Industry

Positioning for the future

The high demand for IVD could seed structural shifts that will have long-term implications for diagnostic-test manufacturers.

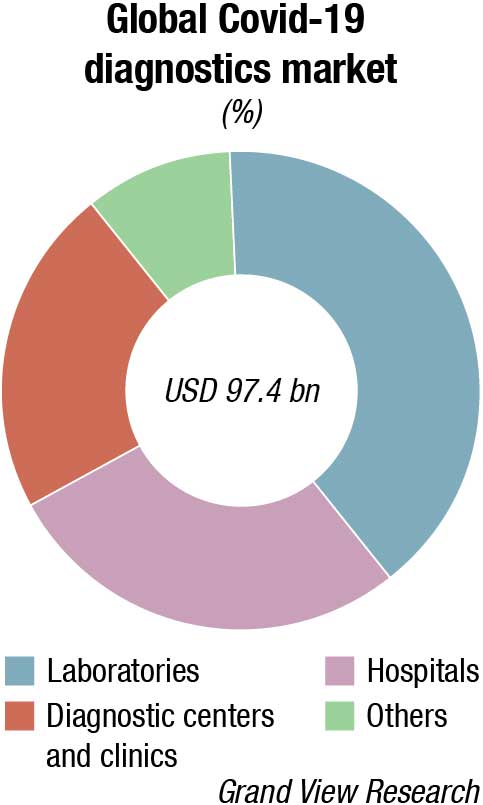

While much of the focus around in-vitro diagnostics (IVDs) has lately been around their utility in the fight against the Covid-19 global pandemic, there is much more going on with IVDs in multiple disease states, and their importance as early diagnostic detection tools to the healthcare system cannot be overemphasized.

The Indian diagnostics testing market is estimated at ₹67,830 crore in 2021. The market growth has been propelled by rapid technological advancements as swift growth in diagnostic imaging, emergence of hub & spoke model, higher medical focus on evidence-based treatment, rise in non-communicable diseases and lifestyle-related diseases, increasing penetration of insurance and demand for preventive diagnostics. Diagnostics is closely linked to delivering superior outcomes for patients as the world and especially India moves toward evidence-based medicine.

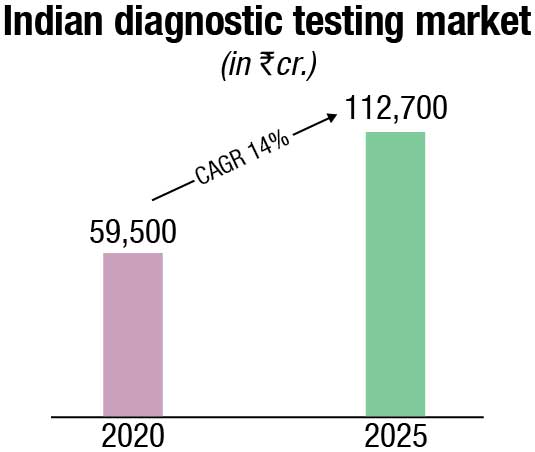

The non-critical visits to the diagnostics labs declined due to the pandemic in 2020. However, high demand for Covid-related tests such as RT-PCR, antigen, antibody, and CT-scans offset the fall in non-critical tests and resulted in a 13 percent net drop in the diagnostics market in 2020. Effectively the diagnostics market dropped slightly to ₹59,500 crore in 2020.

A considerable 46 percent of the diagnostics market is unorganized, led by stand-alone labs. The remaining 54 percent organized channel is further segmented into hospital-based labs, diagnostics chains and online. Hospital-based labs cover 37 percent of the market, wherein most of the major hospitals have their own diagnostic arms, and the smaller hospitals partner with third-party labs to manage their diagnostics facilities. Diagnostics chains cover 16 percent of the market and have grown at a 15 percent CAGR. 60-65 percent of the diagnostics chain segment is led by regional chains, and the remaining 30-35 percent market is led by providers having pan-India presence. Online diagnostics accounts for 0.6 percent of the market as of 2020 but has emerged as a promising channel in the last couple of years, providing the convenience of home sample collection and advanced test booking. The organized sub-channels and players focus heavily on quality, accreditation and offer complex tests, which are not offered by standalone labs – this made them better placed to serve the rising demand for Covid-19 tests.

Preventive diagnostics has emerged as a promising use-case in recent years, led by growing consciousness about staying healthy, especially among the GenZ and millennial consumers. The preventive use-case has also received a push from the employee health tracking initiatives implemented by corporates. Hence, while the preventive segment is relatively small in size (just over 10 percent of the diagnostics market), it has grown at a 27 percent CAGR – more than 2x growth of the curative segment. While the demand for preventive tests dropped in the short-term due to the pandemic in 2020 (as curative tests took precedence), it is projected to get back to rapid growth levels as the pandemic recedes within the next couple of years.

By 2025, the diagnostics market is projected to reach ₹112,700 crore, growing at a 14 percent CAGR in the period 2020-25. The key growth factors are the continued shift from curative to preventive care (will contribute to the rise in the higher ticket size preventive segment), projected rise in India’s population above 65 years of age (who have a greater need for medical diagnostics), emphasis on evidence-based treatment, conducive government policies (such as AB PMJAY, free essential diagnostics under NHM, promotion of preventive diagnostics via tax benefits) and growth in lifestyle diseases requiring regular need for diagnostics tests (e.g. blood sugar monitoring).

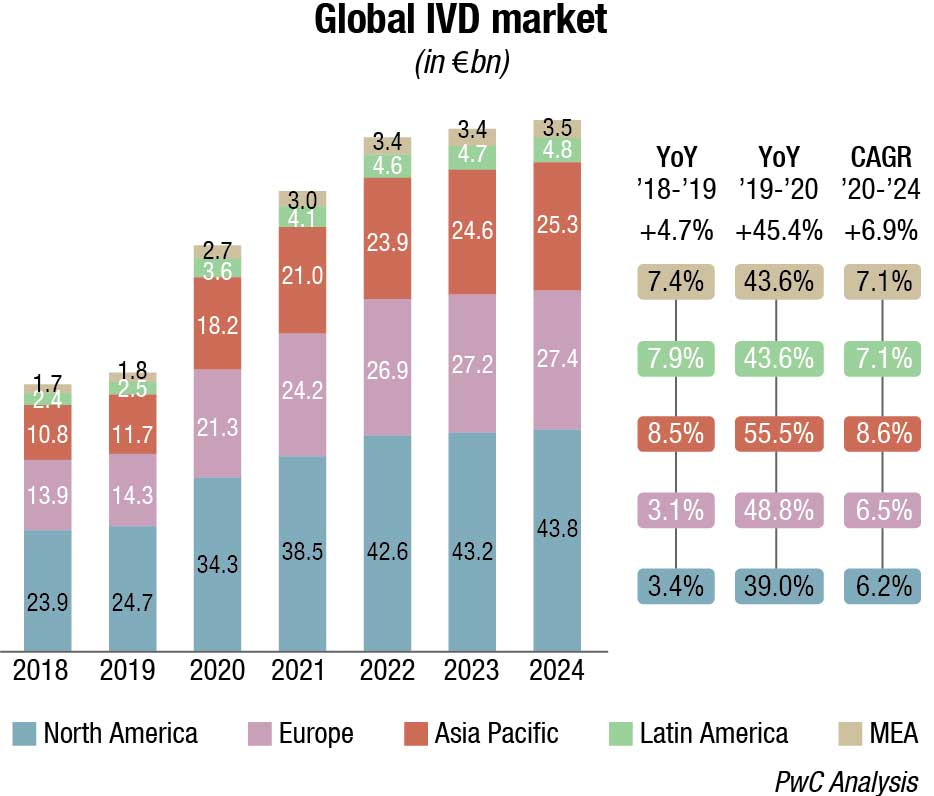

The global diagnostics testing market was valued at USD 162.45 billion in 2021 and is expected to reach USD 339.89 billion by 2029, registering a CAGR of 9 percent during 2022-2029. The global IVD instruments and reagents market has weathered the effects of Covid-19 to register impressive growth in 2020 and 2021. A recent report reveals the world’s IVD instruments and reagents market size stood at USD 90.9 billion in 2021. The market will expand by an annual rate (CAGR) of 6.9 percent from 2021 to 2024.

Covid-19 pandemic is expected to continue to positively impact the market in 2022, which is forecast to grow at a higher pace comparing to pre-pandemic levels (ca. 11%–13%) due to a progressive reduction of swab tests, but an increase in serological ones to map antibodies’ presence after vaccination.

As regards technology segmentation, Covid-19 has positively impacted immunoassay and molecular diagnostics/genetics with a +49.9 percent and 230.9 percent YoY 2019-20 growth, respectively, while there has been a negative impact (ca. 3%–5%) on other segments due to decline in the number of installed bases and routine testing. The same happened considering the application segmentation with infectious diseases recording a +166.2 percent YoY 2019-20 growth and others impacted negatively.

Major IVD corporations expect their innovations from the pandemic to play a key role in the future, along with a renewed focus on better processes and moving testing closer to patients – whether that is at the hospital bedside or at home.

The amount of money put into diagnostic testing during the pandemic from private capital, governments, and nonprofits will bring forward the next generation of testing to market.

The crisis had uneven effects on research and development budgets as the world raced for Covid-19 solutions. While this may have momentarily pulled work away from other projects, it has led to process improvements that will benefit all development moving forward.

The pandemic also has underscored the value of laboratory data and insights, as well as the need for clinical laboratorians to contribute to population health initiatives. There has been a push within the hospital environment for Lab 2.0 for a while now.

The pandemic also has underscored the value of laboratory data and insights, as well as the need for clinical laboratorians to contribute to population health initiatives. There has been a push within the hospital environment for Lab 2.0 for a while now. The pandemic just reinforced the need for that evolution.

Technological improvements and new business models in diagnostics and research tools are also supporting some of the timeliest innovations in healthcare – from personalized medicine to early detection of disease to home-based medicine.

Three trends that are expected to have the greatest impact on the industry include rapid advancements in proteomics technology; continued expansion of liquid biopsy to new applications; and accelerated consumerization of diagnostics.

Rapid advancements in proteomics technology. If the past two decades were the age of genomics, then the 2020s may be the age of proteomics. Proteomics is more directly associated than genomics or transcriptomics (RNA) with human phenotypes and, therefore, represents the most direct way to understand human diseases.

Proteomic tools like immunohistochemistry (IHC), mass spectrometry, and enzyme-linked immunosorbent assay (ELISA) have existed for many decades. However, a mature market for multiparametric proteomic tests has yet to emerge, as these legacy tools have lacked the necessary combination of sensitivity, plex, and resolution to significantly advance understanding of disease states. But growing applications like advanced therapeutic modalities, immunology, liquid biopsy, and precision medicine are driving demand for proteomics, and spurring technological innovation.

New advancements, including higher plex, higher sensitivity, single-cell resolution and spatial resolution, have the potential to propel experts’ understanding of disease etiology and ability to identify targets and biomarkers and to develop and manufacture new therapeutic modalities and precision medicines.

Companies in the space are innovating to solve historical limitations of the two core proteomic technologies, mass spectrometry and protein array, which involve trade-offs on several performance characteristics. Mass spectrometry allows for hypothesis-free testing, and could theoretically provide multiplexed coverage of the whole proteome, but it has relatively low sensitivity (1–1000 ng/mL) and throughput. Seer and Biognosys are developing pre-analytical and post-analytical solutions, respectively, to increase the throughput, sensitivity, and plex of this technology.

Conversely, protein array approaches can have high sensitivity and throughput, but they have greater experimental bias and lower proteome coverage, given the use of specific reagents for specific proteins. In this field, Olink is allowing for greater multiplexing, using barcoded antibodies, and SomaLogic has developed proprietary aptamers that can be screened at high throughput and 7000-plex and growing. Quanterix has developed an ultrasensitive biomarker digital detection technology that can detect proteins at very low levels in the blood, an application well suited for screening, early detection, and monitoring of disease. The science is exciting, but there are some key hurdles that must be overcome for these technologies to be used more broadly, including automation of sample preparation, standardization of analytical procedures, and data sharing.

Step changes in the past five years have also enabled scientists to characterize more than a thousand proteins from a single cell. Scientists are increasingly interested in single-cell proteomics because many diseases are heterogeneous and, therefore, bulk analysis – effectively a statistical average of an entire population of cells – is not necessarily representative of disease pathology. Single-cell proteomics enables identification of functional subpopulations of cells, providing a more granular understanding of disease pathology, mechanisms of therapy resistance, and relevant biomarkers and targets for new therapeutics. Some companies in the space include 10X Genomics, Mission Bio, Bio-Rad, Fluidigm, IsoPlexis, and Berkeley Lights.

Proteomics represents a complementary approach to transcriptomics, a field also experiencing growth, and genomics. Therefore, innovators are also looking to single-cell multiomics as a next wave of single-cell technology. Companies like IsoPlexis, 10X Genomics, Becton Dickinson, Berkeley Lights, and Mission Bio have developed platforms to measure different combinations of the genome, transcriptome, and proteome (though not yet all three at once).

Spatial proteomics is another emerging market with high growth potential. This opportunity is largely in discovery and translational research today, but there is potential for spatial in the clinical setting, given immune-oncology pipeline activity and the shift toward precision medicine. Future clinical applications could include diagnosis, prognosis, treatment selection, and monitoring.

The current competitive landscape is defined by four to five key players using multiplex IHC (Akoya Biosciences, Ultivue), imaging mass cytometry (Fluidigm), and secondary ion mass spectrometry (Ionpath). NanoString Technologies, a key player in spatial transcriptomics, also offers spatial proteomics. This combination of spatial and single-cell techniques would enable a more complete picture of disease states.

Proteomic technologies require data-intensive models and interpretation databases. As a result, numerous proteomics companies, such as Seer, Olink, and Biognosys offer software solutions for proteomic data analysis. Software and informatics offerings, including machine learning and artificial intelligence, represent an opportunity for innovators to differentiate and drive adoption, and are increasingly a necessary part of the solution.

Many proteomics companies raised significant money over the past couple of years via initial public offering or venture capital and had high valuations based on the theoretical potential of their platforms. The financing market for proteomics tools in 2021 was white-hot, based on excitement in life sciences investing and on the promise of emerging proteomics companies to be the Illumina of proteomics.

Investor sentiment is shifting, however, toward expecting proteomics companies to demonstrate tangible business results, including revenue scaling through placements and pull through, and toward proteomics technologies gaining translational and clinical relevance. Multiple publicly traded companies experienced greater than 25 percent corrections in value in January 2022 alone. This year and beyond, it will be critical for these companies to deliver on their promise and show real value for investors. Effectively segmenting and targeting customers – and forming partnerships with biopharmas, contract research organizations, and diagnostics companies – will be key to doing so.

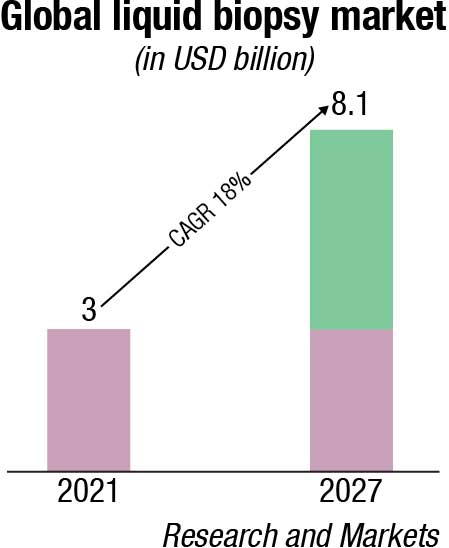

Continued expansion of liquid biopsy to new applications. The liquid biopsy field is working to fulfill its potential to diagnose patients earlier and allow for more informed, precise patient management. There has been significant progress in the past couple of years, and the field is expected to continue to mature in existing applications while accelerating in nascent use cases and therapeutic areas.

Historically, the utility of molecular testing in oncology was limited to advanced disease-state patients to provide guidance on treatment selection. Drivers for this include cost limitations, the focus of precision medicines on later-stage patients, and the need for tissue biopsy. As a result, the first and most mature application for liquid biopsy today is treatment selection for advanced oncology patients. In 2020, the Food and Drug Administration (FDA) approved the first two next-generation sequencing (NGS), blood-based, oncology pan-solid tumor liquid biopsies that guide treatment decisions – Guardant Health’s Guardant360 CDx and Roche’s FoundationOne Liquid CDx. This field will continue to grow, given underlying growth in precision medicine, targeted at a growing number of increasingly complex biomarkers. The market is expected to continue to mature as tests become more broadly reimbursed across geographies and IVD kits allow for test decentralization.

Liquid biopsy applications are also catalyzing a paradigm shift from one and done NGS tests for late-stage patients toward longitudinal testing in broader populations across the entire patient journey. They take advantage of established current procedural terminology codes and coverage decisions, reduce sample collection challenges, and will increasingly use IVD content to enable testing outside of specialty reference labs.

One new application with significant progress in the past few years is minimum residual disease (MRD) monitoring, where ultrasensitive liquid biopsy tests can enable more effective surveillance and earlier detection of recurrence than can existing methods like carcinoembryonic antigen tests or imaging. Adaptive Biotechnologies is a leader in the space for hematological cancers. Natera and Guardant are the most clinically advanced in the solid-tumor space, having commercially launched laboratory-developed MRD liquid biopsy tests that measure circulating tumor DNA in 2019 and 2021, respectively.

The initial focus for these tests is recurrence monitoring and risk stratification in colorectal cancers, though Natera’s liquid biopsy is now covered by the Centers for Medicare & Medicaid Services for pan-cancer immunotherapy monitoring, and Guardant is also planning to include additional tumor types. Additionally, Invitae offers early access to its MRD liquid biopsy, and NeoGenomics Laboratories is preparing to commercially launch an MRD assay this year. This application is valuable to biopharma companies, developing treatments for the adjuvant setting. These technologies are still early in their adoption curve but are expected to see increased uptake, broader reimbursement, and expansion into other tumor types.

Early detection is an even more nascent application of liquid biopsy that has long been considered the holy grail of cancer screening. Two FDA-approved liquid biopsy early detection tests are Exact Sciences Laboratories’ stool-based Cologuard and Epigenomics’ blood-based Epi proColon, both for colorectal cancer (CRC). In 2021, GRAIL launched Galleri, the first multicancer early detection (MCED) test, commercially available in the United States, as a laboratory-developed test.

The test sequences cell-free DNA in the blood to detect more than 50 cancer types. The company is planning to pursue full FDA approval for the test in 2023. Other companies developing early detection tests include Exact Sciences, which is developing a CRC blood screening test and a multiomic MCED test, analyzing DNA and proteins; Guardant, which is currently focusing on CRC but planning to expand to other tumor types; Freenome; Bluestar Genomics; and Singlera Genomics. Early detection tests are an incredible achievement, with the potential to have significant impact on patients, especially since the majority of cancer deaths occur in cancers without recommended screening tests. Sufficient sensitivity for early-stage cancers and broad reimbursement are two key requirements for realizing the full potential of these tests.

Research in liquid biopsy applications beyond oncology is also increasing. Alzheimer’s disease, for example, needs an inexpensive and scalable diagnostic to replace positron emission tomography (PET) scanning and allow for earlier identification of patients, even in pre-symptomatic stages. In 2020, C2N Diagnostics launched a blood test for levels of amyloid beta that could enable this. Nonalcoholic steatohepatitis (NASH) is another disease with a need for a less invasive, inexpensive test to replace liver biopsy and other less-specific blood test methods to screen for, triage, diagnose and/or monitor disease. Eighty million Americans are estimated to have nonalcoholic fatty liver disease, many of them undiagnosed, and of those, 10 percent to 30 percent may have NASH. Last year, Glympse Bio and DiscernDx both reported early proof-of-concept results for blood-based liquid biopsy tests for NASH. These tests, if fully validated, could drastically increase the pool of diagnosed patients appropriate for disease-modifying treatments in development.

For liquid biopsy to move into early screening and detection in oncology and beyond at a wide scale, it will need to meet key requirements including test performance, pull through to confirmed diagnoses, and reimbursement. Minimizing false negatives and false positives will be important for driving widespread adoption. In oncology, physicians need to be able to reliably find the tumor, following a positive liquid biopsy screen, for the tests to be consistently useful. Then, a key question will be whether the healthcare system will be able to afford the earlier and more frequent testing.

For example, the total addressable market for pan-cancer screening in the US could be ~USD 20 billion, assuming all ~120 million Americans aged 50 or older receive a test at ~USD 500 per test every three years. Cologuard is currently reimbursed by Medicare at ~USD 500, but Galleri’s list price is nearly twice as high at USD 949. It is not yet clear what the screening frequency will be, what price the market would accept and whether NGS-based assays would be profitable at that price, given the inherent costs. It will be important to monitor the market’s progress on the above requirements.

Accelerated consumerization of diagnostics. Consumers are increasingly interested in taking their health into their own hands, and diagnostic tests are no exception. The Covid-19 pandemic has made diagnostics a more common part of everyday life and has popularized at-home testing as an alternative to less convenient in-lab testing. Now, consumers are shopping for diagnostic tests that are accurate, convenient, fast, and affordable. At-home diagnostics may benefit the healthcare system as well, by reducing the number of in-person visits for routine tests and lowering the cost of care. At-home sample collection is a common direct-to-consumer model outside of Covid-19 self-tests.

In this model, consumers order tests, send samples to Clinical Laboratory Improvement Amendments-certified labs and then receive results, sometimes reviewed by physicians. Companies like LetsGetChecked, Everlywell, Verisana Laboratories, and myLAB Box follow this model, offering menus of elective tests for (to various degrees) vitamin levels, thyroid levels, cholesterol levels, sexually transmitted diseases, fertility, and more. Many of these companies were founded several years before the pandemic. However, investment in the space has been significant in the past two years – Everlywell raised a USD 175-million Series D round in 2020, and LetsGetChecked raised a USD 150 million Series D round in 2021.

Leading diagnostic companies and laboratories like Abbott Labs, Quidel, Quest Diagnostics, and Becton Dickinson have also made significant investments in new channels for diagnostic tests. Abbott Labs and Quidel are looking to expand in direct-to-consumer diagnostics, Quest Diagnostics is offering consumer-initiated lab testing in partnership with Walmart, and Becton Dickinson acquired Scanwell Health, which has a smartphone app to analyze and interpret test results. The market will likely experience the most growth in respiratory diseases, sexually transmitted diseases and colon cancer screening.

Several challenges with the at-home testing market will need to be addressed, as these tests shift some responsibility to the consumer for selecting the right test, conducting the test properly, paying for the test and, in some cases, interpreting the result correctly. It can be difficult for consumers to assess or compare the reliability of different tests. Many of these tests are not covered by insurance, which will be a barrier to widespread adoption. Interpretation and counseling support will also be critical.

As the market for more-complex at-home tests like cancer screening and organ function tests grows, patients will be discovering consequential health information at home and need support interpreting the results and determining next steps. These tests are often screening tests and not diagnostic tests, and patients need to understand the possibility of a false positive. Consumers, insurers, regulators, physicians ,and test providers will all need to confront these challenges as the market matures.

Due to Covid-19, diagnostics are in the limelight, and public and private investors are watching how the pandemic may impact the IVD market in the future. As the sector receives an influx of investment, companies will be in a strong position to expand their portfolios.

What a year for deals in the IVD sector, for both buyouts and corporate mergers and acquisitions. The number of deals nearly doubled to 34 in 2021 from 18 the prior year, with most of the growth in Asia-Pacific and Europe. Disclosed deal value soared to USD 11.1 billion from USD 2.4 billion. Indeed, there was so much life sciences activity that this year’s report breaks out the sector for the first time.

Traditionally, life sciences assets have been most attractive for corporate buyers, but as the industry evolved to focus more on treatment and detection of infectious diseases, private equity investors have been able to get their foot in the door. They have primarily targeted tools and technologies, used for therapeutic research and diagnostics.

Diagnostic labs have proven to be reliable long-term investments, and in 2021 investors showed great interest in lab consolidators, particularly in Europe and Asia-Pacific, as well as companies that specialize in earlier disease detection. Covid-19 testing has provided significant cash flows; while testing volumes fluctuated as vaccinations rose. Waves of Covid-19 variants are likely to require further interventions from these operators.

In this context, private equity firms have targeted clinical diagnostic providers. Two notable European deals were the EQT acquisition of Cerba HealthCare, a European lab and diagnostics provider, for USD 5.3 billion (an exit opportunity for Partners Group), and the Goldman Sachs, OMERS Infrastructure, and AXA purchase of Amedes Holding, a German-based operator of diagnostic laboratories.

The Cerba and EQT partnership already started playing out its strategy by announcing the add-on acquisition of Viroclinics–DDL. In Asia, notable activity included Catterton Management’s USD 181 million investment in the Japanese company PHC Holdings. Specialty diagnostics firms also stepped up their investments, such as ArchiMed’s acquisition of Zyto Group, a fully integrated cancer diagnostic test and equipment provider for clinical pathology labs.

As drug development and research advances, lab equipment has become more attractive for investors. Key deals in 2021 included Carlyle’s acquisition of Unchained labs, a life sciences tool company and provider of biotechnology solutions, from Novo Holdings for USD 435 million; Altaris’s purchase of a majority stake in Solesis, specializing in biomaterials for life sciences companies; and the acquisition by Adelis Equity Partners of Nordic Biosite, a distributor of diagnostic and life sciences products.

Going forward, IVD investments will face a wide range of hazards in the future. Three main themes are expected to emerge.

First, diagnostics providers will continue to grow as hospitals and other healthcare organizations increasingly outsource testing services and direct-to-consumer testing becomes more common.

Second, adopting technology that facilitates development and testing components, such as mRNA, will benefit life sciences companies.

Finally, last year, money was focused mostly through growth-equity investments toward miniaturizing, automating, and digitally integrating activities in the lab setting. These investments will help to promote the establishment and maturation of integrated lab services companies, which will pique investor interest in the coming years.

While the pandemic brought the laboratories and industry together to focus on a common goal, it has also highlighted numerous challenges that may be encountered during the development and commercialization of a diagnostic test under emergency and critical circumstances. The diagnostic industry must learn from this experience and implement necessary steps to ensure better preparedness for such future emergencies.

A glaring shortcoming that became evident during this pandemic was the global shortage of essential raw materials required for developing an assay. Companies faced a shortage of reagents, PPE, and other necessary laboratory equipment, such as pipette tips.

For the future, companies must evaluate and implement multi-sourcing and multi-manufacturing models to ensure that critical raw materials are always available. Companies need to identify materials and products that are absolutely critical for their businesses and have a reasonable stockpile inventory of those products to ensure they are always available. It is important to understand the supplier(s), their capacity, and maintain an overall healthy working relationship. Better internal surveillance of the epidemiological data is also needed in the diagnostic industry so that they can rationally predict an outbreak and can be prepared.

Additionally, IVD industry stakeholders, including laboratories, manufacturers, and government agencies, need to communicate amongst themselves to coordinate and cooperate in developing a comprehensive national response plan for future outbreaks. Collaborative strategies should be developed to ensure that testing supplies (reagents and consumables) would be available during different stages of a pandemic.

For future preparedness, administrative bodies should also collaborate with IVD assay manufacturers and provide funding to overstock their testing supplies such as reagents, PPE, and laboratory equipment, so an extra amount of necessary test supplies is readily available. However, manufacturers should consider if these supplies can be used or sold before expiration.

Diagnostic companies should identify their bottlenecks and capacity-trigger points from a manufacturing standpoint. Manufacturers should clearly understand their production capacity and the steps needed to escalate it on demand. It is essential that production facilities have emergency escalation plans that would aid in rapid decision-making and expansion during emergencies. Communication within different departments is also vital in establishing goals and preparing for the future.

Another critical gap was the lack of a clear research and development response strategy, which includes better preparedness for developing an assay and collaborative efforts between different industries and stakeholders, such as funding and regulatory agencies, government entities, epidemiological institutions, and researchers. Partnership efforts with different laboratories and contract research organizations for assay development can also be helpful to draw expertise from diverse areas, such as biochemistry, virology, molecular biology, etc., that might assist with optimizing assay parameters.

The inconsistencies observed in the diagnostic performance between different assays highlighted the need for a close partnership between assay manufacturers and component and material providers to reduce the risk of choosing suboptimal parts, specifically in sectors dealing with lateral flow-based assays.

Additionally, having a close relationship with clinical sample banks, government agencies, and hospitals is critical for obtaining clinical samples during emergencies for assay development and testing.

The pandemic has further demonstrated how regulatory timelines can be drastically improved and accelerated, and how assay developers can adapt and benefit from the accelerated pace.

During an emergency, it is essential to determine the amount of oversight needed so that inadequate monitoring does not lead to inaccurate or faulty devices flooding the market or an over-extensive review creates a delay in test availability.

Additionally, it is vital to establish clinical endpoints and desired performance parameters early to provide adequate transparency to the diagnostic assay developers. Regulatory agencies and policymakers should ensure that the diagnostic community can always access the required data infrastructure to evaluate different testing strategies. Regulatory coordination is also of paramount importance on a global scale, and both national and international organizations should collaborate to develop comprehensive response plans and determine adequate regulatory approval processes. Evidence-based policymaking is essential during times of crisis as information changes quickly.

The diagnostics and research tools fields are expanding in new directions. New research tool technologies like proteomics are increasing scientists’ understanding of human biology and disease. New diagnostic tools like liquid biopsy are making possible earlier detection and more targeted treatment of some of the most serious diseases. And new business models are bringing diagnostic tests to patients at home. These developments have the potential to transform the industry and have ramifications across the value chain, touching patients, providers, insurers, scientists, laboratorians, and the biopharma industry. Diagnosof laboratory data and insights, as well as the need for clinical laboratorians to contributics companies should consider their participation in these emerging fields as they build winning strategies.