Industry

Resilience and growth in a crisis

The planning and action taken in the short term can have significant implications, not only for MedTech’s continued resilience in the crisis, but in shaping its longer-term recovery for what is likely a significantly different future for healthcare and the MedTech industry.

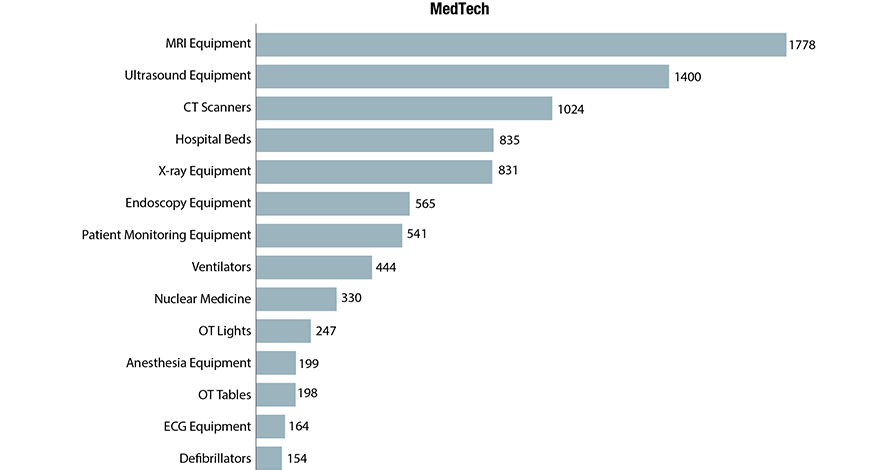

₹crore – 2019

COVID-19 has presented a humanitarian crisis like no other, with nearly 57.23 million infected by the virus and 1.36 million lives lost. Indeed, the speed and depth of disruption due to the pandemic is creating unprecedented challenges for societies and economies across the world. This is especially clear on the frontlines of healthcare delivery. As infections spread around the world, health systems have redirected substantial resources to COVID-19 response efforts.

COVID-19 has presented a humanitarian crisis like no other, with nearly 57.23 million infected by the virus and 1.36 million lives lost. Indeed, the speed and depth of disruption due to the pandemic is creating unprecedented challenges for societies and economies across the world. This is especially clear on the frontlines of healthcare delivery. As infections spread around the world, health systems have redirected substantial resources to COVID-19 response efforts.

COVID-19 has put the MedTech industry at center stage with unparalleled demand for diagnostic tests, personal protective equipment, ventilators, and other critical medical supplies. In addition to the extraordinary measures underway to rapidly ramp up manufacturing capacity and capabilities, MedTech leaders are also looking outside their normal sector boundaries to explore creative solutions to further supplement capacity, such as partnerships with companies outside the sector, open-source equipment design, and deployment of medically trained employees to support public-health needs.

The MedTech industry is also being affected by the dramatic drop in elective medical procedures, many of which are being postponed or cancelled so that hospitals can focus resources on treating COVID-19 patients. In fact, McKinsey’s models project a 60–80 percent decline in elective procedures in the second quarter of 2020 for Europe and the United States, with an additional 40–50 percent decline in the third quarter. Another concern: when the recovery begins, it could be accompanied by a resurgence of demand for both elective and delayed essential procedures, straining business models and financial resilience.

This crisis has seen the MedTech industry quickly recalibrate across the value chain to serve healthcare’s critical needs. But beyond the immediate crisis response, MedTech companies should consider additional imperatives—particularly over the next three to nine months—to strengthen crisis resilience and plan for recovery. Building and stress-testing several scenarios for procedures and product demand will be critical for identifying areas of risk and opportunity and navigating through the crisis.

The planning and actions taken in the short term can have significant implications, not only for MedTech’s continued resilience in the crisis, but in shaping its longer-term recovery for what is likely a significantly different future for healthcare and the MedTech industry.

Global market dynamics

The pandemic has caused an exponential growth in demand for healthcare products such as ventilators, medical clothing, face masks, and diagnostic devices whereas the sales of companies, whose products rely heavily on elective and non-essential procedures, are expected to be hurt badly.

Many such medical device companies have either withdrawn or revised their financial guidance for 2020 due to the uncertainty associated with the degree and duration of the impact of the outbreak.

The short-term impact of COVID-19 is expected to cause a decline in annual growth rate of the global MedTech market from 5.4 percent to 3 percent in 2020. The global MedTech market, which was projected to be worth USD 472 billion in 2020 before the outbreak of this infectious disease, is now expected to generate USD 461 billion this year.

Indian market dynamics

The Indian MedTech market offers a great opportunity not only by its size, but also because of encouraging policies and regulations introduced by the government over the last couple of years. It continues to record robust growth despite a hardened stance on pricing for essential devices.

The Indian MRI equipment market for 2019 is estimated at ₹1778.5 crore, and 290 units, by volume. This estimate includes 12 percent GST and third-party items, which amount to approximately 8 percent of the price of the equipment. The premium systems 3T and 1.5T continue to dominate the market with an approximate 93 percent share by value. The 1.5T segment has the largest market share, at 47 percent by value and 52 percent share by volume, albeit the growth is coming from the 3T segment. The 0.2T-0.5T and refurbished machines and the refurbished ones are stagnant by volume, although there is a drastic drop in price realization.

The Indian ultrasound equipment market in 2019 is estimated at ₹1400 crore. The market was slow as against an average annual growth of 7–8 percent, the market in 2019 saw a 4 percent growth.

The Indian market for CT scanners in 2019 is estimated at ₹1024.6 crore, with 725 units. This is a 17.16 percent decline by value and an 8.8 percent decline by volume in 2019, over 2018. The major gainer in 2019 was 17–63 slice scanners, which saw a 7.5 percent increase in the market share. The 64–128 slice CT scanners saw a 2.8 percent increase, the 128–160 slice scanners a 6.7 percent, and the >160 slice scanners a 2.8 percent increase in market share in 2019, over 2018. They seem to have taken share from the 1–16 slice category, which saw a 14.25 percent drop and the oncology and wide-bore CT scanners. The PET-CT scanners continue to dominate the segment, with a 64.5 percent share by volume, and a 78.8 percent share, by value. Three digital PET-CT scanners, priced in the ₹20 crore range were procured.

In 2019, the Indian hospital beds market is estimated at ₹835 crore, with 137,500 units.

The Indian X-ray market in 2019 is estimated at 14,130 units, with value estimated as ₹831 crore. The CR machines segment has not only lost a major share to the DR X-ray machines, but also has dropped prices over the last couple of years. The segment is steady at about 5800 units. However, the realization of the machines in the DR segment has drastically dropped. Within the DR segment, the sales of fixed machines have declined in favor of the mobile and the retrofit, the latter being the major gainer. This is in spite of the high-end ceiling-suspended machines, unit priced in the ₹1.2 to ₹1.6 crore range, gaining preference in the government hospitals and a handful of the corporate chains.

In 2019, the Indian endoscopes market is estimated at ₹565 crore. The market was dominated by the rigid models, with a 76 percent share by volume and a 67 percent share by value. The local players continue to have a 10 percent market share. While the imported segment commands a unit price in the range of ₹12-15 lakhs, the local players have to make do with ₹7.5 lakhs.

The Indian market for patient monitoring equipment in 2019 is estimated at ₹541 crore, and 57000 units. The premium segment, of which the super-premium is about 100 units, has an 8 percent contribution by value and a 1.9 percent contribution by volume. High-end systems constitute 15.9 percent share in value terms and 7 percent in volume terms. The belly of the segment continues to be competitively priced systems, the mid-end and low-end segment, and the buying in 2019 seemed to have shifted even more in their favor than it was in 2018. The two segments dominated with a combined share of 91 percent by volume, and 78 percent by value.

The Indian ventilators market in 2019 is estimated at 8510 units, valued at ₹444.74 crore. The imported equipment continues to dominate the segment with a 75 percent share by value, and 64 percent share by units. The market saw an 8.5 percent decline by volume. The indigenous systems continued to hold sway at 1000 units. The decline was contributed by various imported machines–new, refurbished, and ambulatory models. Procurement was largely done by government-run hospitals.

The Indian anesthesia equipment market in 2019 is estimated at ₹199.5 crore, at 5095 units.

The Indian ECG equipment market in 2019 is estimated at ₹164.25 crore. In value terms, the high-end machines account for a 58 percent share, and a 36 percent share by volume. The demand for single channel machine is declining ever year, as are the margins. By volume, the 3-channel systems contributed 23 percent by volume, and 14 percent by value. The 6-channel is gradually restricted for niche purposes, as the price differential between 6-channel and 12-channel has narrowed down. Also, with excellent algorithms, possible, the AI modeling of ECGs obtained in sinus rhythm which can identify patients with a history of or impending AF is gaining acceptance. Connected ECG solutions, as part of the 12-channel devices are gaining popularity in the Indian market and the size of this segment is roughly estimated as ₹35 crore in 2019. With telemedicine picking up at government levels and with voluntary organizations, this may just see a 15 percent growth yoy, at least for the next five years.

The Indian defibrillators market in 2019 is estimated at ₹154.56 crore, and 11475 units. Biphasic defibrillators, at a 70 percent market share by value are the mainstay. Monophasic at best are a stagnant segment, bought mainly by small nursing homes and in smaller cities. The AEDs are not yet taken as seriously as must be in a 1.4 billion population size. Accessories to record some parameters as ECG, SpO2, CO2, and NIBP may be added on to the system, as may CPRs that are accessorized with biphasic models, often for the ambulances, and are retailed in the vicinity of 60,000-100,000 per unit. In 2019, both biphasic and AEDs saw a 5-7 percent growth each with HLL, state hospitals, and DGMS being the main buyers. With the lockdown announced mid-March 2020, and most public places as cinema halls, restaurants, airports, railway stations shut, there was barely any demand for AEDs.

The Indian market for nuclear medicine equipment in 2019 is estimated at ₹330 crore.

In 2019, the Indian OT tables market is estimated at ₹198 crore with sales at 5330 units. The market size has remained same as 2018. In 2019, the Indian OT lights market is estimated at ₹247 crore, with 6500 units, an 8 percent increase in 2019 over 2018.The imported lights are estimated at 2300 units and indigenous brands at 4200 units.

In India, till recently, medical devices had not received appropriate attention from the policy makers. Currently, however, medical devices have come into mainstream policy making, albeit often with the absence of deep understanding about the domain, or without an adequately nuanced approach to factor for its hugely diverse range or spectrum.

One major challenge this segment faces is price control. The government controls prices of certain medical devices by either fixing a price at which they may be sold under a formula or by restricting the ability of the marketer of the medical device to increase its price by more than a prescribed percentage at any given time. The presence of multiple regulators, which may make simple tasks (such as rectification of erroneous declaration on the label) quite a tumultuous affair, remains a challenge.

Another challenge is presence of archaic laws that do not permit manufacturers and importers of medical devices to promote their products directly to the customer as cures for certain prescribed conditions and illnesses.

Even though the year 2019 witnessed significant developments, there is an urgent need for the government to accelerate further reforms and supportive measures to make India a global medical device manufacturing hub, reducing import dependency in this sector which is still at 80–90 percent, minimizing outgo of foreign reserves, and making quality healthcare affordable and accessible to the masses at large.

Outlook

No industry has gone untouched as the world grapples with the novel coronavirus pandemic. But MedTech finds itself playing an urgent role in both helping detect the virus and supplying frontline healthcare workers with the equipment needed to fight it. Industry players outside those realms must still adapt to a changing economic landscape in which supply chains, face-to-face sales interactions, and elective surgeries have all been disrupted. It is important for the medical device industry to collaborate with all stakeholders including physicians, patients, regulators, payers, providers, and policymakers. Finally, it is imperative for MedTech companies to focus on combating the crisis while developing products and services for the next phase that can achieve superior outcomes.

Finally, it is clear that the current operating environment under COVID-19 is not an excuse for inaction. It is quite the opposite. Those that do not seize the moment would not just be left treading water but will be left looking up at new goliaths in the industry, saying, “How did we miss our opportunity? There is no coming back now.”

RCT thorax in SARS COV 2 infection as good as a thermometer in the pandemic

RCT thorax in SARS COV 2 infection as good as a thermometer in the pandemic

Dr Abhijit M Patil

With all the uncertainties about the exact pathophysiology of COVID-19 infection, and the very well established fact that the route of entry is the respiratory tract through the ACE receptors, HRCT thorax has become one of the common investigations done for a suspected or diagnosed case of COVID-19. Though in the given pandemic situation any acute lung opacity is to be attributed to COVID-19 infection, the treatment depends upon the effect these have on oxygen exchange and hence presence of hypoxia. Also rightly hypoxia is an important criteria helping to triage patients as given in the guidelines by Ministry of Health and Family Welfare, Government of India. The cause of hypoxia however can be alveolar or vascular. HRCT done in COVID-19 gives only the extent of alveolar impediment to oxygen exchange and the CT severity score not even takes into account the nature of opacities (GGO, interstitial opacities, crazy-paving appearance, alveolar opacities, consolidations, combination of the opacities) which could have variable effect on oxygen exchange. Also coagulopathy is one of the common findings in a patient of COVID-19 pneumonia, by doing a plain HRCT and deciding the treatment on the CT severity score we shall be underestimating the severity of the disease. Also it is a well known fact that even contrast CT pulmonary angiograms have limitations for the diagnosis of micro-emboli.

With all these limitations, people are still inclined to get an HRCT thorax done rather than an Rt-PCR due to the apprehension of being taken to COVID-19 centers and the family having to be quarantined or being forced to take the Rt-PCR test. This has forced the government to reduce the cost of HRCT thorax and make rules to report positive scans suspicious of COVID-19 pneumonia just as the pathology labs are to report positive Rt-PCR cases. But are the number of HRCT thorax done justifiable. At least now that the pathophysiology of the disease is being well understood, we should be using the modality judiciously. It is best to use a CT scan for evaluation of complications of COVID-19 pneumonia rather than to diagnose the viral infection as an upper respiratory infection will have a normal CT thorax. Also the fact that extrapulmonary manifestations are being underestimated as we seen by the fact that the number of investigations for thorax outnumber other system investigations. These facts show that the absence of fever as a prominent sign does not rule out COVID-19 infection and absence of/mild affection of lung in HRCT does not rule out a severe infection. Hence the title HRCT Thorax in SARS COV 2 infection as good as a thermometer in the pandemic seems apt in the given situation.

The author is Professor and Head, Department of Radiodiagnosis, Symbiosis Medical College for Women (SMCW) and Symbiosis University Hospital and Research Centre (SUHRC).