DNA Sequencers

The NGS race is in full swing

As DNA sequencing becomes more accessible and widespread, facilitating its integration into routine clinical practice and research, the future of NGS is promising.

A genomic revolution is taking place in India, where the value of genomic tests is being recognized in the prevention and diagnosis of diabetes, cardiovascular disease, cancer, carrier status, among others. With the power to identify accurate preventive solutions to chart out treatment options for patients, predictive genomic testing is seen as the next major weapon in the arsenal of cutting-edge healthcare tech that can improve patient outcomes without relying on a curative approach.

Till 2022, most of the sequencing around the world was done on instruments made by Illumina, Pacific Biosciences (PacBio), or Oxford Nanopore Technologies (ONT). Today, researchers who sequence DNA have choices that they have not had before. The NGS industry has, in one year, grown from a few players to a crowded field.

In March 2022, Molly He, PhD, an Illumina veteran launching his new company, Element Biosciences, revealed its benchtop AVITI platform, displaying its high accuracy, an option for synthetic long reads, and a low price point.

Another San Diego-based company, Singular Genomics, launched a new benchtop instrument, the G4. According to Singular, it offers flexibility (with four independent flow cells) and very fast run times.

In June 2022, Ultima Genomics surprised everyone with the launch of its high-throughput UG-100. Everything about the UG-100 is grandiose – the box, the throughput, the price tag, and the claims surrounding it.

AVITI, G4, and UG-100 offer good competition to Illumina’s NextSeq instrument.

The veteran was not sitting uninterested. In September 2022, Illumina responded. At Illumina Genomics Forum, the vendor revealed its NovaSeq X series of sequencing instruments, which includes a pair of new instruments – the NovaSeq X and NovaSeq X Plus. The new platform shared the same name as an older platform, but had used a new chemistry, XLEAP-SBS. While XLEAP-SBS is still sequencing-by-synthesis (SBS) (the fundamental chemistry developed by Solexa – the British company acquired by Illumina in 2007), it features a new polymerase, blockers, linkers, and dyes. And there is sustainability in its reagents and shipping program. However, these will only be available late 2023. And XLEAP-SBS will be available on the NextSeq, after P4 flowcell comes out in 2024. Although Illumina has declared that the cost per gigabase will be USD 2 (a 59% reduction in cost per gigabase relative to the current NovaSeq 6000 S4), that will be possible only once the 25B (25 billion clusters) flowcell are launched. Timing is of utmost relevance. If any of the other brands beats Illumina to its game, the tables may turn in their favor.

PacBio was not the one to be left behind. On October 22 the same year, the company announced the commencement of external beta testing of the Onso™ sequencing. Not only does the platform sit at a very competitive price point, but more accurate sequencing means less sequencing – which is cost effective. This was followed by the launch of a new long-read platform, Revio, which will replace the company’s workhorse – the Sequel IIe. Although the Revio uses the same high-accuracy Hi-Fi chemistry, which allows for direct methylation and structural variation detection, the company says that the Revio is 15 times more powerful than the current Sequel IIe system. The new platform moves PacBio into population-scale genomics at under a USD 1000 genome.

Oxford Nanopore, headquartered at the Oxford Science Park outside Oxford, UK, and MGI, the China-based sequencing company, have also been busy. And the American players are promising more!

The reduction in sequencing costs has emerged as a prominent catalyst for the expansion of the next-generation sequencing (NGS) market. Over the past few years, the cost of sequencing has consistently decreased, rendering NGS more affordable and accessible to researchers and clinicians.

The dropping cost-per-base of DNA sequence will be most valuable to those who can extract a large amount of data from each sequencing experiment and apply that to their problem space. Hence, with more individual samples that can be sequenced, researchers can examine more replicates of the same sample, explore more conditions in a process, and go deeper into an environmental sample.

NGS users with lower sample volumes now have an opportunity to buy a sequencer that matches the pricing afforded to high-volume users. In 2023 and beyond, we expect to see the playing field even out, allowing for less sequencing centralization and more democratization and control of samples and the resulting data.

Furthermore, the growing adoption of NGS in clinical diagnostics, its increasing usage in non-invasive prenatal testing (NIPT), microbiology for pathogen detection and identification, and the exploration of microbial communities, all contribute to the expansion of the NGS market.

The pandemic has spurred an increase in demand to apply multiplex testing to Covid-19, RSV, and influenza, enabling researchers to differentiate between multiple viruses in a single assay. The CDC, for instance, has developed a multiplex assay that is a real-time reverse-transcription polymerase chain reaction test that can simultaneously detect and differentiate between influenza A, influenza B, and SARS-CoV-2. Properly designing such tests enables linking biological processes to DNA sequence barcodes. In addition, such tests require skill at creating large numbers of strains and diligence in correctly executing the experimental protocol and downstream data analysis.

Moreover, factors such as the rising number of cancer patients, increased investments in advanced NGS solutions by market participants and research institutes, the imperative to enhance diagnostic procedures and ensure high-quality treatment, and the growing number of genome-related studies collectively drive growth.

Nascent applications, such as spatial biology will continue to grow and prove utility for the genomics market. This will lead to further research findings and applications for NGS to displace legacy solutions, such as Sanger sequencing.

Indian market dynamics

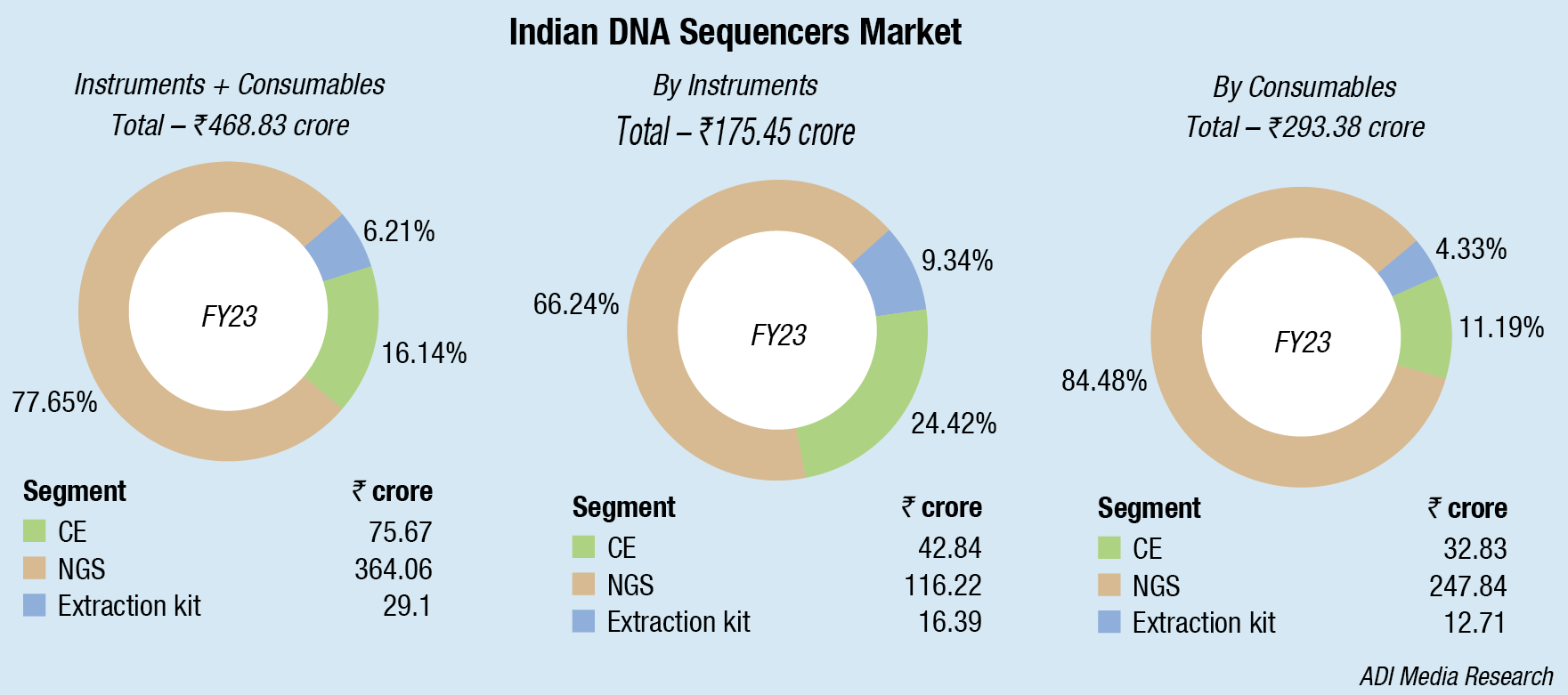

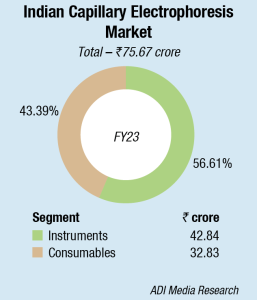

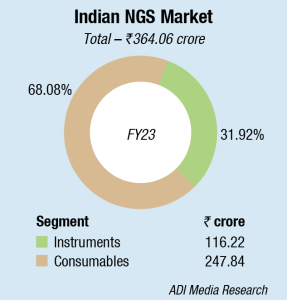

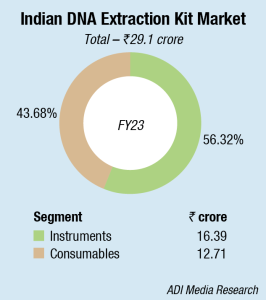

The Indian DNA sequencer market saw an overall 20-percent increase in FY23 over FY22. The consumables saw a 20-percent increase, whereas the instruments a 17-percent increase by value. NGS continues to be the mainstay, contributing 78 percent to the total market.

Favorable government incentives and programs are anticipated to accelerate the market growth. Though India is behind China and Korea in the Asia-Pacific region, propelled by government initiatives and support a lot of Indian start-ups and companies have started undertaking research in this new technique. There is a growing interest among researchers in this space. Genome sequencing will lead to personalized medicine from the diagnosis, prognosis, and treatment perspectives. It could also reshape the drug discovery process.

MedGenome has a state-of-the-art genetic lab where more than 250,000 exomes and genomes are sequenced. VarMiner, an AI-enabled powerful variant interpretation software suite, supports various NGS Dx workflows like Germline analysis where it covers all rare diseases, inherited cancers, mitochondrial genome analysis, PGx, and HLA analysis. The Institute of Genomics and Integrative Biology (IGIB), a CSIR institute, spearheads the IndiGen project, a Genomics for Public Health in India initiative. Genome India Project, a center-backed initiative to sequence 10,000 Indian human genomes, and create a database, was started last year and is now two-thirds through.

Given the availability of skilled manpower and a large patient population, the future looks bright for genomics in India. Over the last few years, there has been steady progress in the advancement of newer sequencing technologies. Awareness among consumers and clinicians and thereby reimbursement seems to be the primary challenge around genomic tests. There is a need to establish a supply chain for raw materials and define how much storage and processing speed are required. In this regard, more technological innovations in this space are expected to become game changers.

Global market scenario

The global NGS market is estimated to reach USD 12.03 billion by the end of 2028 from USD 5.11 billion in 2023 with an annualized growth rate of 18.66 percent through 2023–2028.

Segment insights. In 2022, the technology segment (targeted re-sequencing, whole genome sequencing, de novo sequencing, exome sequencing, RNA-seq, ChIP-seq and methyl-seq) dominated the market with a revenue share of over 73 percent.

|

Indian DNA Sequencers Market Leading players – 2022 |

|||

| Instruments | Consumables | ||

| Capillary Electrophoresis | Tier 1 | Thermo Fisher (brand Applied Biosystems) | Thermo Fisher |

| Tier 2 | NimaGen, Qiagen, GE, Millipore, Chinese brands, and home brewed labs | ||

| NGS | Tier 1 | Illumina (Premas Life Sciences) | |

| Tier 2 | Thermo Fisher, Pacific Biosciences (Spinco), and Agilent | ||

| DNA Extraction Kit | Tier 1 | Qiagen | |

| Tier 2 | Thermo Fisher and Promega | ||

| ADI Media Research | |||

The rising adoption of targeted re-sequencing in oncology research is a major catalyst for the growth of this segment. Targeted re-sequencing is being increasingly employed to study the cancer genome, enabling researchers to analyze it with enhanced efficiency and effectiveness. This trend is expected to persist in the future, propelling the growth of the segment.

The whole genome sequencing (WGS) segment is expected to experience a substantial growth rate in the coming years. Factors, such as the expanding utilization of WGS in both research and clinical applications, continuous technological advancements in WGS, and the inherent benefits it offers, including enhanced accuracy, speed, and cost-effectiveness, contribute to the growth of this segment. Additionally, the increasing adoption of WGS in the development of personalized medicine further drives the growth rate of this segment.

Regional insights. North America with the highest revenue share of 43 percent dominates the NGS market worldwide. The reasons are many but the most important being the increasing incidence of cancer, the increasing applications of precision medicine, and biomarker discovery. Favorable government initiatives and funding for genomics R&D is also a reason for the growth. Also, the presence of skilled professionals and advanced medical infrastructure further fuels the growth rate.

Europe also shows the second-highest growth rate in NGS market due to the growing investments from the European governments for the research and developmental activities of genomics.

The Asia Pacific market is expected to witness significant growth rate in the coming years with increasing investments by governmental and non- governmental organizations in favor of genomics and the growing patient population in developing countries.

Major players. In response to the Covid-19 pandemic and the high need for NGS testing, key market players are taking up strategies, such as developed NGS-based diagnostic tests, drug discovery, mergers and acquisitions, joint ventures, partnerships, and collaborations. These strategic initiatives are facilitating the companies in attaining and preserving their market position. Additionally, several players are intensifying their efforts to expand their product portfolio, thereby enhancing their competitive stance.

Some of the prominent players operating in the next-generation sequencing market are Illumina, Thermo Fisher Scientific, Pacific Biosciences, Macrogen Inc., Partek Inc., Genomatix Software GmbH, Perkin Elmer Inc., GATC Biotech Ag, Agilent Technologies Inc., Biomatters Ltd., BGI (Beijing Genomics Institute), Oxford Nanopore Technologies Ltd., DNASTAR Inc., Knome Inc., and Qiagen N.V.

Technology trends

Some of the recent advances in DNA sequencers are:

Next-generation sequencing (NGS) addresses the need for faster and more scalable genome analysis in the biotech sector. Startups are developing advanced NGS technologies that enable high-throughput sequencing of entire genomes, deep sequencing of specific regions, and accelerated human genome analysis. Helaxy is a Singaporean startup that develops a fluidics NGS prep solution, which minimizes manual pipetting errors and allows hospitals to leverage decentralized Covid testing, and move testing closer to the patients to save time. Another startup CD BioSciences is US-based and creates htDNA-chip, which enables high-throughput sequencing, shorter turnaround times, and high-fidelity customization.

Genome data analysis maintaining in-house data warehouses is cost- and labor-intensive for biotech companies, also integrate data protection to tackle sensitive information leaks and other cybersecurity issues. Here, GENEASIC is a Taiwanese startup that provides GeneASIC NGSAAP, an ultra-fast NGS data analysis platform, and Genpax, a UK-based startup, provides pathogen intelligence.

Genome editing. Startups and scaleups are addressing safety concerns in genome editing, such as off-target effects and mosaicism, through advancements in CRISPR-Cas9 technology. Researchers are also utilizing bioinformatics to improve genome editing mechanisms. Additionally, the efficiency of CRISPR is driving innovations in epigenome editing. US-based startup Bayspair develops scarless genome editing technology and Brazilian startup InEdita Bio facilitates plant genome editing for sustainable soybean and maize production.

Artificial intelligence (AI) plays a crucial role in processing large genomic datasets, uncovering hidden patterns and trends. Researchers utilize AI technologies, such as machine learning and deep learning to expedite data analysis. In the realm of clinical and healthcare genomics, AI enhances drug discovery and disease diagnostics workflows. Here, Imagia Canexia Health is a Canadian startup that offers predictive oncology models that utilize AI and advanced molecular biopsy solutions for treatment selection and monitoring. Einocle is a South Korean startup that develops an AI-powered single-cell genetic analysis platform, which supports the development of optimal treatments for incurable diseases through precision medicine.

Functional genomics improves the understanding of genetic interaction mapping and DNA/protein interactions at the DNA level, and enhances deep mutational sequencing at the protein level. Consequently, functional genomics improves disease modeling and drug target identification. US-based startup Cajal Neuroscience aids neurodegenerative disease drug discovery and another is Tavros Therapeutics that creates targeted cancer therapies.

Metagenomics include NGS, third-generation sequencing (TGS), and functional metagenomics. Functional metagenomics enables researchers to identify enzymes with desirable properties, discover novel bioactives, and analyze antibiotic resistance development. Metagenomics thus finds applications in environmental remediation, biofuel generation, soil microbe analysis, and more.

Metagenomics has two different startups, BiotaX is an Israeli startup that develops TaxonAI, a metagenomic analysis platform, which combines AI and metagenomics to predict multiple disease states and calculate optimal interventions. KITAI is a Chilean startup that facilitates real-time environmental analysis. The startup’s lab-on-a-chip combines AI, microfluidic, and metagenomics technologies to perform various analyses.

Single-cell genomics employs NGS to study individual cells within their microenvironments. Vizgen, a US-based startup, has created MERSCOPE, an advanced platform for in situ single-cell spatial genomics analysis and Swedish startup Nygen Analytics has introduced Scarf Web, a cloud-based interactive analysis platform for single-cell genomics, transcriptomics, and epigenomic datasets.

3D genomics enables scientists to explore how chromatin architecture influences DNA replication, gene expression, and genome integrity. Innovations in chromosome conformation capture (3C)-based technologies, such as genome-wide chromosome conformation capture (Hi-C) and chromatin interaction analysis, using paired-end tag sequencing (ChIA-PET), are advancing 3D genomics research.

In this, two UK-based startups, Enhanc3D Genomics and Nucleome Therapeutics, both build a 3D genome analysis platform.

As technology progresses, there will be ongoing and promising advancements in various fields. Staying proactive in identifying and implementing these developments is key to staying ahead in the market.

DNBSeq-T20 and ultra-high speed DNBSeq-G99 are both high-speed sequencing platforms that utilize the DNA Nanoball Sequencing technology.

DNBSeq-T20 can support the operation of six large open-type sequencing slides simultaneously, producing up to 22 Tb of data per day. The T20 is equipped with six slides and two imagers, as well as a rotating robotic arm, and can produce 72 Tb per run for whole-genome sequencing, whole-genome bisulfite sequencing, whole-exome sequencing, RNA-seq, single-cell sequencing, spatial transcriptomics, and other sequencing types, including pooling different libraries at the same time.

DNBSeq-G99 is an ultra-high-speed sequencing platform designed to deliver even faster sequencing throughput. The G99 is especially suitable for targeted gene sequencing and small genome sequencing, requiring only 12 hours to finish PE150 sequencing. It supports reads lengths, including PE50, SE100, and PE150, while reagent kits with longer reads lengths, such as SE400 and PE300, will be available in the future. With its rapid generation of sequence data, the G99 has already contributed to the discovery of the first imported case of Monkeypox in Chongqing, China.

We have come a long way in 40 years of DNA sequencing, and the exponential rate of NGS advancements looks set to continue. Now that NGS is becoming ever-more accessible and affordable, this exciting technology is revolutionizing numerous life science disciplines across the globe. The increased portability of NGS technology posits NGS as a useful field-based tool, and could be a major transformation in the years to come.

Second Opinion:-

Sequencing your way to health – Challenges and opportunities.

Human genome sequence and its implications – Past present, and future.