Flow Cytometers

What the future holds for flow cytometry

It is always daring to envision what the future holds, or to predict which tools will become important, and which not.

The earliest flow cytometers were large, very complex instruments run by highly-skilled operators. These instruments, although an improvement over traditional microscopy, were only capable of measuring a small number of basic characteristics associated with each cell.

Technology advances have allowed the development of flow cytometers with a wide spectrum of capabilities – from easy-to-use instruments dedicated to specific application areas to high-end research systems, capable of detecting up to 50 fluorescence parameters per cell.

Additionally, researchers are adapting instruments for nontraditional flow-cytometry applications, from biomanufacturing and bioprocessing monitoring (including water-quality testing and agricultural and food-safety certification) to veterinary medicine, oceanography, and ecological field research. Given their high-throughput capacity for detecting and quantifying analytes in solutions and given their multiplexing potential, flow cytometry systems will be quickly adapted to diverse research and industrial sectors.

Looking forward, experts see an increasing need to democratize flow cytometry. Today, it is still considered a highly complex technique, requiring an expert operator and a time-consuming experimental design process. As flow cytometry is increasingly used in new applications, particularly nontraditional immunology workflows, the technique must become less complex, and this will happen by making instruments smarter and preconfiguring reagents.

Indian market dynamics

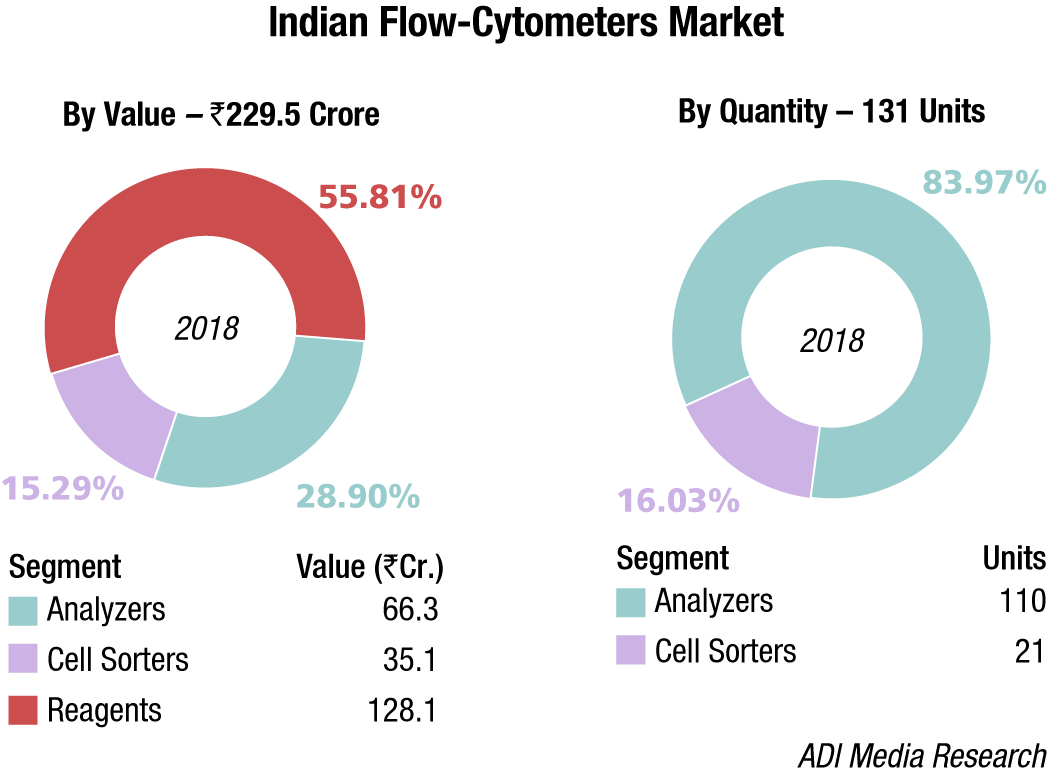

The Indian flow cytometers market in 2018 remained stable. Price points remained same as 2017 and the market saw an 8–10 percent increase in demand. It is estimated at Rs 229.52 crore with reagents constituting 55 percent share. Demand for analyzers is estimated at 110 units, and for cell sorters at 21 units. In 2018, an order for 200 systems was placed by NACO for CD-4 for POCT, with 125 systems on BD and 75 units on Alere. BD India continues to dominate the flow cytometer segment.

| Tier I | Tier II | Others |

|---|---|---|

| BD India | Beckman Coulter | Partec (Sysmex), Bio-Rad, Alere, Merck, Thermo, Bio Legend, MACS, and Mindray |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian flow cytometry market. | ||

| ADI Media Research | ||

Global market

The global flow cytometry market is projected to grow from an estimated USD 3.7 billion in 2018 to USD 5.4 billion by 2023, at a CAGR of 8.1 percent, predicts MarketsandMarkets. Market growth is largely driven by factors, such as technological advancements in flow cytometers, the increasing adoption of flow cytometry techniques in research activities and clinical trials, growing focus on immunology and immuno-oncology research, high incidence and prevalence of HIV-AIDS and cancer, and the increasing availability of novel application-specific flow-cytometry products. The growing market penetration in emerging countries, growth in stem-cell research, adoption of recombinant DNA technology for antibody production, and evolution of tandem-flow cytometry technologies are expected to present a wide range of growth opportunities for market players.

The flow cytometry market is segmented into cell-based and bead-based flow cytometry. Among these, the cell-based flow cytometry segment accounted for the larger market share in 2018. This technology can test compound activity against molecular targets within the context of living cells. With this benefit, the adoption of the cell-based flow cytometry technology has increased in the market. The flow cytometry market is segmented into reagents and consumables, instruments, services, software, and accessories. The services segment is likely to portray the highest growth. Flow cytometry services play an essential role in helping end users understand flow cytometry instruments and the cell-analysis process. The extensive availability of flow-cytometry services is the major factor in driving the market growth.

Majority of target end users (clinical laboratories, large research facilities, and pharmaceutical companies) require a significant number of flow cytometry instruments to simultaneously carry out multiple research studies. This leads to a significant increase in the capital cost associated with the procurement and maintenance of these devices. Academic and research laboratories find it difficult to afford such instruments due to restricted budgets. In addition, maintenance costs and several other indirect expenses result in an overall increase in the total cost of ownership of these instruments. Thus, the high product-installation cost and other related expenditure hinders the optimal adoption of flow cytometry instruments in both clinical and research applications, especially in the emerging nations. Also, flow cytometry instruments are equipped with advanced features and functionalities and are thus high-priced instruments; whereas, flow cytometry-based cell sorters are even more expensive than cell analyzers.

Emerging countries offer significant growth opportunities to major players operating in the global flow cytometry market. This can be attributed to the increasing research initiatives across key countries, coupled with low regulatory barriers, continuous improvement in healthcare infrastructure, growing patient population, rising healthcare expenditure, and strengthening distribution network of market leaders in these regions. Moreover, regulatory policies in the Asia-Pacific region are more adaptive and business-friendly due to less stringent regulations and data requirements. This, along with the increasing competition in mature markets, has further propelled key players in the flow cytometry market to focus on the emerging countries. For instance, China is witnessed with continuously strengthening healthcare infrastructure, fast-paced economy, rising domestic demand, and public-private initiatives that support various research activities. Similarly, the Indian market is also reported with increasing prevalence of target diseases and fast-growing life sciences research industry, coupled with a shift toward advanced analytical equipment and laboratory-workflow automation.

Some prominent players operating in the flow cytometry market are Becton, Dickinson and Company, Beckman Coulter, Thermo Fisher Scientific, Merck KGaA, Sysmex Partec, Luminex Corporation, Miltenyi Biotec, Bio-Rad Laboratories, Sony Biotechnology, and Agilent Technologies.

Technological advances

The world of flow cytometry is rapidly evolving. During the past few years, there have been significant changes regarding the qualifications for personnel credentialed to perform flow cytometry, assays with revived clinical applications, more elegant fluorochrome development, and the size and sensitivity of instruments. There have also been many developments in reagents, instruments, and applications.

Fast immunophenotyping using flow cytometry. A common use of flow cytometry in cellular biology is the identification and quantification of the cell types present in a sample. The identification of the cells is enabled by the fact that different cell types express different proteins on their surface. These proteins can be specifically targeted by antibodies, effectively adding a colored flag that differentiates one cell type from another.

This process, known as immunophenotyping, enables researchers to understand and monitor the number and percentage of cell types present in a heterogeneous population. Immunophenotyping is useful in characterizing the various components of the immune system, as these cells exist in suspension within the blood and the differential surface proteins are well-characterized.

Fluorescence-activated cell sorting (FACS). The characteristics being measured by a flow cytometer can be used in real time to physically sort cells into separate containers. This process requires a specific type of flow cytometer, known as a cell sorter, and is called fluorescence-activated cell sorting (FACS). A specific fluorescent readout or set of readouts will be defined as the trigger to put that cell in a specific container. Those readouts may be from fluorescent proteins within the cells or from fluorescent antibodies labeling the cell. Immunophenotyping markers that are exposed on the cell surface are frequently used in FACS, because they can be labeled with an antibody while the cell is alive. Researchers often prefer to sort live cells, so that subsequent experimentation may be performed using the isolated population.

The future

Recently, the World Health Organization (WHO) incorporated flow cytometry in its model list of essentials in vitro diagnostics. This underlines the platform’s relevance for primary patient care, and experts hope to see more recognition beyond its status as a sophisticated research tool. Though being known for more than 50 years, fluorescence-based flow cytometry regained momentum in the new era of immunotherapies industry entered. But not just immunology-focused researchers have turned to this technology. The frontier of flow cytometry applications is expanding. Which role mass cytometry will play in all of this, remains open; the underlying technology is entirely different, as it is based on elemental mass spectrometry. For utilizing this way of detection, cells are tagged with heavy-metal isotopes instead of fluorescent dyes, therefore, eliminating the problem of spectral overlaps. Clearly, there are inherent analytical advantages in terms of accuracy and signal-to-noise ratio, but instrument purchase costs are extremely high and the data output per experiment is difficult to analyze quickly.

Another technology potentially competing with flow cytometry is known as chipcytometry. Using up to 100 markers, it allows specimens to be phenotyped and banked on the same microfluidic chip, because tissue and cell suspension samples can be preserved for reanalysis after being stored for months.

It is always daring to envision what the future holds, to predict which tools will become important, and which not. Although being challenged by the alternative platforms mentioned, experts still believe that industry will not witness flow cytometry becoming obsolete and phased out from applied research. A lot will depend on how the technology can advance to become more quantitative. Ultimately, the more accurately measurements by flow cytometry can be performed, the more valuable its results can be for the users relying on them, may it be a clinician, a drug developer, or a food-safety technician. Going forward, it will be essential that datasets can be considered valid, that is fully reproducible, irrespective of who, where, and on which benchtop flow cytometer these were generated.