Ultrasound Equipment

Ultrasound – Going Places

The advent of new technology has revolutionized what is possible via ultrasound, leaving it the imaging choice for numerous clinical specialties that would have seemed far-fetched in decades past.

2018 was a record year for the world ultrasound equipment market, with revenues increasing by 6.8 percent, tipping the market over the USD 7-billion mark for the first time, estimates Signify Research. Despite the backdrop of global economic uncertainty, the ultrasound market is forecast to continue to grow relatively strongly in the coming years, with the following trends driving growth.

New users. Over the years, the use of ultrasound has gradually expanded beyond radiology, cardiology, and OB/GYN to a wide range of clinical specialties, including surgery, musculoskeletal, and gastroenterology, to name a few, expanding the customer base and driving additional revenue growth. This trend started out in developed countries, has spread to developing markets, more recently, particularly India and China, where specialty departments at larger hospitals often have their own budgets to buy ultrasound. Additionally, ultrasound is gaining acceptance in acute and primary care settings, both as a screening and diagnostic tool, as well as for procedure guidance. With the use of handheld ultrasound gaining pace, this trend will accelerate in the coming years.

New uses. As well as the growing customer base, the use of ultrasound with existing customers is expanding, typically as a lower-cost and/or radiation-free alternative to other imaging modalities, such as MRI and CT. The global shift to value-based care as a replacement to the traditional fee-for-service approach will support this trend. For example, ultrasound is playing an increasingly important role as a screening tool for women with dense breast tissue. In acute care, ultrasound is increasingly being used for lung imaging to diagnose conditions, such as pleural effusion, pulmonary edema, and pneumothorax. In another example, the use of shear-wave elastography is expanding beyond hepatology (e.g., liver fibrosis) to other body areas, including breast, prostate, thyroid, and spleen. Musculoskeletal is another relatively untapped market for ultrasound, including orthopedics, rheumatology, and sports medicine.

Emerging markets. The ultrasound market in developed regions, such as Western Europe, North America, and Japan, is largely saturated and the outlook is for low- to mid- single-digit growth. While these markets will continue to account for the lion’s share of the world market, developing markets represent a growth opportunity. In 2019, the fastest growth is forecast for Southeast Asia, Brazil, China, and India. That said, ultrasound market growth is slowing in many of the emerging markets, particularly China, largely due to slowing global economic growth.

Handheld ultrasound. The handheld ultrasound market is growing rapidly, as the latest generation of ultra-portable devices gains acceptance among a diverse range of customer groups, from emergency-medicine physicians and intensivists to internists and office-based specialists, and looking forward, primary care physicians. The expanding customer base, coupled with the increased availability of affordable handheld scanners, is forecast to boost global sales of handheld ultrasound by over 50 percent in 2019. By 2023, the global market for handheld ultrasound is forecast to exceed USD 400 million.

Artificial intelligence. Artificial intelligence (AI) will have a transformative impact on the market as it addresses some of the key limitations associated with ultrasound, namely, the shortage of trained sonographers and the relatively steep learning curve, high operator dependency both during image acquisition and interpretation, poor image quality for certain exam types, and the relatively lengthy exam time compared with other modalities. The first wave of ultrasound AI applications are entering the market and are mainly for image optimization (noise reduction) and automation of time-consuming and repetitive tasks, such as anomaly detection, image labeling, feature quantification, and classification. However, the greatest impact of AI will be guided ultrasound (ultrasound navigation), which will provide real-time support during image acquisition (i.e., probe placement and anatomy detection). The first AI-enabled guided-ultrasound systems are expected to be released in the second half of the year. These systems are expected to expand the user base by making ultrasound more accessible to novice users, particularly in acute and primary care.

Indian market dynamics

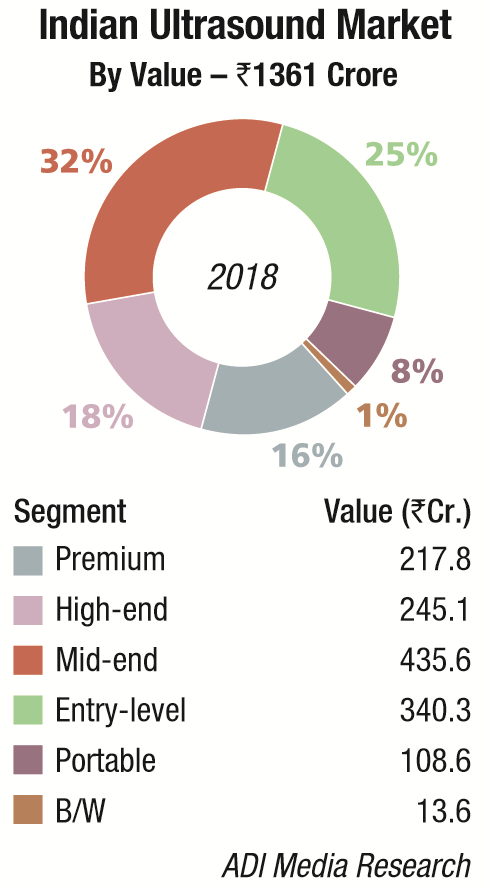

The Indian ultrasound equipment market in 2018 is estimated at Rs 1361 crore.

GE continued to dominate the market. Philips and Mindray were neck-to-neck at about 14 percent market share each. This year, Mindray gained ground with the launch of its premium Reasona series. It received huge orders from Directorate General of Health Services, Bihar Medical Services, and Gujarat Municipal Corporation, apart from the corporate chains of hospitals. Samsung continued to retain its rank. Siemens was also aggressive in this segment in 2018. Sonosite continued to be number one in the portable range of ultrasound equipment. Toshiba, Aloka, Cura, Esaote, and SonoScape were the other prominent players.

Application was primarily in radiology and obstetrics and gynecology, which had a combined share of 77 percent. Cardiovascular ultrasound is also a popular technique with Indian physicians.

| Tier I | Tier II | Tier III | Tier IV | Others |

|---|---|---|---|---|

| GE | Philips and Mindray | Siemens, Toshiba, Trivitron (Aloka and Hitachi), and Sonosite | Zoll, BPL, Skanray, Mediana, and Beijing M&B; Lifepac AEDs (marketed by Medtronics) | Esaote, BPL, SonoScape, and Cura |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian ultrasound equipment market. | ||||

| ADI Media Research | ||||

The Indian ultrasound market is forecast to grow at a double-digit rate in 2019, buoyed by the government’s efforts to expand healthcare coverage, increasing private sector spending on healthcare, and a growing medical tourism industry. Government has also upped its allotted spending by 22 percent. As India’s population continues to surge, the long-term ultrasound market seems promising.

Outlook

Outlook

The advent of new technology has revolutionized what is possible via ultrasound, leaving it the imaging choice for numerous clinical specialties that would have seemed far-fetched in decades past. Ultrasound is going places, and it is time to hitch a ride!