Thermal Cyclers

Real-time PCR gaining traction

There has been a huge shift from traditional PCRs to real-time over the last three years. With sales at ₹100 crore in 2021, this segment is expected to touch ₹120 crore in 2022.

Since kary mullis discovered the polymerase chain reaction (PCR) in 1983, a deluge of scientific publications have detailed significant advancements in specialized machinery, reagents, sample preparations, scientific techniques, and academic research; as a result, this technique has turned into a game-changing watershed for both science and medicine. In order to genotype, clone, and analyze single nucleotide changes of etiologic relevance, a single molecule of DNA or RNA is amplified and produced in a million copies using a nearly standard and reliable process.

The healthcare landscape has also benefitted from the advancements in quantitative polymerase chain reaction, or qPCR first described in 1992, which has become the basis of a variety of scientific applications and publications in a broad range of interests. It allows a precise and rapid detection of nucleic acid by incorporates intercalating dyes or sequence-specific probes for fluorescence into nascent DNA.

On the other hand, the reverse transcription-PCR (RT-PCR) assays have substantially accelerated the momentum and accuracy of human and animal disease diagnosis, especially the infectious agents that were earlier difficult to isolate or demonstrate. It addresses the evident need for quantitative data analysis and snapshots the information regarding the quantity of a given transcript in a cell or tissue.

Any discussion regarding the advances in PCR would be unworthy with a mere mention of dPCR (digital PCR), which is recent technology available commercially since 2011, which utilizes pre-validated primer or probe assays through partitioning of a PCR reaction into hundreds or thousands of individual vessels, typically in droplets or wells with the acquisition of data-positive or negative for every droplet, allowing greater amenability and multiplexed detection of target molecules.

India is one of the potential markets for dPCR and qPCR particularly due to the significant prevalence of cancer and CVD in the country.

Indian market dynamics

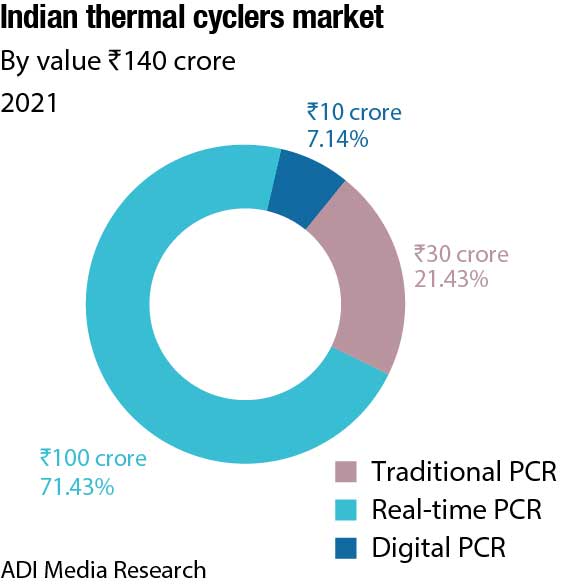

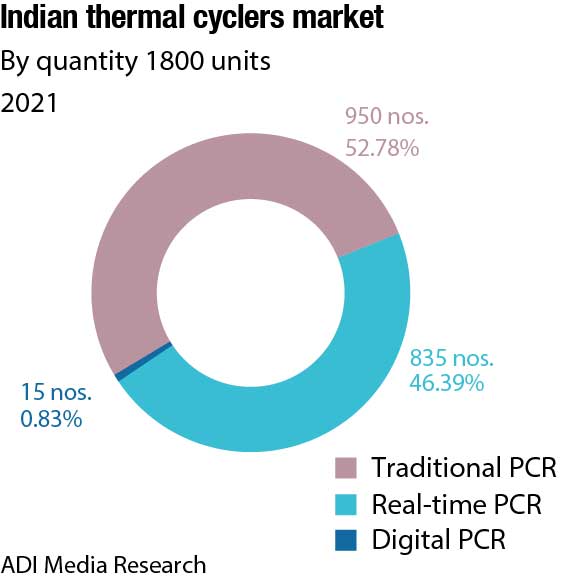

The Indian market for thermal cyclers, catering to the life sciences segment in 2021, is estimated at ₹140 crore. The real-time PCRs dominate the segment by value with a 71.4-percent share. There has been a huge shift from traditional PCRs to real-time over the last three years; the share of real-time PCRs in 2019 pre-Covid was 49.3 percent by value. The contribution is 70 percent from the clinical segment and balance from the research. With sales at ₹100 crore in 2021, this segment is expected to clock ₹120 crore in 2022. Thermo Fisher has dominated this segment since years, with Bio-Rad a second. With renewed focus by Abbott and Roche, the market size in 2023 is expected to increase.

The digital PCR, introduced in India around 2016, and the fastest-growing segment, suffered a setback in the two years of the pandemic. Its share declined, with sales at a mere ₹10 crore and 16 units in 2021. The segment is back on track in 2022. With 20 units already supplied till October 2022, the average realization per unit is up from ₹62.5 lakh in 2019 to ₹1.1 crore in 2022. Bio-Rad is the leading supplier and commands a premium, Qiagen has some presence, albeit at a lower per-unit price. Thermo Fisher is a new entrant in India. The six-color digital PCR system provides high multiplexing and sensitivity for advancing cancer and liquid biopsy studies, Covid-19 and infectious disease research, cell and gene therapies, and environmental testing. Introduction of such digital PCR products is expected to create lucrative growth opportunities for the market.

Global market dynamics

The global thermal cyclers market is valued at USD 31.64 billion in 2021, and is expected to decline at a compound annual growth rate (CAGR) of 8.2 percent from 2022 to 2030. The decrease in the demand for PCR testing for Covid-19 testing is expected to decline the market growth. However, the global real-time PCR (qPCR), digital PCR (dPCR), and end-point PCR market, without the impact of the Covid-19 pandemic, is expected to expand at a CAGR of 8 percent from 2022 to 2030. The increasing incidence of genetic disorders and major infectious diseases, growing utilization of biomarker profiling for disease diagnostics, and the successful execution of the Human Genome Project are the primary factors increasing the demand for technologically advanced PCR tests. In the coming years, significant technological breakthroughs in technologies, increasing investments, funding, and grants are likely to increase the demand for dPCR in different applications.

| Leading players* | ||||

| Segment | Tier-I | Tier-II | Tier-III | Others |

| Traditional PCR | Thermo Fisher Scientific |

Bio-Rad | HiMedia and Eppendorf |

Agilent, Biometra, unorganized, Taiwanese and Korean brands |

| Real-time PCR |

Thermo Fisher Scientific |

Bio-Rad | Abbott, Roche, Qiagen, and Agilent |

HiMedia, Biometra, and some Chinese brands |

| Digital PCR |

Bio-Rad | Thermo Fisher Scientific |

Qiagen | – |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian thermal cyclers market.

ADI Media Research |

||||

Consumer preferences for early disease detection and treatment have accelerated research and development into novel genetic techniques and product creation. Furthermore, increased investment and the accessibility of cash and grants are supporting this surge in R&D activity. Moreover, governments and federal organizations all over the world are increasingly emphasizing the importance of qPCR and dPCR technologies in genomics research. In addition, several financing efforts by the government and corporate organizations to assist genomic research have been seen in the qPCR and dPCR industries during the last decade.

The clinical segment held the largest revenue share of over 85 percent in 2021, by application. This can be attributed to various factors, such as the rising prevalence of diseases including cancer, infectious diseases, and diabetes; high precision of testing methods; increasing commercialization of reagents for diagnostics; efficient disease diagnosis, monitoring, and treatment; and additional benefits in disease detection. The forensic segment is expected to register the fastest growth rate over the next 8 years. The increasing use of novel techniques in forensic applications, such as DNA typing, genetic fingerprinting, and DNA testing is anticipated to drive the segment. Moreover, improvements in existing technologies to prepare the library for forensic DNA typing from difficult samples are driving the segment.

The consumables and reagents segment held the largest revenue share of over 60 percent in 2021, by product. This can be attributed to the outbreak of Covid-19 pandemic, increased demand for earlier detection of disease, and the number of significant companies manufacturing digital PCR consumables and reagents. Furthermore, the widespread use of consumables and reagents and expanding demand for healthcare, research, and other purposes are supporting the large segment share. Moreover, the segment is anticipated to maintain its lead over the next 8 years. Moreover, the rising incidence of chronic conditions and the growing use of PCR has increased the requirement for consumables and reagents. Furthermore, the pharmaceutical and healthcare industries’ rising acceptance of technology innovations and increased research and development will generate a significant potential for this market in coming years.

The quantitative PCR segment held the largest revenue share of over 85 percent in 2021. This segment is driven by factors, such as rapid technological advancements and increasing demand for automated systems and point-of-care diagnostics. In addition, the high adoption of technology, supported by the introduction of products based on real-time PCR for screening and diagnosis of Covid-19, has increased the segment growth at an exponential rate. Digital PCR is a next-generation diagnostic technology for precise nucleic acid measurement. These systems have higher sensitivity and accuracy than other PCR-based techniques, which is expected to drive the market forward.

North America dominated the global market with a revenue share of over 35 percent in 2021, and is expected to maintain its position, majorly due to the presence of favorable regulations and various initiatives about the development of healthcare infrastructure undertaken by the government, and high disease prevalence in the region. Furthermore, the strong presence of prominent manufacturers and an expanding requirement for rapid diagnostic tests in the region are expected to serve as critical factors driving the North American market during 2022–2030.

Asia-Pacific is the most lucrative market due to the presence of significant developments by China and Japan for technological integration of PCR methodologies, and the development of healthcare, R&D, and clinical development frameworks of emerging economies, such as India and Australia. The market is poised to witness lucrative growth opportunities in coming years.

Recent development

Major market players are adopting marketing strategies, such as geographical expansion, partnerships, strategic collaborations, and mergers and acquisitions in emerging and economically favorable regions.

In November 2022, Bio-Rad Laboratories, Inc. and NuProbe USA announced the signing of a licensing and product development agreement. Under the terms of the agreement, NuProbe USA will exclusively license its allele enrichment technologies to Bio-Rad for the development of multiplexed digital PCR assays. This technology will help to advance Bio-Rad’s menu of products in oncology, where highly sensitive and multiplexed mutation detection assays aid translational research, therapy selection, and disease monitoring.

In January 2022, Qiagen entered into two new collaborations that extend the QIAcuity ecosystem: a collaboration with Atila BioSystems to provide non-invasive prenatal testing (NIPT) solutions to Qiagen’s dPCR franchise. NIPT requires only a blood sample from the mother and replaces more invasive testing methods, such as amniocentesis that can endanger the fetus and mother; and a co-exclusive licensing and co-marketing agreement with German life-sciences start-up Actome GmbH extends QIAcuity’s reach beyond genomics into proteomics, enabling the quantification of proteins as well as the analyses of interactions between different proteins and between proteins and target genes.

In October 2021, Thermo Fisher Scientific introduced the Applied Biosystem QuantStudio Absolute Q-Digital PCR System, the first fully integrated dPCR system designed to provide highly accurate and consistent results in genetic analysis and research within 90 minutes. Thermo Fisher recently acquired Combinati and its cutting-edge dPCR technology to rapidly develop and commercialize it alongside an expanding portfolio of assays. Unlike complex, multi-instrument workflows required for traditional dPCR, the Quant Studio Absolute Q System uses microfluidic array technology and simplified workflows designed to improve data accuracy and consistency. The device supports the pharmaceutical fraternity in innovating disease management, advancing significantly in generating consistent and accurate data.

Some prominent players in the global thermal cyclers market include Bio-Rad Laboratories, Thermo Fisher Scientific Inc., Qiagen, Abbott, Agilent Technologies, Inc., bioMérieux, Fluidigm Corporation, and F. Hoffmann-La Roche Ltd.

World’s first PCR test for mouth cancer developed

Researchers at Queen Mary University of London have developed the world’s first PCR test for mouth cancer. The test has now been proved with patients from China, India, and the UK, with the results published in the international journal, Cancers. The inventor, Dr Muy-Teck Teh, named the test the quantitative malignant index diagnosis system (qMIDS).

The test is quick and easy. It only needs the PCR machine used in Covid testing and a technician to operate it. It could be rapidly rolled out around the world at very little extra cost. A tiny sample (the size of half-a-grain of rice) is taken from the suspicious area in the patient’s mouth and the test only takes 90 minutes after reaching the technician – similar to a Covid PCR test.

qMIDS diagnostic accuracy would mean that 90 percent of low-risk patients could be discharged from hospital to go back to their dentist or GP for review. Or they might be tested in the dentist’s surgery and only referred to secondary care if they were high-risk. High-risk cases could also be detected in the pre-cancer period and treated definitively, thereby saving the patient’s life with minor surgery, better cure rates and quality of life, as well as a huge reduction in health service costs. The test process is largely automated, removing the need for expensive pathologists. There is also no need for invasive biopsies. The tests can be carried out on multiple sites when patients have lesions affecting large areas throughout the mouth.

Outlook

Despite the considerable diagnostic potential of PCR, the quality of the samples that contain the nucleic acids for amplification has a significant impact on the outcome of each of its practical uses. It has been documented how a variety of PCR inhibitors, such as false-negative findings or greater limits of detection, might make the work on real-world samples more difficult. There are methods for sufficiently purifying samples and creating DNA polymerases that are resistant to inhibition. The existence of inhibitors does not seem to affect dPCR as much. Another difficulty is achieving efficient PCR amplification of GC-rich DNA sequences. It is made more difficult by the formation of secondary structures that obstruct full denaturation and primer annealing. Various solutions to this issue have been created.

The miniaturization of PCR devices has highlighted another challenge, which should be solved pre-analytically to achieve sensitivity comparable to established laboratories. Miniaturized devices work with low-volume samples and, therefore, the real-world biological samples should be effectively isolated and pre-concentrated, respectively, prior to analysis with such devices.

There are several techniques, such as NGS, where PCR plays an indispensable role and this role will be strengthened in the foreseeable future. PCR will play a major role in future molecular diagnostic techniques. One can envision the use of microfluidics for performing parallel multiple sample analysis, using handheld POC systems. The microfluidic devices will also be able to perform RT-PCR to analyze immunomagnetic exosomal RNA. Droplet-based qPCR for single-cell mRNA purification and gene expression analysis will be another large application of microfluidics in the near future, as well as miRNA quantitation assays and chip-based digital RT-PCR for absolute quantification of mRNA in single cells. Currently, the parallel sequencing of all RNA or DNA molecules, belonging to a single cell inside a larger cell population, is possible due to emulsion PCR, where the nucleic acids from each cell are enclosed in one droplet, barcoded, and then amplified. The only sequencing platform that bypasses PCR is the Oxford Nanopore system.

The miniaturization of PCR will continue with the development of new systems integrating sample preparation with the qPCR, moving toward truly portable sample-to-answer systems for POC applications. The Covid pandemic sped up this development, causing a boom in POC systems by converting existing devices, such as LAMP-based ID NOW, originally developed for influenza, into a SARS-CoV-2 diagnostic tool by changing primers. Further elaboration of CRISPR-based methods to detect and differentiate amplification products can be expected, as this methodology has successfully been applied in various fields of biology.

One can also envision portable dPCR systems with fast turnaround for clinical diagnostics, forensic science, and environmental research, avoiding time-consuming sample transfer to large facilities that risks sample degradation.