MB Stories

Hospitals and labs – Investing in expanding their network

The Indian healthcare industry saw extraordinary growth in FY23. We delve into the numbers that depict the remarkable achievements and strides made by these healthcare entities.

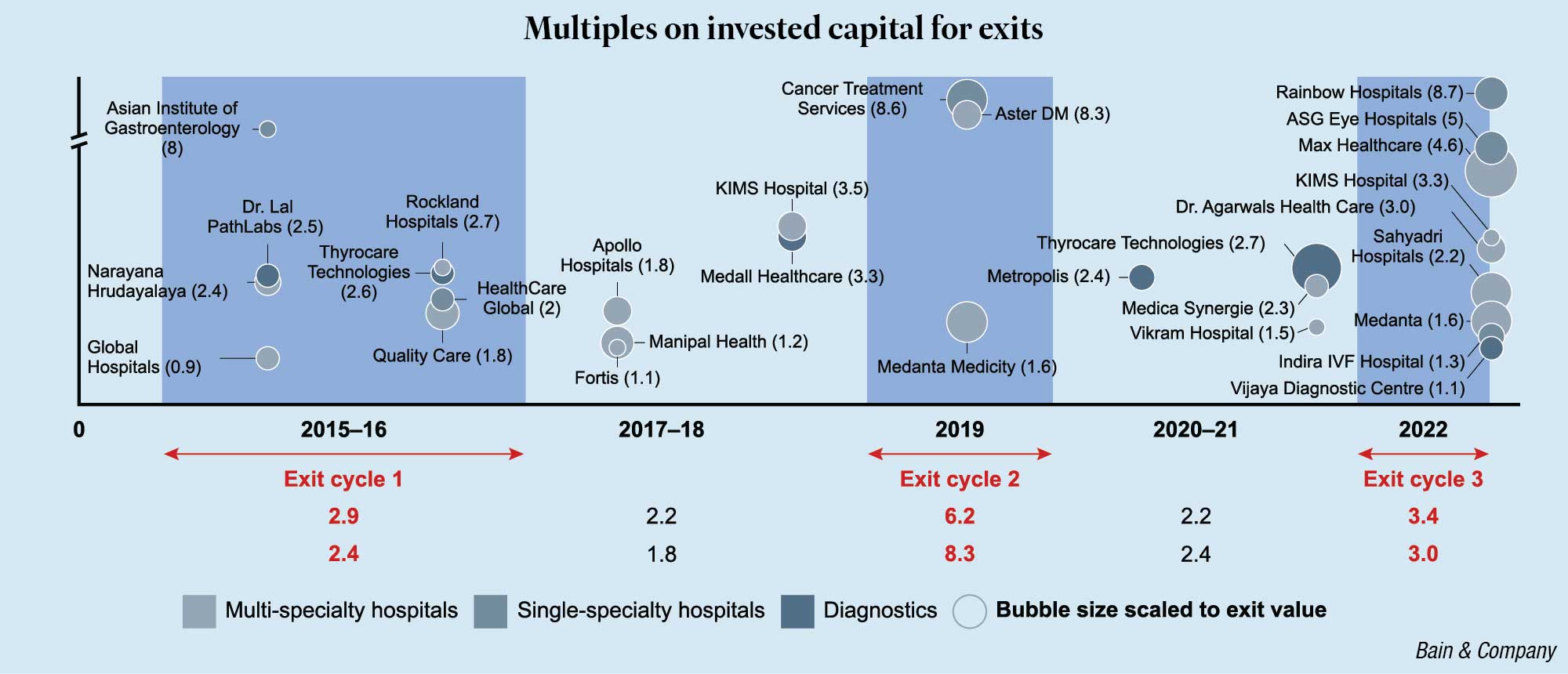

Investors are increasingly looking at India’s healthcare sector for secular returns amidst turbulent tides, with an increase in interest in health providers, pharma, diagnostics, and single-specialty providers since 2020.

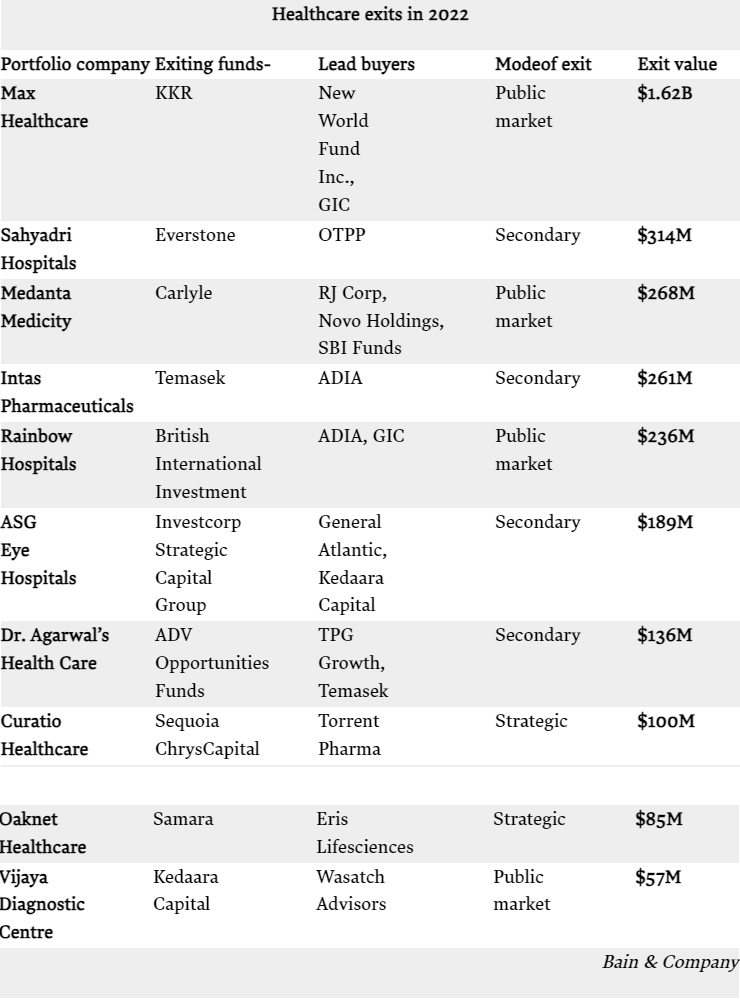

India’s healthcare sector saw deal values reach USD 4.3 billion in 2022, at approximately 8 percent of total investments. However, 2022 was a year where healthcare delivered, expanding to nearly 16 percent of total exit value at USD 3.5 billion. In a year that saw marquee public market exits, IPOs, and secondary sales, KKR’s exit from Max Healthcare grabbed headlines with an exit value of USD 1.6 billion in 4 years, driven by a significant EBITDA expansion, followed by other large exits, such as Everstone’s exit from Sahyadri Hospitals and Carlyle’s and British International Investment’s IPOs of Medanta Medicity (Global Health) and Rainbow Hospitals.

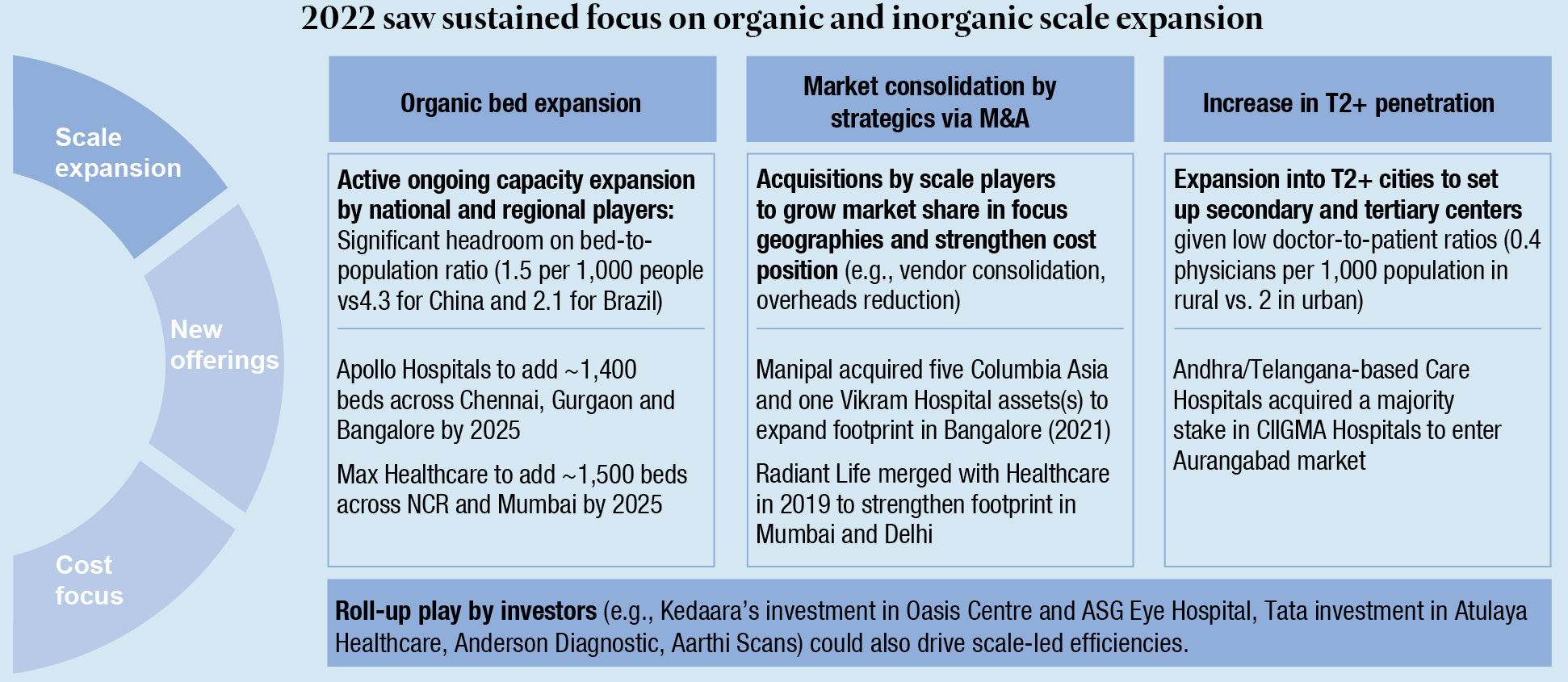

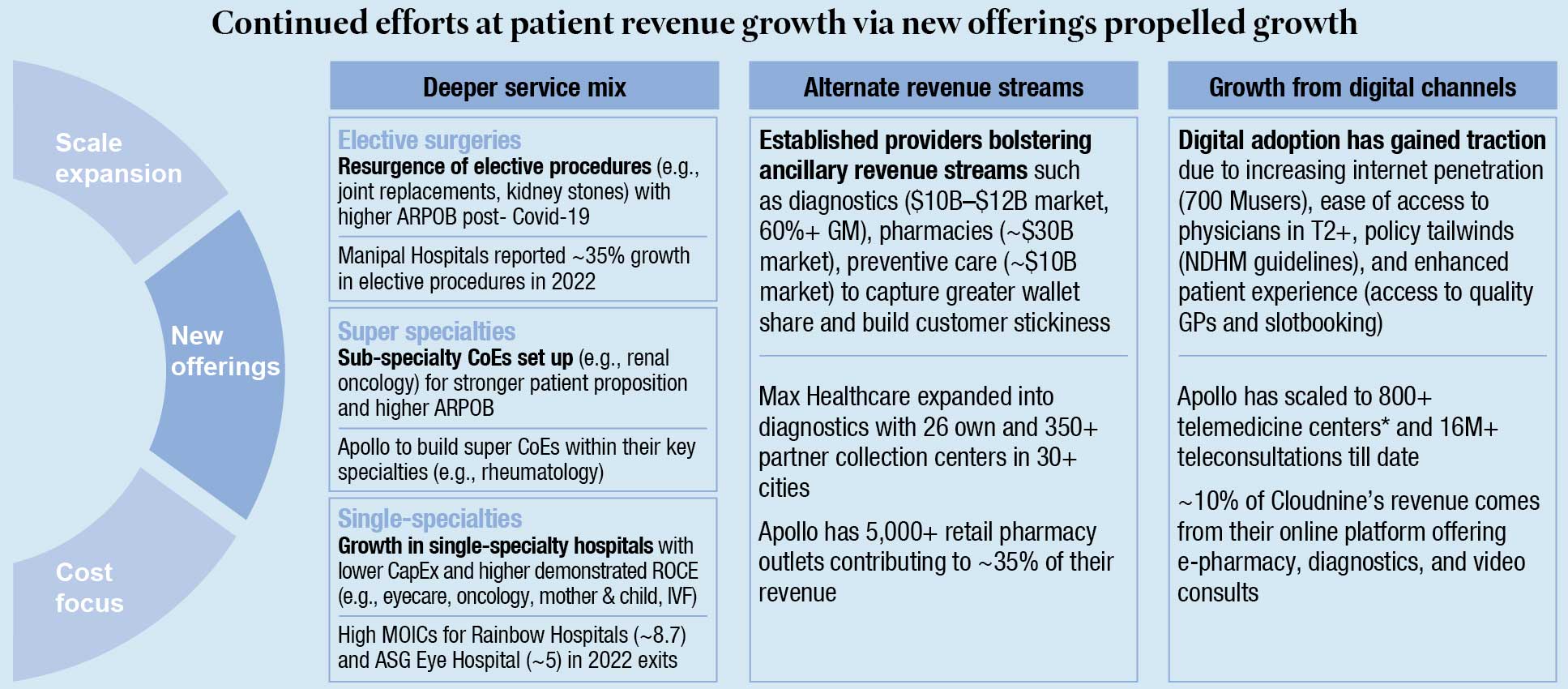

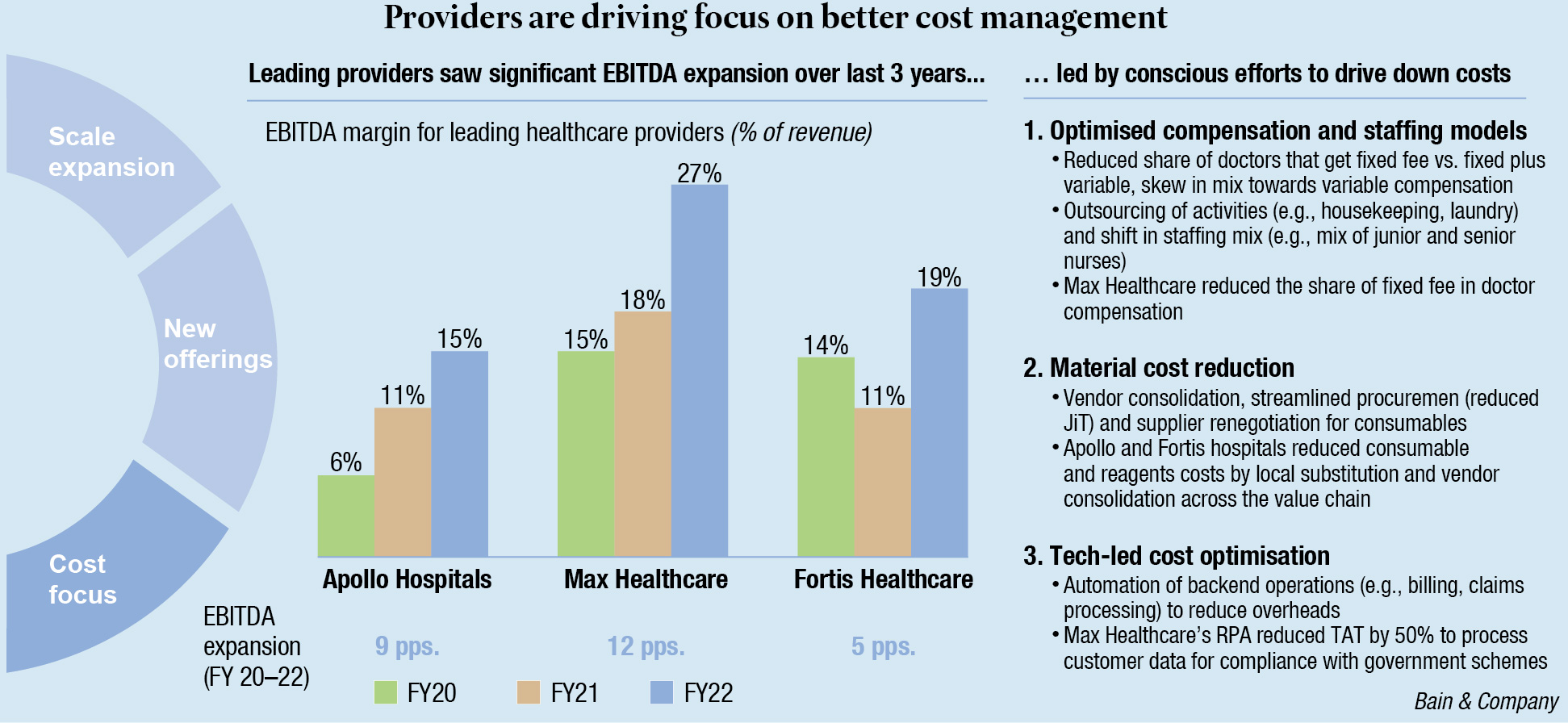

Healthcare providers continue to focus on growth led by scale expansion through consolidation by large players and brownfield expansion, increased specialization in service mix, and cost optimization initiatives, which have resulted in high average revenue per occupied bed (ARPOB), improved utilization, and increased margins. With robust and streamlined models emerging out of Covid, listed health providers have generated two to three times the returns of the Nifty index in recent years.

Revolutionizing diagnosis and treatment

Thomas John

Thomas John

Managing Director,

Agappe Diagnostics Ltd

Hematology, the study of blood and blood-related disorders, has seen remarkable advancements in recent years, revolutionizing analysis and improving patient care. Technological innovations have played a pivotal role, enabled accurate and efficient diagnosis and treatment of various blood disorders while opened new avenues for research.

Automated hematology analyzers

Automated hematology analyzers have transformed blood sample analysis, providing quick and precise complete blood counts (CBC). These instruments minimize human error, enhance laboratory productivity, and aid in diagnosing blood disorders like anaemia, leukaemia, and infections. They can identify abnormal blood cells, assisting in accurate diagnoses.

Flow cytometry

Flow cytometry characterizes and quantifies different cell populations in blood samples. This technique utilizes fluorescent labelling and laser-based detection to analyse cells based on size, shape, and surface markers. It is vital for diagnosing and monitoring blood cancers like lymphoma and leukaemia, identifying abnormal cell populations, assessing immune cell function, and monitoring treatment response. Integration with mass cytometry expands capabilities in complex sample analysis.

Digital imaging and Artificial Intelligence

Digital microscopy allows high-resolution imaging of blood smears, enabling remote consultations and collaboration among experts. AI algorithms trained on large datasets assist in automated detection and classification of blood cells, reducing manual analysis time. AI can flag abnormalities in blood smears, aiding pathologists in accurate diagnoses. Machine learning models analyse patient data to identify patterns and predict disease outcomes.

Agappe has been diligently serving for the past 28 years, driven by unwavering dedication. We have proudly developed and successfully introduced the very first “Make In India” hematology analyser, the remarkable MISPA COUNT X. This groundbreaking device ensures exceptionally precise analysis of blood cells, setting a new standard in the field.

Rapid advancement of technology in hematology analysis has transformed the landscape of blood disorder diagnosis and treatment. Automated hematology analyzers, flow cytometry, molecular diagnostics, and digital imaging with AI have collectively revolutionized the field, enabling faster, more accurate, and personalized patient care.

Performance FY23

FY23 marked a significant milestone for India’s healthcare sector, showcasing its maturity and immense capabilities in delivering medical care and high-end diagnostics.

Amidst unprecedented challenges and an ever-evolving landscape, the healthcare sector has demonstrated resilience and adaptability, showcasing its unwavering commitment to providing quality care and driving innovation.

The financial results of hospitals and laboratories for the fiscal year 2022-23 stand as a testament to their dedication, strategic acumen, and operational excellence.

HOSPITALS

Narayana Hrudayalaya Limited

Narayana Hrudayalaya Limited has reported total revenue of ₹4524.8 crore for FY23 as compared to ₹3701.3 crore for FY22, a 20.9 percent increase. India operating income was ₹3642.4 crore for FY23 as compared to ₹3701.3 crore in FY22, reflecting an increase of 20.9 percent YoY. HCCI operating income was ₹882.4 crore for FY23 as compared to ₹689.3 crore in FY22, reflecting an increase of 28 percent YoY.

|

Narayana Hrudayalaya Ltd |

||

| In ₹ crore | FY23 | FY22 |

| Revenue | 4524.8 | 3701.3 |

| Net profit | 606.6 | 342.1 |

| EBITDA | 1,031.30 | 688.1 |

| EPS (₹) | 13.08 | 6.58 |

The company has posted net profit of ₹606.6 crore for FY23 as against net profit of ₹342.1 crore for FY22 (YoY), a 77.3 percent increase.

The company has reported a consolidated EBITDA of ₹1031.3 crore for the period ended March 31, 2023 as compared to ₹688.1 crore for FY22, a 49.9 percent increase.

Navigating the challenges of the Indian diagnostic industry

Udit Singla

Udit Singla

Vice President,

TM Media (Titan Biotech Limited)

The Indian diagnostic industry has made remarkable strides in recent years, becoming a critical pillar of the country’s healthcare sector.

In this dynamic healthcare landscape, facilities face significant challenges, particularly in the timely detection of infectious diseases. To address these hurdles, we at TM Media have been working relentlessly to offer innovative solutions that enhance efficiency without compromising accuracy.

Time is of the essence in healthcare, and prompt and accurate detection is vital for early intervention and better treatment outcomes. However, factors like the specimen quality, high workload, manual preparations, and human errors can lead to delays in obtaining test results or even false outcomes. To address these issues, the industry is turning towards solutions that streamline processes without compromising accuracy, and in this regard, Ready-to-Use Culture Media has emerged as an efficient solution for diverse microbial infections.

These pre-prepared media, which come in various formats such as plates, bottles, slants, tubes, and transport mediums, eliminate the time-consuming process of media preparation. Facilities can immediately utilize these solutions, significantly reducing turnaround times for test results. Moreover, the precise formulation of Ready-to-Use Culture Media minimizes the chances of contamination, leading to more accurate and reliable test results.

One of the major advantages of Ready-to-Use Culture Media is its long-term cost-effectiveness. By eliminating the need to invest in media preparation equipment and reducing capital expenditures and maintenance costs, facilities can allocate more resources to other aspects of diagnosis. Additionally, the standardized composition and shelf life of these media help avoid waste.

As the diagnostic industry continues to navigate challenges and embrace opportunities, the adoption of Ready-to-Use Culture Media will play a pivotal role in ensuring timely and accurate diagnosis.

Over the past 31 years, TM Media, with its continued research and development investments and wide-ranging product portfolio, ISO 13485:2016, CE, and GMP quality-guaranteed certifications, becomes a leading leader in the microbiology sector, simplifying and expediting diagnosis in over 92 countries.

The company has reported EPS of ₹13.08 for FY23 as compared to ₹6.58 for FY22.

Narayana Hrudayalaya Limited operates a chain of multispecialty, tertiary, and primary healthcare facilities. The company has a network of 19 hospitals and 4 heart centers across India, along with overseas presence at Cayman Islands, with over 5880 operational beds and a capacity of over 6180 beds.

Max Healthcare Institute Limited

Max Healthcare Institute Limited’s network gross revenue stood at ₹6234 crore, reflecting a growth of 18 percent on a like-to-like basis.

|

Max Healthcare Institute Limited |

||

| In ₹ crore | FY23 | FY22 |

| Gross Revenue | 6,234 | 5272 |

| Net profit | 1328 | 752 |

| EBITDA | 1636 | 1305 |

The company posted a PAT of ₹1328 crore in FY23 as compared with ₹752 crore in FY22. Net revenue rose to ₹5902 crore in FY23 as compared with ₹4981 crore in FY22.

Network operating EBITDA stood at ₹1636 crore, registering a growth of 25 percent on a like-to-like basis, while ARPOB improved by 15 percent due to price and improvements in payer mix and case mix, leading to margin expansion by 152 basis points.

Apollo Hospitals Enterprise

Apollo Hospitals Enterprise has reported consolidated revenues of ₹16,612.5 crore in FY23 as compared to ₹14,662.6 crore in FY22 (YoY), a 13 percent increase. EBITDA was at ₹2050 crore.

|

Apollo Hospitals Enterprise |

||

| In ₹ crore | FY23 | FY22 |

| Revenue | 16612.5 | 14662.6 |

| Net profit | 819.1 | 1055.6 |

| EBITDA | 2,050 | 2,185 |

For FY23, breakup of revenues were:

Healthcare Services (HCS) revenue at ₹8677 crore; 9 percent YoY growth (excluding vaccines, YoY growth was at 13 percent).

AHLL: Revenues at ₹1231 crore for FY23; 6 percent YoY de-growth (excluding vaccines, YoY growth was at 10 percent).

Apollo Healthco: Pharmacy distribution and digital health revenues at ₹6705 crore; 25 percent YoY growth.

PAT.

Healthcare Services (HCS) PAT at ₹1161 crore; YoY growth of 24 percent.

AHLL: PAT loss at ₹38 crore.

Apollo HealthCo: PAT loss at ₹304 crore.

FeNO measurement in lung diagnostics

MA Reyas

MA Reyas

Managing Director,

Rbeck Healthtech Pvt. Ltd.

Our mission is to help improve asthma diagnosis & management of adults and children in India through FeNO monitoring.

FeNO stands for fractional exhaled nitric oxide. When you breathe out, your breath can show if you have inflamed airways. A FeNO test measures the amount of nitric oxide in your breath.

FeNO levels of < 25 parts per billion (ppb) is considered normal, 25 ppb – 50 ppb as intermediate, and > 50 ppb high [9]. Although definitive data linking asthma and FeNO is lacking, some strong conclusions can be made, thus improving the correlation of FeNO to the condition in asthmatics.

With innovation in the field of lung function diagnostics Feno Monitors aid in monitoring and quantification of inflammation in Asthma diseases.

Asthma is commonly referred to as an inflammatory disease that affects a person’s airways, leading to hyperresponsiveness, obstruction, mucus hyper-production, and airway wall remodelling9.

A majority of asthma patients’ airway inflammation is an allergen-driven response. There is significant evidence from external literature suggesting FeNO (Nitric oxide) is a key biomarker tool for inflammation of the respiratory tract. Increased levels of FeNO in asthma are thought to come from inducible NOS2 expressed in inflamed airways. NObreath® offers an alternative aid to diagnose asthma, which is non-invasive, and significantly more cost-effective than current gold standard methods to diagnose airway eosinophilic inflammation, further in the diagnosis of asthma. As a result of substantial amounts of literature supporting FeNO measurements as an effective biomarker for asthma and other airway inflammation, FeNO breath testing is now recommended in NICE guidelines as an aid to diagnosing allergic asthma. Literature also suggests the ability for FeNO measurement to be used as a good management tool for asthma, assessing the effectiveness of treatments for patients and optimizing asthma treatments.

Nowadays FeNO measuring devices are available for individual Asthma patients so that they can monitor their inflammation level on a daily basis. As a standard most of the FeNO devices come with a measuring range of 0-500ppb. Our purpose is to make FeNO monitoring more accessible, with the creation of an effective yet cost-efficient FeNO monitor and equally low-cost consumables.

The company has posted net profit of ₹819.1 crore for FY23 as against net profit of ₹1055.6 crore for FY22 (YoY) after accounting for higher operating costs of Apollo 24/7 of ₹735 crore and due to the nonrecurring revenues from Covid and vaccination.

FY23 consolidated EBITDA excluding 24/7 operating cost and ESOP charge stood at ₹2785 crore; 16 percent YoY growth.

Healthcare Services (HCS) EBITDA at ₹2133 crore; YoY growth of 18 percent.

AHLL: EBITDA at ₹118 crore.

Apollo Healthco: Pharmacy distribution EBITDA at ₹534 crore, YoY growth of 31 percent.

Apollo 24/7 operating cost of ₹657 crore and non-cash ESOP charge of ₹78 crore.

FY23 consolidated reported EBITDA at ₹2050 crore, after 24/7 operating costs of ₹736 crore, as compared to EBITDA of ₹2185 crore in FY22.

The company has reported EPS of ₹56.97 for the period ended March 31, 2023.

Apollo Hospitals had total 70 hospitals with 9957 operating beds across the network (including 562 beds in AHLL), out of which 14 hospitals were new with 2384 operating beds.

Aster DM Healthcare Limited

FY23 was a year of growth investment for Aster. On the consolidated basis, the year saw an unprecedented addition of five hospitals across India and GCC, 150 pharmacies and 7 clinics.

And for expansion in India, through adding 126 pharmacies and 91 diagnostic centers and the patient experience centers. These investments have although impacted its near-term EBITDA and PAT performance, it should enable deliver improved performance in the years to come.

|

Aster DM Healthcare Limited |

||

| In ₹ crore | FY23 | FY22 |

| Revenue | 11933 | 10,253 |

| Net profit | 425 | 526 |

| EBITDA | 1,565 | 1,483 |

The GCC business added 2 new hospitals, 24 pharmacies and 6 clinics. The year also saw Covid testing revenue of FY22, actively being replaced by core healthcare revenue, which grew by 26 percent across hospitals, pharmacies and clinics.

Aster DM Healthcare Limited has reported a revenue increase of 16 percent YoY from ₹11,933 crore in FY23 to ₹10,253 crore in FY22. 75 percent of its revenue is contributed by GCC, and remaining 25 percent by India.

The roadmap to future success

Amrith Rangan

Amrith Rangan

CMO,

AKAS Infusions

AKAS Medical Equipment, with 26 years of excellence in contributing to the infusion technology and market standing, is one of the fastest-growing medical device companies in India.

AKAS Infusions is the research driven organization with more than 10 percent of our workforce working for the research and development department, and also a leading manufacturer drug-delivery like volumetric and syringe infusion pumps. AKAS Infusions is an abbreviation of Advances Knowledge on Accurate and Safe Infusions.

AKAS has a well-planned roadmap ahead of time, where we are focused on innovations and quality of the product. We employe well-qualified and dedicated engineers to take forward our products with new innovative ideas, where quality and affordability are not compromised.

AKAS Infusions has excelled in infusion technology, it has come up with an idea to achieve high accuracy in volumetric infusion pumps through a fixed drop sensor concept. Drop sensors are essential feedback mechanism for upstream occlusion, IV container/bottle empty and, most importantly, the accuracy of the flow when substandard quality of tubing sets is used.

Currently, AKAS is working on its fifth-generation syringe and volumetric infusion pumps with more advancements. The company has also planned to launch ambulatory syringe driver, called as Mobifusion, dedicated for iron chelating therapy to treat thalassemia disorder, whereas AKAS Mobifusion is a compact, top-loading ambulatory syringe, which is used for delivery drugs in disposable syringes precisely and accurately according to the flow rate set mL/hr.

As we have expanded our market to various countries, we are also complying with the regulations of those individual countries. We have obtained CE marking for our products under MDD, also complied with electrical and functional safety tests as per European standards and now currently we are working toward the transition of EU MDR 2017/745.

AKAS is committed to give high-quality products, so it has established the QMS as per ISO 13485:2016 – Medical devices – Quality management systems – Requirements of regulatory purposes, and it is continuously engaged to work for the mitigation of risks in their products as per ISO 14971:2019 – Medical devices – Application of risk management to medical devices.

EBITDA grew 6 percent from ₹1483 crore in FY22 to ₹1565 crore in FY23 and Profit after tax, post-NCI, stands at ₹425 crore when compared to ₹526 crore in financial year 2022, a 19 percent decline, largely impacted by launch of 5 new hospitals across GCC and India. Excluding new hospitals and one-time other income: Revenue, EBITDA, and PAT (post-NCI) are ₹11,776 crore (growth of 15 percent), ₹1655 crore (growth of 11 percent), and ₹581 crore (growth of 7 percent) respectively.

The Aster India business continues to grow well with revenues growing at 25 percent to ₹2983 crore, and EBITDA increasing by 28 percent to ₹453 crore, and profit after tax post-NCI standing at ₹147 crore as compared to ₹60 crore in financial year 2022, a growth of 146 percent.

As part of the expansion plans, 100 beds each are being added to Aster MIMS Hospital Kannur and Aster Medcity Kochi. Additionally, work has begun on the upcoming 200-bed project at Aster Hospital Kasargod, and Phase-I of Aster Hospital in Trivandrum with 350 beds also has started. The Phase-II development of Aster Whitefield Hospital in Bangalore, comprising of 375 beds, is nearing completion and is expected to be operational soon.

The group has increased its stake in its subsidiary, Malabar Institute of Medical Sciences, MIMS, from 74.14 percent to 77.93 percent. Its stake in Ramesh Hospital, another subsidiary that manages 5 hospitals in Andhra Pradesh with bed capacity of 739, has now increased from 51 percent to 57.49 percent.

Aster Labs has established its presence in Karnataka and Kerala, Maharashtra, Tamil Nadu, Andhra Pradesh, and Telangana. As of March 2023, there is 1 reference lab, 15 satellite labs, and 189 patient experience centers.

The company has total 257 Aster pharmacy branded retail stores, which are operated by Alfaone Retail Pharmacies Private Limited.

Dr Nitish Shetty has been announced as the CEO of Aster DM Healthcare India. Dr Shetty has been instrumental in the growth of the company’s Karnataka operations.

The UAE-based group is reportedly looking to sell stake, could even be a controlling stake in its India-listed hospital chain, and has initiated talks with private equity groups, including Blackstone and KKR, among others, for a deal.

The news comes close on the heels of Aster DM Healthcare confirming that it is in ongoing discussions with Dubai-based Fajr Capital, as well as various potential counterparties, as part of exploring a potential carve-out of its Gulf business. Aster is reportedly looking to sell 65 percent stake in its Gulf business to a consortium led by Fajr Capital at a USD 500-million valuation.

The company operates 32 hospitals in West Asia and India, as well as clinics, pharmacies, laboratories, and patient experience centers.

HealthCare Global Enterprises Ltd.

HealthCare Global Enterprises Ltd. has reported revenue of ₹1694.4 crore for FY23, as compared to ₹1397.8 crore for FY22, a 21-percent increase. HCG Centers contributed ₹1628.1 crore in FY23, a 22-percent increase from ₹1335.7 crore in FY22. Milann Centers contributed ₹66.3 crore in FY23, a 7-percent increase from ₹62.1 crore in FY22. Within the HCG Centers, the mature centers saw 19 percent increase in FY23 over FY22, and the emerging centers saw a 30-percent revenue increase in FY23 over FY22.

|

HealthCare Global Enterprises Ltd. |

||

| In ₹ crore | FY23 | FY22 |

| Revenue | 1694.4 | 1397.8 |

| Net profit | 29.34 | 53.73 |

| EBITDA | 320.8 | 245.3 |

PAT for FY22 was pre-exceptional items, and stood at ₹11 crore whereas for FY23 it was a post exceptional item. In FY23 PAT was ₹29.34 crore, as compared to ₹53.73 crore in FY22, a 45-percent decline.

The company has reported adjusted EBITDA of ₹320.8 crore for FY23 as compared to ₹245.3 crore for FY22.

Under the Milann brand, HCG operates 7 fertility centers. Strand Life Sciences, an associate company of HCG, is a precision diagnostics company, with strong track record in bioinformatics, and a pioneer of genomic testing in India.

Shalby Limited

Shalby Limited has reported a total income of ₹827.4 crore for FY23 from ₹711.4 crore for FY22, a 16.3-percent increase.

|

Shalby Limited |

||

| In ₹ crore | FY23 | FY22 |

| Total income | 827.4 | 711.4 |

| Net profit | 67.7 | 54 |

| EPS (₹) | 7.52 | 6.46 |

Net profit for FY23 surged to ₹67.7 crore from ₹54 crore in FY22, a 25.4-percent increase.

The company has reported EBITDA of ₹159.3 crore for FY23 from ₹132.4 crore for FY22, a 20.3-percent increase.

The company has reported EPS of ₹7.52 for FY23 as compared to ₹6.46 for FY22.

The group has 10 multi-specialty hospitals across western and central India, 4 orthopedic centers of excellence and an FDA-approved implant manufacturing facility to sell across the US and international markets.

Fortis Healthcare Limited

Fortis Healthcare Limited has reported consolidated revenue of ₹6298 crore in FY23 as compared to ₹5718 crore in FY22, a 10.1-percent increase. Healthcare contributed ₹5107.41 crore, a 19.8-percent increase and diagnostics ₹1190 crore in FY23, an 18.1-percent decline.

|

Fortis Healthcare Limited |

||

| In ₹ crore | FY23 | FY22 |

| Revenue | 6298 | 5718 |

| Net profit | 588.73 | 555.12 |

| EBITDA | 1163 | 1096 |

| EPS (₹) | 7.8 | 7.35 |

The company has posted a net profit of ₹588.73 crore for FY23 as compared to ₹555.12 crore for FY22, a 6.05-percent increase. Healthcare contributed ₹635.36 crore and diagnostics ₹150.01 crore in FY23.

The company has reported EBITDA of ₹1163 crore for FY23 as compared to ₹1096 crore, a 6-percent increase for FY22.

The company has reported EPS of ₹7.80 for FY23 as compared to ₹7.35 for FY22, a 6.12-percent increase.

The hospital business revenue growth for FY23 was led by a healthy improvement in occupancy reaching 67 percent for the year versus 63 percent in FY22. ARPOB growth was 11.5 percent for FY 23.

Fortis Healthcare Limited’s revenue will continue to grow owing to sustained improvement in operating margin, according to Nomura. While Fortis may lag its peers on EBITDA margin, the company’s hospital business is on the mend due to accelerated revenue growth post the IHH takeover in 2018.

According to Nomura, Fortis Healthcare’s margin improvement will be driven by three factors in the near-to-medium term:

- Expected divestment and closure of loss-making facilities.

- Addition of almost 1400 beds through brownfield expansion.

- Rising contribution of oncology in the short-to-medium term.

The gross margin for Fortis is largely in line with peers like Max Healthcare Institute Limited and Medanta. However, the EBITDA margin is lower, primarily due to higher overheads like higher doctor and employee costs. In fiscal 2022 alone, doctor and employee costs accounted for 47 percent of total sales for Fortis, against 39 percent for Max and 36 percent for Medanta. Major risks for Fortis include lower-than-estimated volume growth in hospitals and weaker-than-estimated price realization due to increased competition.

Medanta (Global Health Limited)

Medanta closed FY23 with robust revenue growth and enhanced profitability.

Medanta has reported a total income of ₹2759.2 crore for FY23 as compared to ₹2206 crore for FY22, a 25.1-percent increase. Medanta Patna, which commenced IPD operations in January 2022, delivered revenue of ₹170.7 crore in FY23 and achieved EBITDA breakeven in its first full year of operations. Developing hospitals, Medanta Lucknow and Medanta Patna revenue share increased from 18 percent in FY22 to 27 percent in FY23 amounting to ₹742.6 crore. Revenue from international patients increased by 68 percent to ₹156.4 crore. Out-patient pharmacy business continues to register a strong growth. Revenue increased by 58 percent from ₹53.6 crore in FY22 to ₹85 crore in FY23.

The company has posted a net profit of ₹326 crore for FY23 as against net profit of Rs. 196 crore for FY22, a growth of 66.2 percent.

The company has reported EBITDA of ₹677.1 crore, up by 38.3 percent over FY22 for the period ended March 31, 2023. Developing hospitals, Medanta Lucknow and Medanta Patna, EBITDA share increased from 16 percent in FY22 to 32 percent in FY23 amounting to ₹215.9 crore.

The company has reported EPS of Rs. 10 for FY23 as compared to Rs 8.66 for FY22.

The hospital is poised for net debt-free position with well-capitalized balance sheet to drive future expansion plans and growth.

Under the Medanta brand, the company has a network of five hospitals currently in operation, one each in the cities of Gurugram, Indore, Ranchi, Lucknow, and Patna. Spanning an area of 4.7 million sq. ft., its operational hospitals have 2697 installed beds as on March 31, 2023. It also has one hospital under-construction in Noida.

DIAGNOSTIC COMPANIES

Performance review of laboratories

Metropolis Healthcare Limited

Metropolis Healthcare has reported a total income of ₹1148.2 crore during the period ended March 31, 2023 as compared to ₹1228.3 crore during the period ended March 31, 2022 (YoY).

|

Metropolis Healthcare Limited |

||

| In ₹ crore | FY23 | FY22 |

| Total income | 1,148.20 | 1,228.30 |

| Net profit | 142.9 | 214.7 |

| EPS (₹) | 41.9 | 35.8 |

The company has posted PAT of ₹142.9 crore for FY23 as against PAT of ₹214.7 crore for FY22, a 33-percent decline. However, the company had one-time exception gain in the financial year of ₹16 crore, bringing PAT to a 26 percent decline. Gross debt stood at ₹79 crore as on March 2023.

The company has reported EBITDA of ₹288.3 crore for FY23 as compared to ₹342.8 crore for FY22, a 15.9-percent decline. EBITDA margin contracted by 280 bp YoY to ~25 percent in FY23. This decline was due to expenses pertaining to network expansion, higher staff costs, and a fall in realization per test (due to falling Covid-related profit), which resulted in an operating deleverage. A planned network expansion, integration of the Hitech Diagnostic Center, and investments in digitization and marketing are expected to affect operating margin in the short term. The management expects the margin to revert to pre-Covid levels (27–28 percent) in the medium term with the completion of network expansion, stabilization in realizations, and integration of the Hitech Diagnostic Center.

The company has reported EPS of ₹41.9 for FY23 as compared to ₹35.8 for FY22, a 16.9-percent increase.

As part of its network expansion strategy, Metropolis added 14 laboratories and 548 centers in FY23. It aims to add 30/800 new laboratories/centers in FY24. The company is on track to achieve its plans to add 90 laboratories and 1800 centers by FY25. It is looking to leverage Hitech Diagnostic Center’s capabilities by opening 50 new centers in South India. The management aims to increase its focus on the premium wellness segment as these tests are highly margin-accretive and offer higher realization (over ₹2000).

At the end of March 2023, the company undertook a price increase of 4 percent for 900 tests (~25 percent of overall test basket) largely in the specialized test segment, which will likely boost FY24E revenue growth by 1 percent.

Its efforts to enhance revenue growth has taken a hit due to non-recurring Covid-linked tests and PPP contracts. NACO contract was a one-off with duration of three years, which was largely focused on specialized tests. The contract has not been renewed, with the government taking over the testing.

The company is empowered with a robust network of over 175 labs, 3675 collection centers and 10,000+ touch points.

Dr Lal PathLabs Limited

Dr Lal PathLabs Limited reported a total revenue of ₹2017 for FY23 crore versus ₹ 2087 crore in FY22, a 3.4-percent decline. FY23 non-Covid revenue came in at ₹1954 crore versus ₹1691 crore last year, a growth of 15.5 percent.

|

Dr Lal PathLabs Limited |

||

| In ₹ crore | FY23 | FY22 |

| Total income | 2017 | 2087 |

| Net profit | 241 | 350 |

| EPS (₹) | 28.74 | 41.57 |

The company has posted a PAT of ₹241 crore for FY23 as compared to a PAT of ₹350 crore for FY22, a 31.2-percent decline. Normalized PAT was ₹297 crore for FY23 versus ₹369 crore in FY22, at a 15-percent margin.

The company has reported EBITDA of ₹490 crore for FY23 as compared to ₹561 crore for FY22, a 12.6-percent decline. Normalized EBITDA was ₹528 crore for FY23, a 26.2-percent margin versus ₹600 crore for FY22, a 28.8-percent margin, and a 12.1-percent decline.

EPS was ₹28.8 for FY23 as compared to ₹41.7 for FY22.

Dr Lal PathLabs made headlines earlier this year when it announced its first-ever price hike in February 2023. The decision was aimed at improving the company’s revenue per patient. The price increase encountered minimal resistance. It had a 1.7 percent impact on Q4 FY22 and 2.5 percent on an ongoing basis.

Dr Lal PathLabs Limited has 277 clinical labs (including National Reference Lab at Delhi and Regional Reference Labs at Kolkata, Bangalore, and Mumbai).

Thyrocare Technologies Limited

Thyrocare Technologies Limited has reported revenue from operations of ₹526.67 crore for FY23 as compared to ₹588.86 crore for FY22, a 11-percent decline. Diagnostics revenue decreased 11 percent YoY in FY23 due to steep degrowth in Covid revenue (₹171 crore in FY22 versus ₹6 crore in FY23).

|

Thyrocare Technologies Limited |

||

| In ₹ crore | FY23 | FY22 |

| Revenue | 526.67 | 588.86 |

| Net profit | 65.89 | 176.06 |

| EPS (₹) | 12.14 | 33.24 |

The company has posted a net profit of ₹65.89 crore for FY23 as against ₹176.06 crore for FY22, a 63-percent decline.

The company has reported normalized EBITDA of ₹150.53 for FY23 as compared to ₹245.03 crore for FY22, a 39-percent decline.

Thyrocare Technologies has 31 labs, and a network of 900-plus phlebos, strategy remaining to be a B2B service provider, with three geographies – Africa, Middle East, and Southeast Asia – as the first wave.

Agilus Diagnostics Limited

Consequent to the expiry of the brand license agreement of the company, the board, in its meeting held on February 8, 2023, approved the proposal to change the name from SRL Diagnostics to a new name, Agilus Diagnostics Limited, for the company.

|

Agilus Diagnostics Limited |

||

| In ₹ crore | FY23 | FY22 |

| Total income | 1371.1 | 1681.34 |

| Net profit | 116.64 | 554.7 |

| EPS (₹) | 263 | 412 |

Agilus Diagnostics Limited has reported a total income of ₹1371.1 crore in FY23, as compared to ₹1618.34 crore in FY22, a 15.28-percent decline, mainly due to decrease in business of Covid and its allied tests.

Net profit after tax in FY23 is ₹116.64 crore as compared to ₹554.7 crore in FY22.

For FY23, Agilus Diagnostics reported net revenues of ₹1347 crore compared to ₹1605 crore reported during FY22. The overall revenues declined compared to FY22 due to high Covid revenue in FY22. The Covid revenue as a percentage of total revenue has declined from 28 percent in FY22 to only 4 percent in FY23. On the contrary, our non-covid business has grown from ₹1152 crore in FY22 to ₹1289 crore in FY23, a 12-percent growth. The company’s EBITDA for the year stood at ₹263 crore, representing a margin of 19 percent compared to a margin of 26 percent reported during the previous financial year.

Agilus Diagnostics has a pan-India presence spanning over 1000 cities and 30 states and Union territories as of fiscal 2023. The company has added 53 new labs and over 1100 customer touch points in FY23.

Vimta Labs Limited

Vimta Labs Limited has reported a total income of ₹321.6 crore for FY23 as compared to ₹279.7 crore for FY22, a 15-percent increase.

The company has posted a net profit of ₹48.17 crore for FY23 as against PAT ₹41.33 crore for FY22, a 16.55-percent increase.

The company has reported EBITDA of ₹94.9 crore for FY23 as compared to ₹80.3 crore for FY22, an 18.2-percent increase.

The company has reported EPS of ₹21.35 for FY23 as compared to ₹18.32 for FY22, a 16.54-percent increase.

Founded in 1984 with headquarters in Hyderabad, India, Vimta Labs Limited is a leading contract research and testing organization, providing food, agri, bio/pharmaceutical, medical devices, specialty chemical, and electronics companies an integrated scientific, technical, and regulatory expertise to support all stages of product development and manufacturing process. Vimta also provides clinical diagnostic services and environmental assessments and testing services.

The company has embarked on doubling its capacities in the Genome Valley, Hyderabad campus, and gearing up for its growth for the next 5 years. The company has laid the foundation and started construction of Life Sciences expansion project, which will add ~225,000 sq. ft. of additional space for labs and support functions.

FY24

The healthcare sector in India exhibited a commendable performance in FY23, demonstrating the maturity and significant capabilities of hospitals and laboratories in providing medical care and diagnostics.

The surge in occupancy and ARPOB is likely to help hospitals report a revenue/EBITDA/PAT growth of 3 percent/7 percent/19 percent QoQ in Q1 FY24E, respectively. The outlook remains steady for hospital chains as higher in-patient and surgery count is generating cash flow and the companies are diligently investing in expanding their network through M&A or brownfield CapEx.

Base impact from Covid-led tests is largely behind for diagnostic companies, and the listed companies are likely to post a strong 9 percent/13 percent/20 percent rise in revenue/EBITDA/PAT in Q1 FY24E, respectively. Non-Covid volumes continue to witness steady 12–15 percent growth despite steep competitive pressure. Companies are now taking price increases in selective test portfolios as against their earlier focus on maintaining volume share, says an ICICI Securities report.

Hospital business – Preview. Revenue for listed companies is expected to grow a modest 3 percent QoQ (+16 percent YoY) to ₹7170 crore in Q1 FY24. EBITDA margin is expected to surge 60 bps QoQ to 14.9 percent on better traction in hospital business and improvement in the performance of ancillary business. PAT is likely to grow 19 percent QoQ to ₹440 crore.

Company-wise performance. For Q1 FY24, Apollo Hospitals is likely to register EBITDA growth of 11 percent QoQ, driven by its hospital business, and the management is trying to curtail down losses of operating online pharmacy business. KIMS is expected to witness a sequential dip of 134 bps in EBITDA margin to ~27 percent (EBITDA dip of 2 percent QoQ) due to the addition of doctors at some hospitals. It remains on track to restart operations at a hospital under Sunshine and a new hospital in Nashik. Fortis is likely to report a nominal 7 percent sequential increase in EBITDA, primarily driven by its hospital business. It has recently renamed SRL to Agilus Diagnostics Limited. HCG is expected to report 6 percent QoQ jump in EBITDA.

Diagnostics – Synopsis. Revenue for listed companies is likely to surge ~9 percent YoY (+8 percent QoQ) as impact of Covid base is largely behind and traction in non-Covid tests continues to be healthy. Covid-led tests accounted for 4 percent/7 percent/3 percent for Dr Lal/Metropolis/Vijaya, respectively, in Q1 FY23 as against 14 percent/17 percent/15 percent in Q4 FY22. EBITDA margin is expected to surge 95 bps YoY (up 15 bps QoQ) largely on account of better pricing and network expansion. Q1 FY24E EBITDA/PAT growth for our coverage universe is expected at 13 percent/20 percent YoY, respectively.

Company-wise performance

Dr Lal PathLabs is expected to report 10 percent surge in revenue to ₹550 crore in Q1 FY24E. It is now expanding across Tier-III towns in the North, South, and Western regions. EBITDA margin is likely to surge 93 bps to 24 percent while absolute EBITDA may grow 15 percent YoY. PAT is expected to grow 23 percent YoY.

Metropolis Healthcare is likely to report 6 percent YoY rise in revenue as contribution of Covid-led tests remains moderately high in the base. It plans to add 600–800 collection centers and 50 hi-tech centers in FY24. EBITDA margin may rise by 73 bps to 25.2 percent while PAT may grow 7 percent YoY.

Vijaya Diagnostics is likely to post 12 percent YoY growth in revenue, driven by its strong foothold in AP and Telangana regions. EBITDA margin may surge 137 bps YoY (−99bps QoQ) to ~40 percent while PAT may grow 37 percent to ₹239 millions owing to its smaller base.

Diagnostic companies’ earnings are likely to go up and the multiples will rerate, according to Aditya Khemka, fund manager at InCred Financial Services. Diagnostic companies’ profit-and-loss statements came under pressure following a good performance over two years, as they hiked their operating expenses. “During the Covid-19 period, the market swung to one extreme, where they thought that diagnostics was even better than FMCG. Today, the market is swinging to the other extreme, where they are saying that the business model is disrupted. Earnings of diagnostic companies are under pressure because they have spent a lot of money in expanding their footprint and adding capabilities,” adds Khemka.

Take the example of Thyrocare. Historically, Thyrocare used to report an EBITDA margin of 38–40 percent. The margin is expected to come down to 25–26 percent levels, as the company has invested in workforce, increasing pincodes, sales and marketing. The company’s non-Covid business did not grow for four years between FY18 and FY22.

PharmEasy acquired a 66-percent stake in Thyrocare in June 2021. The company invested in workforce expansion and reducing the turnaround time for test reports. Thyrocare decentralized its operations and set up a number of regional labs. This led to a rise in their overhead costs and the rental expenditure increased. InCred expects the margin to bounce back to 30–32 percent, as the operating leverage kicks in.

There is a large opportunity in Tier-III and Tier-IV markets, that grow at twice the rate of metro cities. The last four years have been challenging for the rural population. Urban consumption surged because people had more money to spend, as compared with rural consumers. During the Covid era, the non-agricultural income completely went away. This non-agricultural income comes from government schemes, infrastructure, and roads. Government spending on social schemes was significantly higher during the pandemic. Now that Covid is behind us, social spending has dramatically dropped and the planned infra spending has gone up.

This will give cash back to the rural income in Tier-III and IV cities. Services like diagnostics, healthcare, discretionary and non-discretionary spending, which might have stopped because of lack of income over the past three to four years, would have made a comeback.

The outlook remains steady for hospital chains as higher in-patient and surgery count is generating cash flow and the companies are diligently investing in expanding their network through M&A or brownfield CapEx, as it does for the labs as impact of Covid base is largely behind and traction in non-Covid tests continues to be healthy.