Company News

Stryker reports 2023 operating results and 2024 outlook

Stryker reported operating results for the fourth quarter and full year of 2023:

Fourth quarter results

- Reported net sales increased 11.8% to $5.8 billion

- Organic net sales increased 11.4%

- Reported operating income margin of 21.6%

- Adjusted operating income margin increased 60 bps to 27.2%

- Reported EPS increased 102.7% to $2.98

- Adjusted EPS increased 15.3% to $3.46

Full year results

- Reported net sales increased 11.1% to $20.5 billion

- Organic net sales increased 11.5%

- Reported operating income margin of 19.0%

- Adjusted operating income margin increased 40 bps to 24.2%

- Reported EPS increased 33.7% to $8.25

- Adjusted EPS increased 13.5% to $10.60

“We drove excellent organic sales growth of over 11% in both the fourth quarter and the full year, and delivered strong adjusted earnings,” said Kevin Lobo, Chair & CEO. “It was exciting to surpass $20 billion in sales as we continue to drive high growth. I would like to thank our teams for the strong performance in 2023.”

Sales analysis

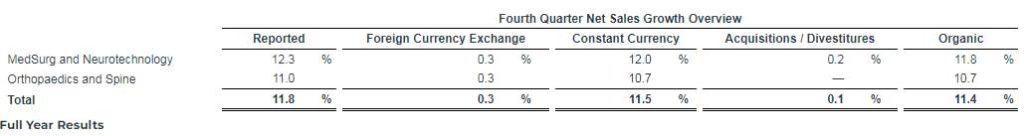

Consolidated net sales of $5.8 billion and $20.5 billion increased 11.8% in the quarter, 11.5% in constant currency, and increased 11.1% in the full year, 11.6% in constant currency. Organic net sales increased 11.4% and 11.5% in the quarter and full year including 10.7% and 10.9% from increased unit volume and 0.7% and 0.6% from higher prices.

MedSurg and Neurotechnology net sales of $3.4 billion and $11.8 billion increased 12.3% in the quarter, 12.0% in constant currency, and increased 11.5% in the full year, 12.1% in constant currency. Organic net sales increased 11.8% and 11.8% in the quarter and full year including 10.1% and 10.2% from increased unit volume and 1.7% and 1.6% from higher prices.

Orthopaedics and Spine net sales of $2.4 billion and $8.7 billion increased 11.0% in the quarter, 10.7% in constant currency, and increased 10.5% in the full year, 11.1% in constant currency. Organic net sales increased 10.7% and 11.1% in the quarter and full year including 11.5% and 11.9% from increased unit volume partially offset by 0.8% and 0.8% from lower prices.

Earnings analysis

Reported net earnings of $1.1 billion and $3.2 billion increased 103.0% and 34.2% in the quarter and full year. Reported net earnings per diluted share of $2.98 and $8.25 increased 102.7% and 33.7% in the quarter and full year. Reported gross profit margin and reported operating income margin were 63.7% and 21.6% in the quarter and 63.7% and 19.0% in the full year. Reported net earnings include certain items, such as charges for acquisition and integration-related activities, the amortization of purchased intangible assets, structural optimization and other special charges (including asset write-offs and impairments), costs to comply with certain medical device regulations, recall-related matters, regulatory and legal matters and tax matters. Excluding the aforementioned items, adjusted gross profit margin was 63.9% in both the quarter and full year, and adjusted operating income margin was 27.2% and 24.2% in the quarter and full year. Adjusted net earnings of $1.3 billion and $4.1 billion increased 15.4% and 13.9% in the quarter and full year. Adjusted net earnings per diluted share of $3.46 and $10.60 increased 15.3% and 13.5% in the quarter and full year.

2024 outlook

Based on our momentum from 2023, strong procedural volumes, healthy demand for capital products and a stabilizing macro-economic environment, we expect 2024 organic net sales growth to be in the range of 7.5% to 9.0% and expect adjusted net earnings per diluted share to be in the range of $11.70 to $12.00. Based on the steady progress of our pricing actions, we would expect the full year impact of price to be roughly flat. If foreign exchange rates hold near current levels, we anticipate sales will be modestly unfavorably impacted for the full year, being more negative in the first half of the year. We expect adjusted net earnings per diluted share will be negatively impacted by foreign exchange rates approximately $0.05 to $0.10. This is included in our guidance.

MB Bureau