X-ray Equipment

Mobile radiology will generate new growth opportunities

Mobile radiology concept is expected to play an important role in complementing traditional imaging practices, and enabling users to perform a large number of radiology examinations in an effective way.

The overall economic impact of Covid-19 has been wide-ranging, affecting all industries. Medical imaging is the largest driver of the diagnostic segment of the healthcare equipment market, and has experienced a wide range of fluctuation. The pandemic has caused an unprecedented negative impact on the interventional and surgical X-ray market. However, the pandemic turned the spotlight on diagnostic imaging by demanding a need for high-speed workflow and efficient patient management. This helped to highlight the importance of the role of digital radiography (DR), which offers fast turnaround with less than one minute needed between exposure and image acquisition. As we start to enter the post-pandemic period, the continuing need for DR technology is still as strong as ever.

Furthermore, the demand for mobile X-ray systems has increased as a result of the pandemic. With the consumers being more aware of the benefits of mobile X-ray systems, and the possibility of another pandemic in the future, healthcare facilities may consider switching to mobile diagnostic equipment owing to its faster image processing, workflow optimization, integrated AI, and other features.

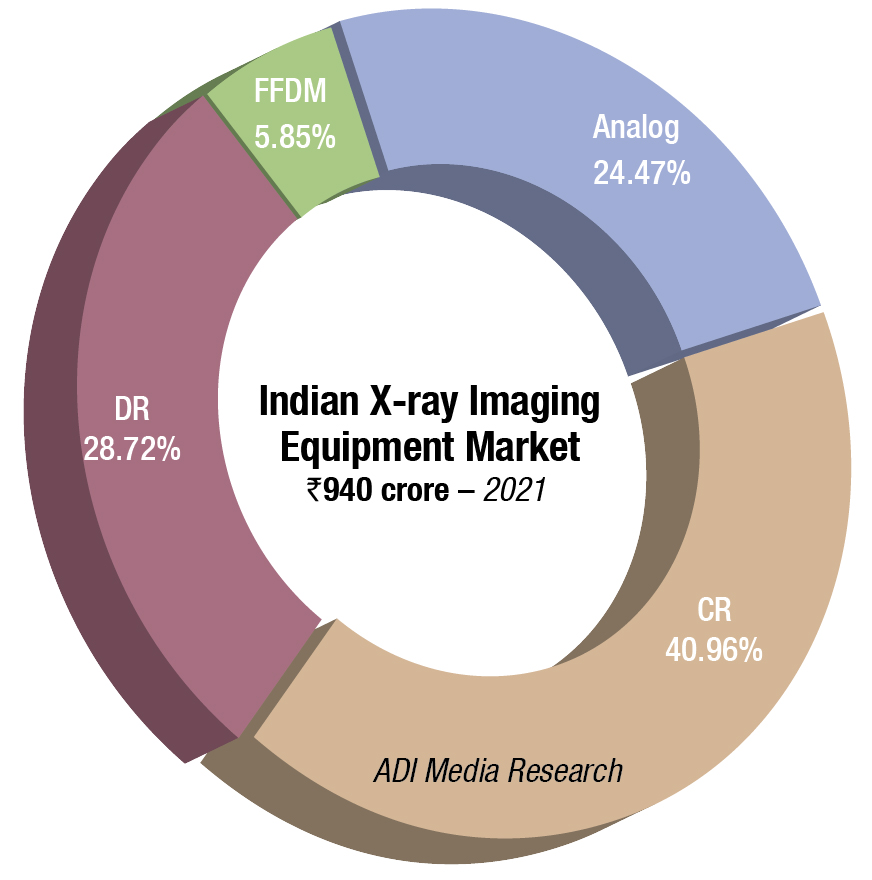

The Indian X-ray machines market in 2021 is estimated at 18,532 units, valued at ₹940 crore. The analog machines, with a 46-percent share by quantity, contribute a 24-percent share by value.

The CR machines, at a 38-percent share by quantity, dominate the segment by value with a 41-percent share. The DR machines constitute 29 percent of the market by value and 16 percent by quantity. The full-field digital mammography (FFDM) machines, for which we have estimated the market size for the first time, are largely imported, at an average unit price of ₹1 crore. Two indigenous brands, Allengers and Panacea, have recently made an entry into this segment.

|

Indian X-ray equipment market

|

||||

| Analog brands | CR brands | |||

| Tier 1 | Allengers | Fujifilm | ||

| Tier 2 | Vision, Kiran, Medion, and Epsilon | Carestream | ||

| Others | Skanray, BPL, Alerio (Iatome Electric), and regional fragmented brands | Agfa and Konica | ||

|

DR fixed brands |

||||

| Imported | Agfa, Carestream, Fujifilm, and Konica | |||

| Indian | Allengers, Prognosis, Kiran, Skanray, and BPL | |||

|

DR mobile brands |

||||

| Imported | Indian | |||

| Tier 1 | Samsung | Allengers | ||

| Tier 2 | Carestream | BPL | ||

| Others | Agfa | Skanray, Alerio (Iatome Electric), and Kiran |

||

|

DR retrofit brands |

||||

| Tier 1 | Konica, Carestream, and Fujifilm | |||

| Tier 2 | Agfa and CareRay | |||

| Others | PZ Medical, Rayence USA, and Canon | |||

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian X-ray imaging market. | ||||

| ADI Media Research | ||||

While, with the price difference narrowing between DR and CR systems, there has been a shift in favor of the DR segment, and during Covid a preference for mobile models, within the DR segment, the retrofit detectors constitute about 57-percent share by volume and value. And once considered along with OEM panels, they hold a combined share of 96 percent by volume, and 88 percent share by value.

Some distinct trends are observed. While the funds are not a constraint at the hospitals, and they are keen to equip their facilities with high-end equipment, the government’s Make in India push is restricting procurement. Orders are being placed on Indian integrated and assembled equipment, especially on tendered procurements, a case in point being 21 machines purchased by HLL recently. With the tightening in the regulatory environment, new product launches are now taking longer, sometimes as much as six months.

The buyers are inclined to de-risk their institutions from technological innovations, and are shifting to OpEx models and opting for pay-per-case. Others are preferring to buy value models. Having said that, new players are keen on the Indian market and Chinese and Korean brands find their way here.

Mobile radiology represents a transforming concept that is evolving rapidly in line with notable advancements in the point-of-care (POC) testing arena. By wrapping digital X-ray capability into a mobile cart or portable system, the concept allows medical professionals to perform imaging examinations almost anywhere, including at patient bedside. The functionality incorporated into a mobile and compact footprint facilitates seamless examinations and accelerates the imaging turnaround to ensure faster diagnosis and treatment-related decision. The increasing acceptance of these mobile radiology units in clinical and other settings is anticipated to empower people and help healthcare providers in monitoring and managing patient health in an efficient manner. The mobile radiology trend is anticipated to receive a considerable push from increasing focus on point-of-care testing and ongoing advances in this direction. The concept is expected to play an important role in complementing traditional imaging practices and enabling users to perform a large number of radiology examinations in an effective way.

The global digital mobile X-ray devices market is expected to enjoy a valuation of USD 3.6 billion by the end of 2022, registering 6.6 percent CAGR, exceeding USD 6.9 billion in 2032. According to a recent study, in terms of product type, mobile devices held 91.3 percent of the global digital mobile X-ray devices market share in 2021. Based on product type, the market is segmented into mobile digital X-ray devices and hand-held digital X-ray devices. Among these segments, mobile digital X-ray devices are expected to dominate the global market with a share of around 88 percent in 2032. The use of these mobile X-ray machines has increased with the proliferation of smartphone across the globe. Mobile digital X-rays help avoid the use of X-ray cassettes and their tedious transportation, therefore, reducing the work force requirement.

Further, in terms of technology, computed radiography segment held a revenue share of around 53.3 percent in 2021, and is expected to display a gradual growth rate of 5 percent. This is due to the improved contrast resolution and post-processing capabilities provided by computed radiography.

Owing to the high cost involved with the clinical trial procedures, the digital mobile X-ray devices manufacturers might face a little challenge, especially in the emerging economies. Clinical studies for diagnostic imaging equipment are ideally carried out a year before the product is released. However, the manufacturers are finding it challenging to perform early-stage trials and form partnerships with regional businesses due to the regulatory limitations.

The competition in the market is set to intensify as several key players are focusing on expanding their portable X-ray device portfolios through acquisitions and collaborations. The market is expected to offer several opportunities for new players and the currently established market leaders. The key players in the market include Canon Medical Systems, General Electric Company, Koninklijke Philips NV, and Shimadzu Corporations.

In July 2022, Canon Medical Systems USA Inc. signed a definitive agreement to acquire NXC Imaging.

In March 2022, Konica Minolta Inc. (Konica Minolta) launched AeroDR TX m01 in Japan. It is a portable X-ray system, featuring a wireless dynamic digital radiography function.

In November 2021, GE Healthcare launched nearly 60 new solutions, including AI algorithms on a mobile X-ray device for automated measures, quality control, and case prioritization at the RSNA 2021 (Radiological Society of North America) annual meeting.

In September 2021, Carestream announced their collaboration with the Health First’s Holmes Regional Medical Centre in Melbourne to supply them advanced medical imaging systems.

Post-Covid teleradiology growth will be fueled by the rise of radiology super groups. As we enter year three of the pandemic, and radiologist burnout continues to grow, there is also an increasing competition for talent that puts pressure on hospitals and practices to improve the employee experience while delivering the best possible care. At the same time, increasing consolidation can be seen in the market as radiology practices merge into super groups with regional or national scale and scope.

As these groups continue to merge and grow, many are further embracing teleradiology. This change enables staff to work from anywhere at any time, while also providing the ability to support greater flexibility. In all, this not only gives these practices a competitive advantage in recruiting in a tight market, but it can also improve radiologists’ quality of life and help address rampant burnout.

Teleradiology also provides great benefits to patients, especially those in the underserved or unserved areas, as it gives them access to specialists outside their local market. With the ability to review images and scans remotely, radiologists can, in turn, deliver reports much faster, speeding up the diagnosis and treatment of many conditions.