Immunochemistry Instruments and Reagents

Rethinking Immunochemistry

Automation systems and chemistry instrumentation, oddly enough, have gotten a little bit bigger over time. With advances in technology, things should at some point start getting smaller.

Over the past decade, the development and applications of immunoassays have continued to grow exponentially. There have been tremendous advances in immunodiagnostics during the last five decades, which have led to the emergence of potential diagnostic technologies, new immunoassay formats, and diagnostic platforms. The radioimmunoassay and enzyme-linked immunosorbent assay (ELISA) were the predominant techniques during the initial era of immunodiagnostics.

In the current scenario, there is an increasing trend for testing of hormone levels and other non-infectious bio-markers like assays for autoimmune diseases, oncology and cardiac markers, and tests for vitamins. This is in addition to the focus on diagnosis of infectious diseases like hepatitis, HIV, dengue, and malaria. Among the emerging assays, anti-Mullerian hormone (AMH), ferritin, calcitonin, hGH (human growth hormone), and PTH (parathyroid hormone) are most widely prescribed. These tests are available in all formats: rapids (PoC), ELISAs, and fluorescence/chemiluminescence immunoassays (CLIAs), the latter being the most prevalent format nowadays.

The strenuous research efforts by researchers during the last three decades have enabled the development of potential antibodies for a wide range of analytes. Despite the tremendous advances, there is a critical need for rapid and cost-effective immunoassay procedures and novel diagnostic platforms in order to increase the outreach of immunodiagnostics to the remote settings and developing countries.

Indian market

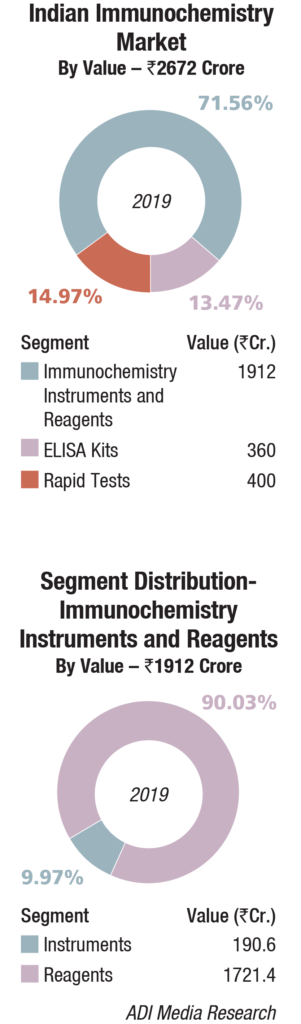

The Indian immunochemistry instruments and reagents market, in 2019, is estimated at Rs 1912 crore, with reagents dominating the market, with a 90 percent share at Rs 1721 crore. Roche dominates the market, followed by Abbott, bioMérieux, Beckman Coulter, and Siemens, each with sales in the Rs 200 crore to Rs 250 crore slab. OCD and Mindray are the other aggressive brands. In 2019, the market saw two new entrants Fujirebio from Japan, now a part of Miraca group and Mindray from China. In 2019, bioMérieux, strengthened its presence with the inclusion of the products from its two acquisitions in 2018. Astute Medical, a US company had developed the Nephrocheck test for the early risk assessment of acute kidney injury; and Hybiome, a Chinese company, which specializes in automated immunoassay tests.

The Indian immunochemistry instruments and reagents market, in 2019, is estimated at Rs 1912 crore, with reagents dominating the market, with a 90 percent share at Rs 1721 crore. Roche dominates the market, followed by Abbott, bioMérieux, Beckman Coulter, and Siemens, each with sales in the Rs 200 crore to Rs 250 crore slab. OCD and Mindray are the other aggressive brands. In 2019, the market saw two new entrants Fujirebio from Japan, now a part of Miraca group and Mindray from China. In 2019, bioMérieux, strengthened its presence with the inclusion of the products from its two acquisitions in 2018. Astute Medical, a US company had developed the Nephrocheck test for the early risk assessment of acute kidney injury; and Hybiome, a Chinese company, which specializes in automated immunoassay tests.

Price erosion has been a major setback for the vendors, and although volume may have increased in some segments, the margins were compromised greatly. While the newer assays are being introduced by the vendors, the absence of insurance reimbursement is keeping away the consumer.

The Elisa kits and rapid tests segment, dominated by J Mitra and Transasia are combined estimated at Rs 760 crore in 2019. This segment holds promise as there is an increase in tropical diseases, and cancer testing. Affordability is no longer a major issue as a huge Indian middle class is inclined to go ahead with diagnostic testing and allergy testing. The health aggregators are consolidating and focusing on building volume as the sample lasts for a longer time, once frozen.

The year 2019 saw an attempt by a handful of vendors for partial placement through their distributors, that is, placing the machine at a certain service revenue. How much success this model has and the extent it contributes to the bottom line will only be seen in the next couple of years. Competition continues to be cut-throat, margins are under pressure, and attempts are being made, not always with success at imposing penalties for not meeting commercial commitments of number of tests run by the laboratories to the vendors in a specific period.

As testing demand surges, laboratory administrators also face budgetary pressures and staffing shortages. There is an influx of integrated analyzers, which combine chemistry and immunoassay testing on a single platform. It has provided labs with an opportunity to consolidate testing and streamline their workflow even further. With today’s healthcare reform, laboratories are looking for ways to reduce the total operational costs of owning a new instrument. Lab professionals also demand the ability to produce highly accurate and clinically relevant results to satisfy physician demand.

Major Vendors* in Immunochemistry Instruments and Reagents Market – 2019 |

||||

| Tier I | Tier II | Tier III | Tier IV | Others |

| Roche | Abbott, bioMérieux, Beckman Coulter, and Siemens | OCD | Mindray | Tosho, Transasia, DiaSorin, Tulip, Compact Diagnostics, Horiba, Iris, Randox, Sysmex, Trivitron, Bio-Rad, Maglumi (Snibe and Immunoshop), Agappe, Snibe, SD Biosensor, and CPC |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian immunochemistry instruments and reagents market. | ||||

| ADI Media Research | ||||

The core lab is increasingly being viewed as the solution. As more and more testing are being driven to the core lab from across the healthcare network, capabilities such as reliability, scalability, and turnaround time—especially for stat assays—are no longer regarded as merely nice to have. These are critical, fundamental capabilities that drive the metrics by which labs are measured.

In a recent development, SphingoTec GmbH, Germany launched penKid testing, a functional kidney biomarker, on a rapid point-of-care platform. This has a unique potential to enable timely therapy decision by physicians at ICUs and EDs and thereby improve patient outcomes. It will be made available at the end of January 2020 to the critical care community.

Global market

The global immunochemistry analyzers and reagents market is expected to increase from USD 1.9 billion in 2019 to USD 2.77 billion by 2025, with CAGR of 7.27 percent, predicts Market Insights Reports. There is a rising focus on biomarker development across the globe as they help in detection of various diseases in their initial stage. Immunochemistry plays a crucial role in the development of biomarkers; thus, with the growing demand of biomarkers, the market for immunochemistry instruments and reagents will also flourish.

Furthermore, government support in terms of funds and grants has also provided much needed impetus to this market. Moreover, increasing focus on drug monitoring and growing incidences of various diseases are other factors driving the growth of the market. In addition to this, technological advancement, with which automated and more accurate instruments are present in the market, is another major factor propelling the growth of the market. However, factors such as stringent regulations for the development and launch of immunochemistry products and low adoption rate of automated immunochemistry products in developing economies due to high cost can hinder the growth of the market in coming years.

Under the strong rules and regulations, laboratories find it difficult to have good revenues. Thus, it is very important to find ways to sustain in such a cost-crunched environment. Due to cost cutting in clinical lab fees, profitability per test is decreasing, which makes it necessary for the laboratories to focus on the volume rather than the value. There is also heavy pressure for quality and error-free results to ensure patient satisfaction. This forces labs to lean toward more automated systems with effective workflow solutions.

In the US, laboratories are encouraged for automation due to the heavy influx of patients with insurance coverage. But with limited workforce in the clinical labs, it is difficult to manage the huge inflow of patients. On the other hand, patients need prompt and error-free results. Thus, this scenario demands laboratories to seek the help of systems that have a high accuracy, with managing high-growing volumes, and also offer remote data-acquisition capabilities.

The market is likely to witness stiff competition among the prominent players. The high development of the medical industry and the increasing investments by the players for research activities are projected to ensure the development of the market in the next few years. Moreover, the high number of collaborations and acquisitions is considered as another key factor that is predicted to ensure the market development in the coming years.

North America accounted for the major share in the immunoassay market in 2019 globally as the players in the region are continuously investing capital for research and development. Also, the increasing prevalence of chronic diseases and infectious diseases, accessibility of government assets, mounting usage of immunoassays in clinical diagnostics, and improved healthcare infrastructure are driving the growth of the North American market.

Asia-Pacific is observed to witness the fastest growth, with large population base, increasing prevalence of chronic diseases, and technological advancements. In addition, increasing healthcare expenditure, developing healthcare infrastructure, and growing pharmaceutical and biotechnology industry in the region are supporting the growth of the Asia-Pacific immunoassay market.

Demand for immunochemistry analyzers is slowing in the US and Western and Eastern Europe. Europe’s challenges in this segment include laboratory consolidation in France and economically troubled Greece, Italy, Spain, and Portugal. China’s growing rural hospital market lacks basic diagnostics laboratory infrastructure and represents an untapped opportunity for affordable immunochemistry analyzers.

The leading players in the global market include Siemens Healthineers, Abbott Laboratories, Beckman Coulter, Ortho-clinical Diagnostics, Thermo Fisher Scientific, F. Hoffmann-La Roche, Becton, Dickinson and Company, Danaher Corporation, Sysmex Corporation, Mindray, bioMerieux, SD BioSensor, and DiaSorin.

Future of CLIA technology

Diagnostic technology is rapidly evolving, and over the last decade, substantial progress has been made even for the identification of antibodies, increasingly approaching this type of diagnostic to that of automated clinical chemistry laboratory.

Numerous analytical methods have been proposed for autoantibody detection. Of these, immunoassay has undergone important and radical changes in recent years due to continuous technological development, which has been spurred on by an increased demand for services analogous to that already occurring in other sectors of modern laboratory diagnostics.

Nowadays, CLIA systems are gaining momentum, which in turn results in a decline in ELISA tests. With stringent checks, rapid tests are also seeing a decline and gradually shifting to chemiluminescence.

Regardless of its current optimal analytical performance, CLIA technology is destined for further development. The new flow-injection chemiluminescent immunoassay (FI-CLIA) technology, which is based on the fast injection of micro-bubbles into the reaction system with the aim of ensuring a more efficient reagent mixture and of reducing incubation times and increasing temperature control, is able to improve the immunoreaction kinetics and, therefore, significantly reduce analysis time.

Current chemiluminescent immunoassay consists of discrete tests, i.e., measures one autoantibody at a time. However, the need is emerging for multi-parametric tests that can identify all the components of a complex immunological picture in a single analytical step, efficiently and at reasonable cost. Use of the two-dimensional resolution for CL multiplex immunoassay could open doors for the setting up of multi-parametric CLIA tests. The technique is based on a multichannel sampling strategy, in combination with the use of various enzyme labels. After a brief period of batch incubation, the free conjugated enzymes separate from those bound to immunocomplexes and are captured by magnetic microparticles; at the same time, activation of the magnet leads to the arrest of the immunological reaction. Subsequently, application of the channel-resolved approach makes it possible to record signals coming from various parallel measuring channels, and thus enables the sequential determination of multiple analytes.

Multianalyte assay has also been realized with the zone-resolved strategy, a method that implements the array – different antigens are immobilized in different positions on the solid phase in such a way that the individual immunoreactions can occur simultaneously and be distinctly individuated by array detectors. Use of specific CCD (charge-coupled device) equipment accelerated the development of chemiluminescent imaging techniques and is making CLIA array more convenient compared to those employing alternative labels.

Finally, applying ultrasensitive chemiluminescence magnetic nanoparticles immunoassay (CL-MBs-nano-immunoassay) technology further increases the analytic sensitivity of the CLIA method. In this non-competitive and direct-type immunoassay, where the solid phase is made up of magnetic beads, gold nanoparticles with double labelling are used. One label is a monoclonal antibody specific for the analyte and the other label is horseradish peroxidase, thus amplifying the luminescent signal derived from the immunoreaction and the associated enzymatic reaction in an exponential manner.

In conclusion, the evolutionary process of the CLIA method is, in all likelihood, merely beginning. In the coming years, new and more efficient analytical methods based on the principle of chemiluminescence will be introduced into autoimmune diagnostics at steadily reduced cost. This transformation will align antibody diagnostics with already-consolidated biochemistry and immunoassay methods, with noticeable advantages in terms of both diagnostic accuracy and expediency, to great clinical benefit.

New assays

When it comes to test menus for clinical chemistry and related areas, several new assays and new biomarkers are in development. Certainly, there are new tests that are always innovating in terms of the core laboratory. For example, high-sensitivity troponin assays for diagnosing myocardial infarction are now becoming available to laboratories in the United States. New biomarkers may soon be available for diagnosing and monitoring traumatic brain injury, and encouraging research is emerging for tests for Alzheimer’s disease.

Promising research also is underway involving biomarkers for ischemic stroke and for kidney disease. There is never a shortage of researchers looking for new markers, especially in the world of immunoassays.

In addition to new assays, innovations are leading to improved performance of existing assays and in core laboratory instruments. Automated platforms are being designed to handle a wider variety of sample types and smaller sample volumes.

Radioactive and toxic components of many assays are being replaced with safer materials, and there are innovations in electrical technologies and biosensors.

Outlook

Beyond new and improved assays, innovation is underway in how immunochemistry connects through automation to other areas of clinical laboratories. This is a continuation of a trend that has been happening over the past few decades, as core laboratories have grown to encompass disciplines spanning chemistry, immunoassay, hematology, and hemostasis, among other categories.

Going forward, more novel technologies, once reserved for specialized settings, such as molecular/virology, may increasingly migrate into the core laboratory.

Efforts are underway to connect both mass spectrometry and molecular diagnostics instruments to clinical chemistry systems. If mass spectrometry could be connected to chemistry and immunoassay analyzers on the same platform, drugs of abuse testing could be done in real time, with samples moving directly from immunoassay screening to confirmatory testing. Likewise, if molecular diagnostics instruments were to connect to core laboratories, chemistry and immunoassay testing could be combined for diagnosing and monitoring infectious diseases, with follow-up molecular confirmation using the same sample on the same track. The risk of contamination for molecular diagnostics tests has been a barrier in the past, but companies are coming up with new ways to manage this risk.

Looking farther into the future, the trends that have allowed many clinical chemistry assays to move to the point of care could ultimately influence the size of core laboratories, as well. Automation systems and chemistry instrumentation, oddly enough, have gotten a little bit bigger over time. With advances in technology and microfluidics, things should at some point start getting smaller.

Right now, most core laboratories are optimized for economies of scale, and high-volume testing based on traditionally sized collection tubes and cost per test on these platforms is much lower than on small devices at the point of care. Yet if microfluidic technologies were to become less expensive, this calculation could change.

At some point in the future, the technology will catch up and things in a core clinical laboratory will start getting smaller, because a lot of labs are facing space pressures. So, at some point that momentum has to shift. In the meantime, innovation will remain largely in the realms of developing new biomarkers, improving existing technologies, and connecting clinical chemistry with other areas of clinical laboratories.

Industry Speak

Automated hematology analyzers are playing vital role

Nitin Srivastava

Nitin Srivastava

National sales Manager-IVD,

Nihon Kohden India

Automation of cell counting and characterization has revolutionized the results of hematology analysis since its initial development in the 1950s. Although many detection methods are still in use, optical technology has represented a key innovation in automated hematology analysis since its introduction.

Light, scattered and detected in specific angles, captures an array of information about cell size, structure, inner complexity, nuclear segmentation, and cytoplasmic granulation. In particular, innovative expansions of optical flow cytometry have enabled laboratories to obtain higher-quality results, for more accurate and rapid clinical decision making.

The most common technologies are electrical impedance, radio-frequency (RF) conductivity, optical light scatter (optical flowcytometry), cytochemistry, and fluorescence. Optimal combinations of these detection methods provide an accurate automated complete blood count (CBC), including white blood cell (WBC) differential, in a short span of time.

Increasing adoption of automated hematology instruments, rising technological advancements, and integration of basic flow-cytometry techniques in modern hematology analyzers are some of the key factors driving the growth of the global hematology analyzers and reagents market. In addition, rising future demand for high-throughput hematology analyzers and development of high-sensitivity point-of-care (PoC) hematology testing are also fueling the growth of the global hematology analyzers and reagents market. However, the high cost of hematology analyzers and competition among existing players are restraining the growth of the global hematology analyzers and reagents market. In addition, stringent and time-consuming regulatory policies for hematology instruments also impede the market growth.

Indigenous market

The Indian hematology instruments and reagents market in 2019 is estimated as USD 126 million. Reagents constitute 65 percent of the market USD 82 million , and instrument the balance at USD 44 million.

The hematology instruments market may be segmented as 5-part and 3-part analyzers. By quantity, in 2019, the 3-part analyzers dominated with an estimated 80 percent market share, albeit the margins continued to come from the 5-part analyzers. Within the 3-part analyzer segment, the single-chamber is a dying breed and the laboratories are opting for its double-chamber counterpart. Within the 5-part analyzers, the entry-level analyzers are more popular. The maximum growth is being seen by the 5-part entry-level analyzers or high end 6PDA.

Nihon Kohden India is playing key players active in the hematology analyzer market are introducing new and innovative products to increase their market share by installing Celltech-G MEK-9100K with high accuracy.

Industry Speak

ELISA continues to be trusted as the gold standard

Rashmi Jha

Rashmi Jha

Asst. Manager- Immunoassays

Transasia Bio-Medicals Ltd.

Valued at around Rs 2700 crore, the immunochemistry segment is the second largest contributor to the Indian IVD market. The rise in the prevalence of infectious diseases is a major reason for the growth of this sector.

While Chemiluminescence Assay (CLIA) is the most recent advancement with high sensitivity, its use is mainly restricted to high workload settings in urban areas. Radioimmunoassay (RIA) and Fluorescence Immunoassay (FIA) are age-old procedures which over the time have been replaced by Enzyme-Linked Immunosorbent Assay (ELISA). Rapid tests can reveal the test results in less than 30 minutes, hence are preferred for screening. ELISA, on the other hand, continues to be trusted as a gold standard, owing to extremely high sensitivity, specificity, precision, and throughput of ELISA.

Automation in ELISA

The last two decades have seen tremendous automation in ELISA technology. From a compact bench top micro strip processor, ELISA processors are now available with 6 plates, allowing reporting of over 500 test results at one go. Automated processors are equipped with robotic probes and dedicated workstations, which drastically improve ELISA workflows. These fully automated processors are complete walkaway systems that minimize manual errors, while improving the accuracy and turnaround time for critical tests. Usually being open systems, the limitation of ELISA kits from a single source, can also be ruled out.

The diagnostic landscape in India is largely varied with the chain labs concentrated in the big metros and the rural areas often devoid of even the most basic facilities for routine testing. Moreover, public hospitals in metros are often overloaded. In either of these scenarios, ELISA is often the preferred choice for being affordable and reliable.

Way forward

The global ELISA market is estimated to witness a CAGR of 5.1 percent up to 2025. Increase in the number of cancer cases, rise in infectious and immune-mediated diseases and the increasing demand for cost-effective diagnostic solutions are expected to drive the growth of this sector. While the technique is widely accepted as a whole, technological advancements are set to take the traditional ELISA to new levels. Further, there is a scope for hybrid automation systems of ELISA and CLIA.

Industry Speak

Nephelometry technology

will change the way healthcare is being delivered

Sanjaymon KR

Sanjaymon KR

General Manager – Business Development,

Agappe Diagnostics Limited

The in vitro diagnostics industry continues to drive growth in mature and emerging markets such as India, specifically with specific protein analysis. The advent of advanced nephelometry technology for specific immunochemistry analysis is becoming more and more popular nowadays as these have proved to be very effective tools to diagnose cancer, renal disorders, lifestyle, and nutritional disorders. In addition to this, technological advancements such as automation, cartridge based regent segment and auto calibration technology are the major factors propelling the growth of specific protein analysis in Indian IVD market. Cloud based calibration process, online logs, alerts, and online service support is another technology advancement, which will further change the way specific protein testing is delivered In India and nearby countries.

Several semi-automated nephelometers and fully automated specific protein analyzers are now commercially available for the performance of a variety of specific protein tests. The latest addition to this list is Vitamin-D and H Pylori testing. The available semi-automated platforms are compact units that take up limited space in the laboratory and breaks all the barriers of space constraints especially in the metro cities.

Indian nephelometry market has now spread out its wings to urban India. The new generation systems are also fitted with battery backup to address the various needs of the customers. Semi-automated nephelometry systems were introduced in India in the last decade and became the game changer in the specific protein testing. It is estimated that approximately 3000 nephelometric analyzer units are installed in India annually. Valued at Rs. 96 crore, reagents are having the highest share in the specific protein market as compared to the instrument (valued at Rs. 30 crore). With increase in the number of parameters, these systems are gaining wide acceptance among the customers in all segments.

For the last 10 years there is a shift from standalone high cost floor model systems, toward highly affordable bench top analyzers with very low recurring cost. Manufacturers believes that nephelometry technology will change the way healthcare is being delivered in India, especially by providing quality healthcare at affordable rate to the remotest part of rural India.

Industry Speak

Immunoassays, fast-growing clinical diagnostics technologies

Dharampal Sharma

Dharampal Sharma

Sr. Product Manager – Immunoassay,

Mindray Medical India Pvt Ltd

Immunoassays are utilized in healthcare industry in applications such as infectious diseases, endocrinology, oncology, bone disorders, cardiology, blood screening, autoimmune disorders, toxicology, and prenatal screening by using purified antigens and antibodies, which makes immunoassays very sensitive and specific.

Immunoassays have been one of the fast-growing clinical diagnostics technologies over the years globally and similar is the scenario in India. The technological advancements in immunoassays driven by the need for early detection of diseases have supported their adoption over the years, and hence have supported the immunoassay market growth. Today, with the development of excellent methods of signal generation, the attention has shifted to the development of immunochemical methods and instruments to provide convenient high-performance systems.

The escalating need for inexpensive diagnostic testing coupled with improving accuracy of advanced rapid diagnostic tests are also supporting the immunoassay market growth . The leading market players are continuously focusing on R&D to develop and deliver innovative products to align with the market requirements.

As a recognized manufacturer in the field of in vitro diagnostics Mindray is committed to contribute to the improvement of public health. Scientific and technological innovation is at the heart of the Mindray strategy. It has enabled to extend Mindray’s expertise to the fields of Immunology through innovative chemiluminescence technology with development of important clinical markers. We understand the market needs and requirements and by keeping the vision of better healthcare for all by working with the mission of advanced medical technologies to make healthcare more accessible and with core values of aligning with our customers are committed to contribute to the improvement of public health through our scientific and technological innovation.

Second Opinion

Immunochemistry – Need of today

Dr Kanchan Sonone

Dr Kanchan Sonone

Consultant, Biochemistry and Laboratory Director,

Wockhardt Hospital

In medical science, there have been many advances, and one of the key factors in advancement is the Immunochemistry technology, which has developed to detect levels of molecules, such as proteins, hormones, drugs, and other substances that control human body on the molecular level. Immunochemistry is an important tool for scientific research, and a complementary technique for the elucidation of differential diagnosis that is not determinable by conventional analysis. Immunochemistry has witnessed extraordinary advancement in every aspect of basic and clinical research, and these are due to technological advances which enable quantitatively and comprehensively measuring immune response to genetic or environmental perturbations. Immunochemistry analyzers are becoming more and more popular these days as they have proved to be very effective tools to diagnose cancer, hepatitis, illegal drugs, fertility problems, infectious diseases, and many chronic diseases. Nowadays, chemiluminescence immunoassay (CLIA) systems are gaining momentum; this in turn results in a decline in enzyme-linked immunosorbent assay (ELISA) tests. Due to stringent checks, rapid tests are also seeing a decline, and are gradually shifting to chemiluminescence.

Automated CLIA analyzers are now preferred by even standalone laboratories. Besides faster TAT (turn-around time), it offers other benefits, such as precision, ease of processing a large number of samples, and minimal manual intervention, leading to a streamlined workflow. Immunochemistry plays an important role in development of biomarkers too as growth in incidence and prevalence of infectious diseases, cancer, gastrointestinal and cardiovascular diseases, endocrine diseases and many other chronic diseases. The evolution of diagnostic and prognostic markers is significantly changing the clinical practice, and this can be demonstrated by the use of immunochemistry. The demand for immunochemistry has increased owing to overall increase in healthcare expenditure, decreasing mortality, increased awareness, and lifestyle-related diseases.

Immunochemistry is the backbone of diagnosis and prognosis of diseases in healthcare system, and is thus the need of today for accurate and precise measurement of the sensitive parameters, and for their rapid diagnosis.

Second Opinion

Immunoassay challenges – How to select the equipment of your choice?

Dr Pramod Ingale

Dr Pramod Ingale

Professor & Head, Dept. of Biochemistry,

LTM Medical College and LTMG Hospital

With more and more requests pouring in from clinicians, particularly endocrinologists, medical diagnostic laboratories have to equip themselves to provide extensive menu of immunoassay tests. This also poses a challenge on how to select an immunoassay equipment. In this article, efforts are made to simplify this challenge.

Test menu. It is important to understand the test menu the lab has to offer. Although majority of tests are available with all leading manufacturers, it is important to check that the lab’s requirement is fulfilled. Even if one test is not available, the lab may have to procure another equipment to carry out the missing test. Hence, checking test menu is very important. One also has to check additional tests available on the equipment so that the facility is available for future needs.

Throughput. Due to large variation in assay timings for different tests, throughput of immunoassay depends on the combination of assays the equipment has to perform at any given time. It is never a fixed value and is always stated as upto. Hence, it is advised to choose equipment that has throughput higher than the actual laboratory requirement. This also takes care of the future increase in workload.

Proficiency testing performance. There is tremendous variation in test results amongst different immunoassay equipment. What is reported normal by one equipment may be reported as hypo or hyper by other equipment. Since there are challenges of harmonization of results across all immunoassay platforms, it is advised to study proficiency testing performance of various equipment for different analytes from reputed PT providers. This gives an idea on total number of labs using similar equipment and their overall performance. Also, PT providers rank top 8–10 equipment’s performance for each analyte. Based on this study, one can find out the most popular equipment, the equipment giving consistent performance, and equipment-wise accuracy for every single analyte. This exercise can be done by studying at least past one-year data of popular PT providers.

Software for prenatal screening. If the lab is planning to provide prenatal screening tests, then it is important to know which software is available for reporting. Many referring obstetricians are inclined toward a particular software. They are comfortable with a specific software report format. Choosing any other software increases the risk of losing business of prenatal screening tests.

Others. Other points like initial and recurring cost, cost per reportable test, service back-up, long-term equipment performance, support in terms of consumables, reagents, user-friendliness, etc., remain the same as that of any other laboratory equipment, and needs to be looked into before finalizing the equipment.

I am sure this short but crisp write-up will make things easy for you for selecting immunoassay equipment.