Company News

Microbix reports record results for Q1 fiscal 2024

Microbix Biosystems Inc. reports results for its first quarter of fiscal 2024 ended December 31, 2023, with record quarterly revenues and a record quarterly profit, reflective of ongoing progress to increase sales from its diagnostic-test related ingredients and devices, and material licensing revenues from its fully-funded program to revalidate and relaunch its approved drug, Kinlytic® urokinase.

Management discussion

Results for Q1 demonstrate strong growth in sales of each of Microbix’s test ingredients (“Antigens”) and its test quality assessment products (“QAPs™”), which were collectively up by 80% year-over-year. In addition, Microbix recognized and received material licensing payments relating to Kinlytic. Collectively, the resulting revenues of over C$ 8.4 million led to strong net earnings and set the stage for a record full-year fiscal 2024. Microbix believes sales growth will continue for Antigens and QAPs, alongside satisfaction with the progress of Kinlytic toward FDA re-approval and re-launch into the United States market.

Quarter ending December 31, 2023 (“Q1”)

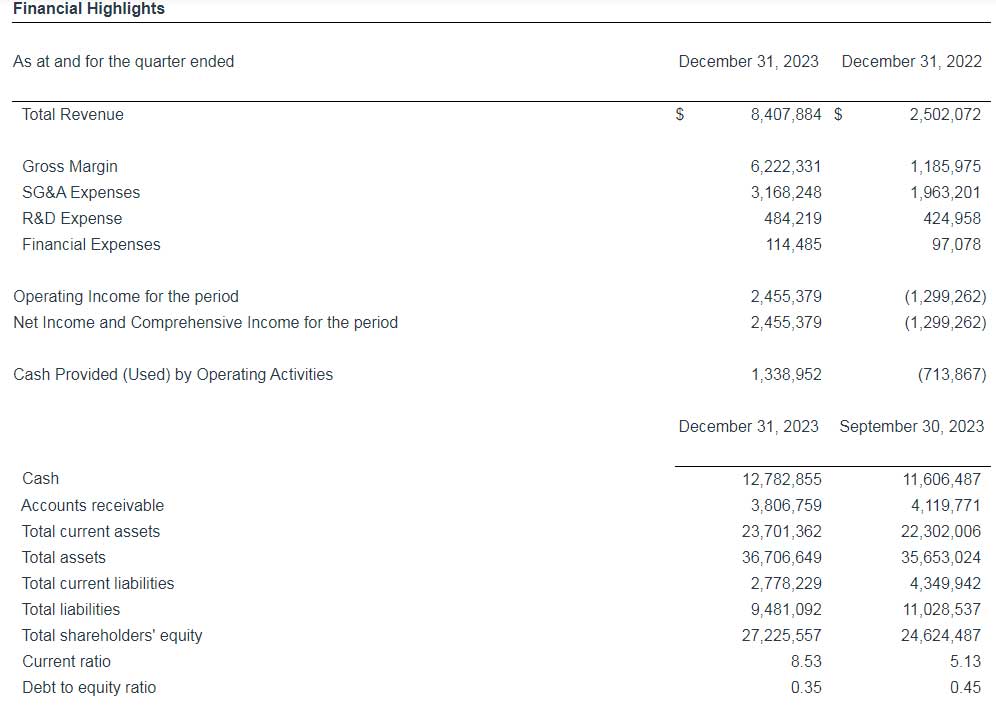

Q1 revenue was $8,407,884, a 236% increase from Q1 2023 revenues of $2,502,072. Antigen sales grew by 95% to $1,953,677 (Q1 F2023 – $1,003,608), while QAPs grew by 69% to $2,248,236 (Q1 F2023 – $1,333,503). Revenue from royalties decreased to $119,311 (Q1 F2023 – $164,762). Q1 revenues were also greatly influenced by the recognition of $4,086,000 in Kinlytic licensing milestone payments (Q1 F2023 – nil).

Q1 gross margin was 74%, significantly up from Q1 2023 gross margins of 47%. Gross margins were primarily impacted by Kinlytic licensing revenues, to which no COGS were attached. Without the impact of the Kinlytic licensing revenues, our gross margins of 49% were up from 47% last year.

Operating and finance expenses in Q1 increased by 52% relative to Q1 2023 principally due to consulting fees related to our Kinlytic licensing agreement that were absorbed into G&A. In addition, Q1 costs reflect the ongoing costs of our new IT systems which began in the latter half of fiscal 2023, and amortization relating to the reversal of the impairment of the Kinlytic intangible asset which began at the end of fiscal 2023.

Increased sales and higher gross margins were partially offset by increased operating expenses (due to increased investment into business growth and infrastructure). The above results led to a Q1 operating income and net income of $2,455,379 versus a Q1 2023 operating loss and net loss of ($1,299,262). Cash provided by operating activities was $1,338,952, compared to cash used in operating activities of ($713,867) in Q1 2023.

At the end of Q1, Microbix’s current ratio (current assets divided by current liabilities) was 8.53 and its debt to equity ratio (total debt over shareholders’ equity) was 0.35, both measures having improved from the prior year first quarter (Q1 2023) and the immediately preceding fourth quarter (Q4 2023).

MB Bureau