Company News

NeoGenomics reports Q4 and full year 2023 results

NeoGenomics, Inc. announced fourth quarter and full year 2023 results for the period ended December 31, 2023.

“NeoGenomics’ fourth quarter and full year 2023 results show the momentum and strength of our business as we continued to deliver long-term, sustainable growth on our way to becoming the leading oncology laboratory,” said Chris Smith, CEO of NeoGenomics. “We believe 2024 will be an exciting year as we continue to invest in our people and technologies to support consistent revenue growth and profitability, while allowing us to better serve our patients and providers.”

Fourth quarter results

Consolidated revenue for the fourth quarter of 2023 was $156 million, an increase of 12% over the same period in 2022. Clinical Services revenue of $130 million was an increase year-over-year of 20%. Clinical test volume increased by 6% year-over-year. Average revenue per clinical test (“revenue per test”) increased by 13% to $441. Advanced Diagnostics revenue decreased by 17% to $25 million compared to the fourth quarter of 2022.

Consolidated gross profit for the fourth quarter of 2023 was $67.6 million, an increase of 18.9% compared to the fourth quarter of 2022. This increase was primarily due to an increase in revenue. Consolidated gross profit margin, including amortization of acquired intangible assets, was 43.5%. Adjusted Gross Profit Margin(2), excluding amortization of acquired intangible assets, was 46.7%.

Operating expenses for the fourth quarter of 2023 were $86 million, an increase of $3 million, or 4%, compared to the fourth quarter of 2022. This increase primarily reflects an increase in professional fees, an increase in payroll and payroll-related costs, including non-cash stock-based compensation expense, and an increase in travel expenses. This increase was partially offset by a decrease in recruiting expenses and a decrease in credit card fees.

Net loss for the quarter was $14 million compared to net loss of $23 million for the fourth quarter of 2022.

Adjusted EBITDA was positive $9 million compared to negative $1 million in the fourth quarter of 2022. Adjusted Net Income(2) was $4 million compared to Adjusted Net Loss(2) of $7 million in the fourth quarter of 2022.

Cash and cash equivalents and marketable securities totaled $415 million at quarter end.

Full year results

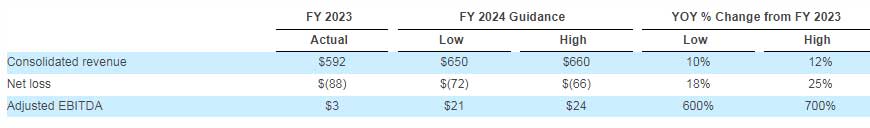

Consolidated revenue for 2023 was $592 million, an increase of 16% over 2022. This increase was primarily driven by an increase in test volume, a more favorable test mix in our Clinical Services segment, an increase in average unit price due to strategic reimbursement initiatives, and growth in our Advanced Diagnostics segment, primarily due by increased volume and higher billings across its portfolio. Net loss for 2023 was $88 million compared to net loss of $144 million in 2022. Adjusted EBITDA(2) for 2023 was positive $3 million compared to negative $48 million in 2022. Adjusted net loss(2) for 2023 was $15 million compared to adjusted net loss of $70 million in 2022.

2024 financial guidance

The Company also issued 2024 guidance today (in millions).

MB Bureau