked variation in revenues.

Abbott, its coffers swelled by Covid test revenues, spent just 7.4% of its gross income on research in 2021, versus 9.4% in 2019. The same pattern may be seen with Roche’s proportional spending, and for the same reason.

Philips embodies the opposite situation. It upped its R&D spending by a huge 28% in 2020 as it refocused to become a pure-play MedTech company, and did its damnedest to get new ventilators to hospital wards. But damned, in fact, it was: faulty ventilators have been repeatedly recalled over the past year or so and the group’s revenues have stalled.

Its overall sales grew by just 1% from 2020 to 2021, and are forecast to do the same to 2022. This means that in 2021 it spent a whopping 13% of its sales on R&D. This proportion is forecast to shrink in the years to come, though will remain higher than other big MedTechs. The question for investors is when the fruits of this investment might appear. Evaluate