Cath Labs

Cath labs finding popularity in tier 2 and 3 Indian cities too

The growth of the cath labs market in India has been remarkable in recent years, with technological advancements and innovations driving the industry forward. With continued investment in R&D, the industry is poised for further growth and advancement.

Cardiovascular disease is a significant health challenge in India that affects people from all socioeconomic backgrounds. Every year, over 2 million interventions are required to save critical lives due to the approximately 2.5 million people who succumb to cardiovascular diseases. To address this growing burden, it is essential to scale up the number of catheterization laboratories (cath labs) in major cities across India to over 6000. However, currently, there are only about 2500 active cath labs in approximately 250 cities. Cath labs, no longer a luxury item for the elite, are now an essential component of value-care, with demand for their services growing across all tiers of society, from urban to rural areas.

In the past, the high cost of cath lab projects made it difficult for many healthcare providers to offer these services. However, market dynamics have changed with the emergence of Indian brands that offer a wide range of cath labs at different price points has made these essential healthcare services more accessible to healthcare providers of all sizes and budgets.

In addition, government regulations on stent costs and availability of interventional cardiologists have reduced the financial burden and increased the efficiency of cath labs, even in smaller cities.

Today, Indian cath labs are equipped with a range of high-end features, such as AI, dose management, stent-enhancement software, and high-rating tubes, which add significant value to this high-demand segment.

Indian market dynamics

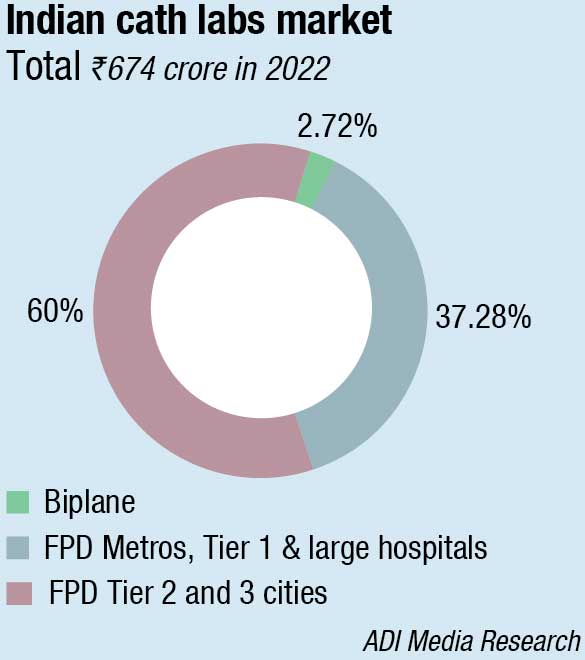

The Indian cath lab is a steadily growing market. In 2022, the cathlab market is estimated at ₹ 674 crore, and 295 units. The biplane segment has very limited demand, mainly from a handful of discerning hospitals. The high-end flat-panel display labs are procured in metros, Tier-I citites, and large hospitals. The last couple of years have seen the Tier-II and Tier-III cities set up cath labs, and this trend is expected to continue, and provide the requisite impetus to this segment. Some refurbished cath labs continue to be in demand.

The imported segment is dominated by GE, Siemens, and Philips. Shimadzu and Toshiba (Erbis Engineering) also have some presence.

The government continues to be an active buyer, albeit in this product segment, it restricts itself to lower-end labs. HLL’s order for 55 cath labs on Toshiba a couple of years back was creditable. Bids have been invited in 2023 too. Some recent ones include Government Medical College and Hospital for a cathlab at Dehradun, Kerala Medical Services Corporation Ltd. has floated a tender for cardiac cath lab with electrophysiology facility for Thiruvananthapuram; a pediatric cathlab machine at the Neonatology Department, Institute of Post Graduate Medical Education & Research (SSKM Hospital), Kolkata, and a digital subtraction angiography (DSA) cathlab machine for cardiovascular and thoracic surgery [CVTS] at Jagjivan Ram Hospital, Western Railway BCT, Mumbai.

|

Indian cath lab market 2022 |

|

| Leading branding | Others |

| GE, Abbott, Siemens & Philips | Allengers & Toshiba, Shimadzu, IITPL & Skanray |

| *Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian cath lab market.

ADI Media Research |

|

The prevalence of heart disease is expected to rise post-Covid-19. The key reason behind this is the risk of cardiovascular disorders in patients post-recovery from Covid-19 infections. There is also an upward trend in obesity during the pandemic and lockdowns, which impacted the demand for cathlab services.

Technology has not seen any dramatic change. Modules are upgraded, and features are added in response to the requirement. 55-inch single screen for single window view, a touch screen panel as the UI and controller for the entire machine, and onsite upgrade option are all now accepted as norms.

Vendors are commonly offering diagnostic options as computer-based IVUS and coronary angiography co-registration, integrated virtual FFR, and live digital stent enhancement, space optimization enabling wide range of cardiac, neuro and peripheral vascular procedures, non-touch-based anticollision sensors for detector, table pivot movement of 90 degrees, real-time verification of the stent positioning, and design to deliver high-quality images at a low dose.

Automated cath labs are being sought as they reduce the workload of cardiologists. With the artificial intelligence-enabled cathlab diagnostic imaging platforms, interventional cardiology system can guide non-invasive cardiovascular procedures with better precision and versatility.

In 2022, as end-users, hospital-based labs dominated the market with a revenue share of over 95 percent. This can be attributed to the increasing number of corporate hospital-based cath labs, favorable reimbursement, and the accessibility of top-quality care and equipment in hospital-based settings.

Freestanding cath labs are witnessing lucrative growth owing to the lower cost of services and less time-consuming treatment. In addition, during the Covid-19 pandemic, the patients preferred independent labs due to the risk of infection in hospital-based settings and inefficiency in hospital-based services due to the Covid-19 burden. Moreover, patients prefer independent cath labs due to the non-requirement of admission post-surgery, resulting in quick recovery. The ambulatory catheterization centers facilitate better personalized patient care, which is not often possible in a hospital-based setting.

Over the past two decades, cath labs have evolved significantly in terms of their size, shape, and quality. While initially, biplane cath labs were commonly used for diagnostic and interventional procedures, they are now rarely seen, and are primarily used for neuro interventional procedures.

Today, the order of the day includes monoplane cath labs and hybrid cath labs, which offer advanced capabilities for both diagnostic and interventional procedures. Hybrid cath labs are now widely used for complex procedures, such as aortic aneurysms, TAVI (transcatheter aortic valve implantation), and abdominal aneurysm procedures. Additionally, electrophysiology procedures require a different dimension of cath lab needs, where integration of images from CT scans is necessary for performing complex 3D navigational procedures. In Tier-III cities, flat- panel and digital cath labs with large storage space are available, making these essential healthcare services more accessible to people in smaller communities.

Cath labs that can be used with DSA (digital subtraction angiography) are particularly useful for lower-limb peripheral and cerebral angiograms, and are commonly found in multispecialty hospitals. High-volume centers that routinely perform complex chip interventions in cardiology often integrate their cath labs with IVUS (intravascular ultrasound), OCT (optical coherence tomography), and FFR (fractional flow reserve) for co-registration, enabling more precise and effective treatments.

The cath labs market in India has seen significant advancements and innovations over the years, with a wide range of options available for healthcare providers at various budget levels.

The implementation of advanced technologies and procedures has allowed cath labs to provide more accurate and efficient treatments to patients.

Global market dynamics

The global cath lab market is estimated to reach USD 87 billion by the end of 2029, with an annualized growth rate of 9.5 percent through 2022 to 2029.

Segment insights. In 2022, the services segment dominated the market with a revenue share of over 70 percent. This is due to the rising prevalence of cardiovascular diseases across the globe. The service segment is sub-segmented into therapeutic and diagnostic services. Therapeutic services accounted for a dominant share in 2022 due to most patients having heart diseases requiring long therapy.

The equipment segment is expected to witness lucrative growth over the next 5 years with the increasing need for diagnostic and therapeutic surgical procedures. The preference for minimally invasive surgeries is resulting in the launch of new equipment in the market. The trend of value-based services is resulting in higher adoption of new equipment bythe cath labs.

New innovations. The advancements in procedures and emerging technologies are making dramatic changes in treatment processes. The diagnostic angiogram and angioplasty procedures have taken the place of surgery and many of the patients are discharged on the same day after the surgery.

Regional insights. North America accounts for the major cath lab services market.

Europe also shows a high growth rate in cath labs monitoring systems market due to increasing cardiac and interventional surgical procedures.

Cath labs monitoring systems market in the Asia-Pacific region is expected to witness significant growth rate in the coming years.

Major players. In response to the Covid-19 pandemic and the high need for cath lab services, key market players have taken up strategies, such as new equipment launches, mergers and acquisitions, joint ventures, partnerships, and collaborations. These initiatives are enabling the companies in achieving and maintaining their market position. Aside from that, several players are increasing their focus on expanding their product portfolio.

Some of the prominent players operating in global cardiac cath lab market are Abbott, Shimadzu, GE HealthCare, Koninklijke Philips N.V., Medtronic, Siemens Healthineers, B. Braun Melsungen, Johnson & Johnson, Netcare Hospital, Campbell County Health, Ramsay Health Care, Care UK, Alliance Medical, Alberta Health Services, Alliance HealthCare Services, and Boston Scientific.

Industry updates

In February 2023, Abbott announced a definitive agreement to acquire Cardiovascular Systems, Inc. (CSI), a medical devices company with an innovative atherectomy system used in treating peripheral and coronary artery disease. Under the terms of the agreement, CSI stockholders will receive USD 20 per common share at a total expected equity value of approximately USD 890 million. The acquisition of CSI will add new, complementary technologies to Abbott’s leading vascular device offerings.

In June 2022, Shimadzu Medical Systems launched a new AI-based angiography system, requiring a 40-percent lower x-ray dose while maintaining high imaging quality. The new Trinias system uses AI deep learning technology to improve the visibility of medical devices, while using 40 percent or more lower x-ray dose than the company’s previous models under standard dose ratio (Air Kerma) at 7.5 pps and 10 pps.

Emerging technologies and their potential applications

Emerging technologies have the potential to revolutionize the field of cardiac catheterization and provide new tools for diagnosing and treating heart disease. Some of the emerging technologies likely to have a significant impact on cath lab procedures include:

Wearable sensors are used to monitor a patient’s heart rate, blood pressure, oxygen saturation, and other vital signs during cath lab procedures. This information can be transmitted in real time to the physician and other members of the medical team, allowing them to monitor the patient’s condition closely, and identify potential complications early on. One of the key benefits of wearable sensors is that they provide physicians with a more complete picture of a patient’s heart function.

In many cases, patients may have underlying heart conditions that are not apparent during routine examinations. Wearable sensors can help identify these conditions early on, allowing physicians to develop targeted treatment plans that address the underlying causes of the patient’s symptoms.

Virtual reality (VR) technology has the potential to revolutionize the way physicians plan and perform cath lab procedures. By using VR simulations, physicians can visualize the anatomy of the heart and surrounding blood vessels in 3D, which can help them develop more precise treatment plans and improve patient outcomes.

Nanotechnology has the potential to revolutionize the way we deliver drugs and other therapies for heart disease.

Wireless power transfer technology has the potential to eliminate the need for batteries in implantable medical devices, such as pacemakers and defibrillators. Devices can be powered by an external source, which can reduce the risk of device failure and improve patient outcomes.

Cath lab software has been advancing rapidly, with new and advanced suites automating various functions like managing patient records, MRI scans, and insurance claims. The software aspect of cath lab advancements is growing at a fast pace . The transformation is not only limited to automation but also includes the management of patient data through electronic health records (EHR) and advanced reports.

Outlook

Going forward, the advancements in cath lab technology have significantly improved patient outcomes and made these procedures safer and more effective.

With the growing burden of cardiovascular disease in India, it is essential to scale up the number of cath labs in major cities across the country.

The integration of advanced technologies and procedures has enabled cath labs to offer more precise and effective treatments for patients, improving the overall health outcomes of the population.

As the demand for cath lab services continues to grow globally, it is crucial for healthcare providers to invest in affordable and economically viable cath labs, while maintaining high standards of quality and safety. By doing so, we can not only meet the growing demand for these services but also improve the overall health outcomes of the population.

Technological advancements and emerging trends in catheterization labs

Ashu Goyal

Director – Sales (Cath Lab & Exports),

Allengers Medical Systems Limited

Statistics show that nearly 35 million people from rural and urban India have cardiovascular diseases. Indian healthcare professionals want to offer value-based care for optimized patient outcomes through their expertise and skills. Therefore, private and public sector investments are increasing in catheterization lab (Cathlab) setups in Tier 3 and Tier 4 cities.

The latest cath lab systems, integrated with intriguing technologies allow cardiac, neurovascular, and peripheral interventions. Techniques like IVUS, FFR, OCT, and TAVI/TAVR have unique advantages allowing clinics to achieve streamlined workflows. For example, IVUS allows the identification of calcified plaque, stent thrombosis and in-stent restenosis and guides an appropriate therapeutic path. Similarly, cardiologists can use FFR as a straightforward quantitative technique for the evaluation of coronary stenosis’s physiologic impact. OCT gives nearly ten times more detailed intracoronary images than conventional intravascular ultrasound. TAVI/TAVR is the most painless technique for aortic valve replacement.

Live stent view in modern cath labs helps in the accurate placement of stents in less time with minimal radiation exposure. Big format detectors in cath labs allow clinical application in neurovascular and peripheral disease segments. Motion-compensated DSA is a unique feature nullifying patient motion impact giving high-quality imaging. Mono scans and Rotational Angiography (RA) are other favorable features. RA can be further extended to 3D scans for generating an effective 3D roadmap. Modern cath labs with heavy-duty x-ray generators and x-ray tubes are robust systems allowing handling heavy patient loads and guiding the treatment of highly complex diseases.

The present-day cath labs meet stringent QA and QC guidelines of AERB utilising dose-reduction techniques like preview collimation and multibeam filtration, minimising radiation exposure for ensuring patient and user safety.

Remote-controlled support and troubleshooting techniques for this life-saving equipment ensure maximum system uptime for a seamless workflow.

Takeaway

With the government promoting cardiac care setups and made-in-India products, indigenous cath labs integrated with the latest technologies have already made in-roads in the Indian market. Upgrading healthcare facilities in line with emerging trends can help public and private healthcare facilities achieve better workflow efficiencies and enhanced patient care.

COMPANY FOCUS: Innvolution Healthcare Private Limited. (Gaurav Agarwal, Managing Director)